A Deloitte survey – in which the company interviewed 1000 M&A executives of top US companies and private equity firms – reveals that 79% of executives at corporations, and 87% of M&A executives at private equity firms expect their organizations to close more deals in coming months when compared to the previous year.

2018 brought a surge in value as well as the volume of M&A deals, and there are strong signals that this trend is going to follow an upward trend in the coming decade as well. We are witnessing a transition period where technology is getting integrated into – in a literal sense – everything. Technologies such as AI, Blockchain, IoT, VR are finally leaving the doors of early adopters for wider acceptance. When one tries to put all these pieces together, a picture emerges, which depicts an exciting time for the M&A landscape ahead.

One of the centerpieces of this puzzle is the Smart home domain, which is expected to witness a huge uprise in M&A activity in the coming future. Want to know more? Join us as we take a dive into how M&As could solve the pressing issues of security and paranoia among consumer base regarding privacy in the smart home domain. We’d also take a brief look at:

- The Market Size

- Major Geographies

- The efforts of corporation and governments in the proliferation of the domain

- Roadblocks of privacy and security the industry is facing

- How Blockchain could be a solution?

- How major players are using M&A to accomplish their objectives?

It is going to be quite a ride in a short amount of time. If you are interested to read a specific section, the table of contents below could come in handy.

Smart Home Market Forecast

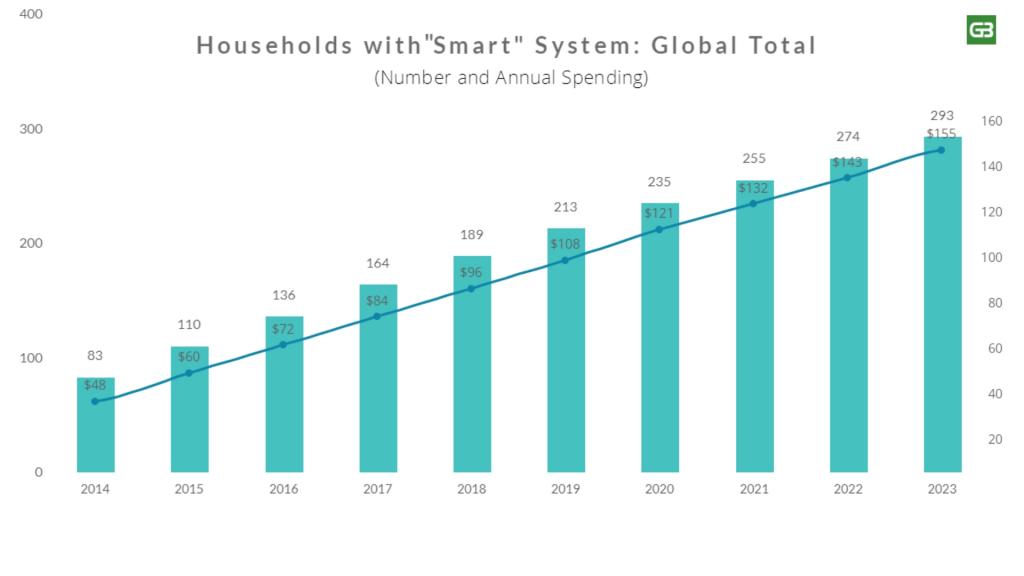

After digital economic innovations, the twin towers of IoT and Blockchain can disrupt every nook and corner of the Smart home market – a USD 84 billion in 2017 (up by 16% when compared to USD 72 billion in 2016) as per a report by Strategy Analytics.

It has been estimated that worldwide consumer spending in the smart home sector (i.e. devices, hubs, and services) might sum up to nearly $96 billion in 2018 and is expected to grow at 10% CAGR to $155 billion over the forecasted period from 2018 to 2023.

These are exciting times for any company to hop on the smart home wagon and gain early mover advantage. Unsurprisingly, a lot of activity could be noticed in the domain, as multiple new players and big players from parallel domains have ventured into the sector to leverage the opportunity in front of them.

These are exciting times for any company to hop on the smart home wagon and gain early mover advantage. Unsurprisingly, a lot of activity could be noticed in the domain, as multiple new players and big players from parallel domains have ventured into the sector to leverage the opportunity in front of them.

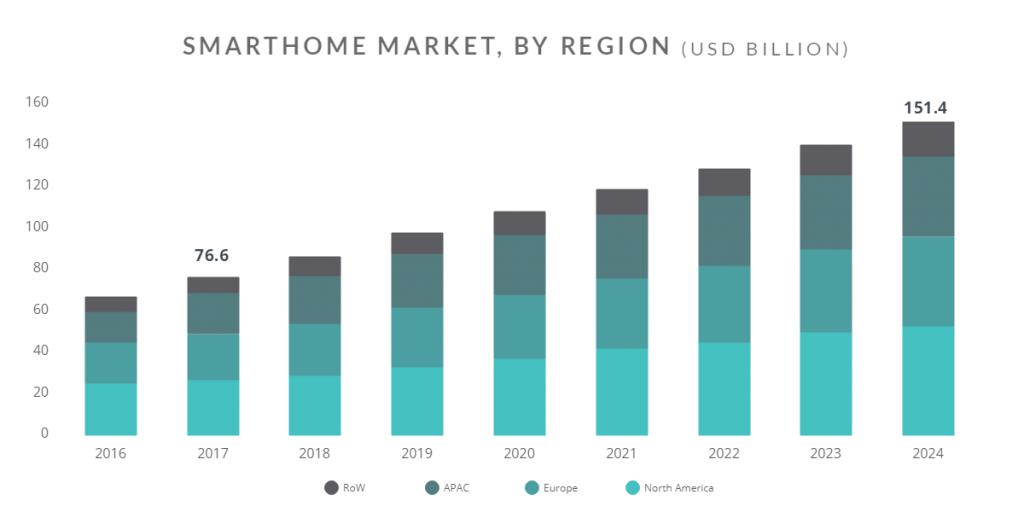

Geographical Distribution of Global Smart Home Market

The geographical distribution of the global smart home market could be distributed into five major regions – North America, Europe, Asia Pacific, South America, and the Middle East & Africa. North America is expected to credit for 41% of total spendings summing up to around USD 40 billion and continue its dominance during the period (2018 – 2023).

It could well be anticipated that the rising demand for smart home health care could be the market driver for the smart home market in North America. Further, the smart home market in the Asia Pacific and Europe is also expected to grow handsomely at USD 26 billion and USD 17 billion respectively.

This is again huge, considering the size of the population in the Asia Pacific and the high rate of adoption of such technologies in northern and Western Europe.

Over 10 billion it connected devices are in use, which will hit the 20 billion device marks within the next two years, cites a report by Gartner. The same report also mentions security and privacy to be a major concern amongst the market.

Over 10 billion it connected devices are in use, which will hit the 20 billion device marks within the next two years, cites a report by Gartner. The same report also mentions security and privacy to be a major concern amongst the market.

Another study suggests that the interest of smart home devices is higher among people aged less than 35 years and this group will be the potential purchasers of the Smart Homes of tomorrow.

The Future Outlook of Smart Home Market

Let’s have a look at how the Smart Home sector is panning out so far and what could be the future outlook.

Governments want the Smart Home market to boom

Smart homes have gained increased attention in both policies and government regulations across the globe. Climate change, skyrocketing energy consumption, and prices have necessitated governments to look for new and eco-friendly ways of producing, delivering and consuming energy.

Governments around the globe are giving the burgeoning Smart Home industry a big push. Let’s have a look at some of those initiatives:

- The UK govt. has set a target to install smart electricity meters in 26 million homes by 2020. Moreover, the IoT initiative of the Chinese govt. is also expected to give a tremendous boost to the home automation market.

- The govt. of India’s smart city initiative will make the country one of the largest smart home market. The govt. has plans to develop 500 cities to smart cities and this is expected to give a strong push to the smart home market across the country.

- Aged Care Housing industry in Australia has started incorporating smart home technologies to make the lives of the elderly more independent[ The Government of Australia is playing a critical role in this].

According to a report by Reuters, led by government initiative like accelerating smart meter roll-out, awareness of the energy crisis, and European directive to reduce 80% of carbon emission by 2050, the UK Smart Home market is expected to see significant growth over the forecast period (2018 to 2023). Moreover, according to the same report, Italy, Russia, France, and Germany are expected to lead the pack for HVAC systems.

Security and privacy remain the Achilles heel of the smart home industry

Though the smart home market has sailed smoothly through the initial phase of the hype cycle, the next-gen of smart home adopters is expecting a more secure and reliable ecosystem. There still exist some significant technical concerns like data security, integration/connectivity and inoperability that need to be addressed soon.

Any device that is connected to the Internet is at risk of being hijacked.

– Edith Ramirez, Chairwoman of the Federal Trade Commission

The connected devices are susceptible to cyber-crimes and security breaches. Considering the level of access afforded to connected devices (like security cameras, motion sensors, and home-based virtual assistants, etc.), the network or the servers that gather, and process the information from sensors has always been a cause of concern among most people.

For example, an attacker might hack into a smart home ecosystem through a connected coffee maker or speaker, for that matter. Therefore, there is a persistent threat of data breach led by identity theft, revealing critical banking info to hackers etc.

In the light of privacy concerns led by the events like Facebook alleged data breach, Deloitte survey, not surprisingly found that close to 39% of respondents raised concerns about connected devices tracking their usage, and more than 41% said they were worried that such gadgets might reveal too much about their personal information (e.g. Their private life, financial information, etc.)

According to a report by Business Insider 72% of respondents who already own a smart security system are worried that home security companies will invade their privacy. Moreover, 87% of respondents have concerns related to in-home delivery services like Amazon Key.

No wonder many companies have concentrated their efforts on security and privacy of user data in smart home ecosystems. As per Priori data, the global smart lighting market grew by nearly 81% to $101.2M between Q2 2016 and Q2 2017, and the global smart security systems market grew by 78% to a staggering $723.8M between Q2 2016 and Q2 2017. That is, security and convenience are driving the growth of the smart home market.

IoT + Blockchain Can Become The Force to Reckon With

Blockchain technology is currently being tested for its ability to enhance device security and it can kill the paranoia around privacy and security. This can enable the decentralization of data i.e. hackers cannot access the trends even by hacking into a device connected with your smart home ecosystem. Additionally, in a blockchain-powered smart home system, you can securely enable limited/full access of specific devices to other people (i.e. without giving them access to everything).

A good example of smart home tech using blockchain for this purpose is Comcast. It is using the Xfinity X1 platform to help ease the implementation of their blockchain security to their customer’s smart gadgets. Their blockchain platform utilizes a permission-based ledger, enabling the homeowners to grant permissions remotely through a mobile application. The mobile app also enables them to revoke these permissions at a single click. This is just one. Below listed are some more players and their offerings in the space.

- Telstra is experimenting with a combination of blockchain and biometric security for its Internet of Things (IoT) smart home offerings, according to Katherine Robins, a principal security expert at Telstra.

- Hdac, an IoT platform by Hyundai, recently revealed it would expand its blockchain services to smart homes and so-called “online-to-offline” areas. This would bridge the gap between public and private blockchain services.

Circling back to the topic, blockchain-powered smart home technology can also enable additional benefits like homeowners can hire domestic workers for specific tasks and pay them through smart contracts to ensure that the specified terms are met before executing the contract. With the implementation of technologies like IoT, AI and blockchain in the Smart Home ecosystem, no doubt, even more, advanced solutions are yet to turn up.

According to a survey by digital security firm Gemalto, adoption of Blockchain technology to Secure IoT nearly doubled in 2018.

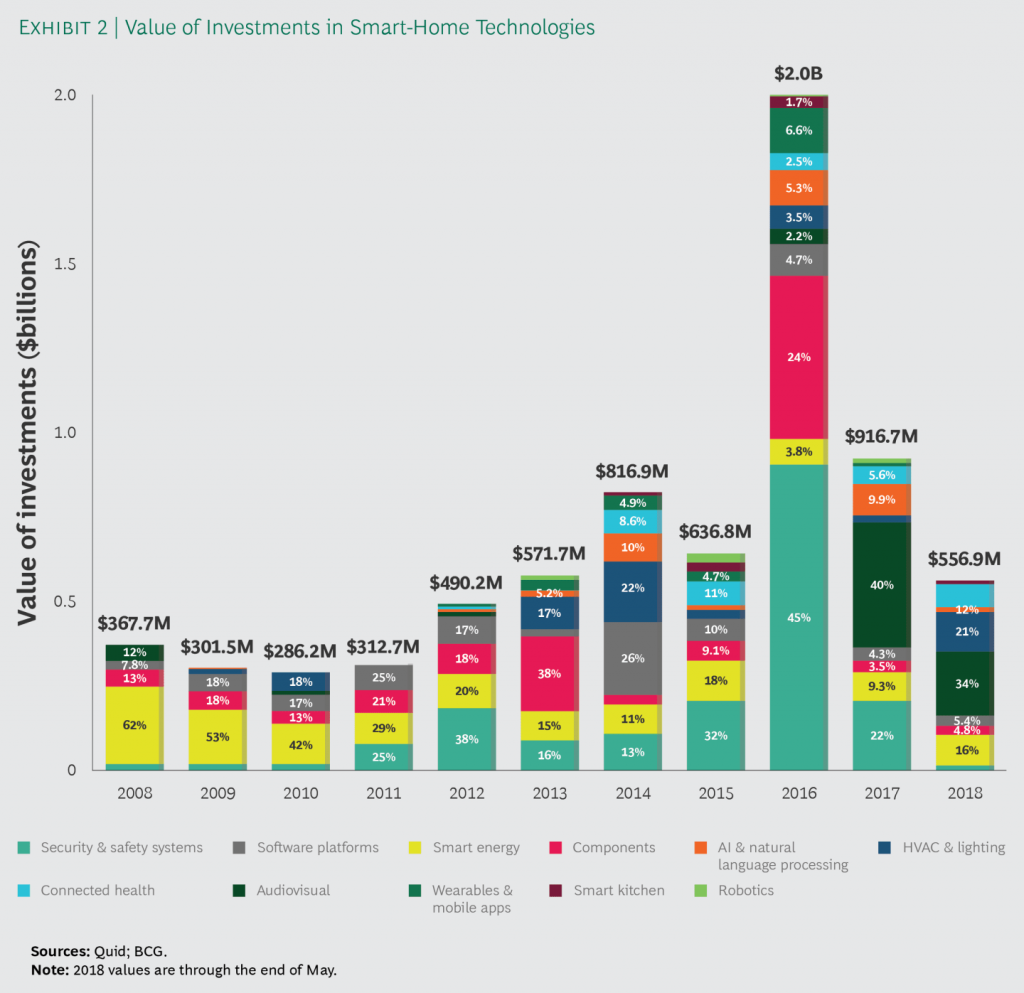

M&A Activity in the Smart Home domain

M&A activity of tech giants has been yet another signifier of the growing importance of the smart-home market. Of all the varying sectors (like HVAC and lighting, wearable and mobile app, security & systems, etc.) in the Smart Home domain, those in the security and safety segment have encountered maximum M&A activity.

According to BCG, multibillion-dollar acquisition (with the highest median value, at $1.8 billion) between Hellman & Friedman and of Verisure might be one of the major factors triggering such an encouraging activity. HVAC and lighting market encountered the second largest activity in the domain (median value of $1.7 billion), guided by Google’s acquisition of Nest and Samsung’s acquisition of Smart Things for USD 200 million.

These, in addition to the aggressive investment activity from top players like:

- Amazon’s investment in Ring – Ring (formerly DoorBot) has roughly 1.6 million customers which could be integrated with Amazon’s Echo virtual assistant (Amazon Web Services) and sensing the opportunity, Amazon invested a hefty sum of $1 billion into the company. Through the acquisition of Ring, Amazon is clearly aiming at the home security market with its smart video doorbells and security cameras.

- Samsung acquired US-based home monitoring software company Perch that can enable people to use their old smartphones as security cameras.

- Intel and Samsung co-invested in MindMeld (it offers a voice interface that utilizes natural language processing for AI-powered conversations).

- Moreover, besides Nest, Alphabet has also invested in some other monitoring companies, including Revolv and Dropcam.

It would be fair to say that given the unexplored potential in the smart home domain, M&A activity to develop inter-industry solutions is making new winners every day.

Final Thoughts: The Vision of Seamlessly Connected Homes is Still a Far Cry

Even though Smart home is a hot topic for almost a decade now, the anecdotes we hear from the users and from think tanks across the smart home industry are primarily associated with three main concerns:

- Security and Privacy

- High cost of adoption

- Consumer trust

With the growth of the tech industry, we see many viable solutions by different players popping up hoping to solve the alleged “major” loopholes in the industry. Take blockchain tech for example – it can potentially solve the concerns associated with security and privacy. That said, there is still no practical solution yet along with a lot of tiny whitespaces to fill and hurdles to overcome. I think it would be safe to say that the industry is in its nascent stage (considering the percentage of the global population it prevails in) and has a lot of unforeseen and foreseen issues to overcome.

Moreover, various stats show that inter-industry or cross-industry collaboration and M&A could be a great way to combine resources to eliminate the primary challenge the industry is facing. This could potentially give the players an early mover advantage.

IBM & Samsung have collaborated for IBM’s proof of concept for ADEPT, a system developed in partnership with Samsung to build a decentralized Internet of Things and Toyota & Panasonic joining hands to get ahead in EV space, are some of the successful examples of the biggies from parallel industries inking deals to maintain an edge.

Added to that is recent M&A events in the smart home industry, especially in the segment of security and systems, this signals that many industry players are keen to lead the pack by forming strong collaborations or partnerships. The growing interest of other players from parallel industries in the Smart Home domain stresses on the fact that this is the high time to grab the opportunity.

After all, it is the early bird that gets the worm.

Authored By: Gaurav Sharma, Associate, IP Solutions