Cocoa is at a breaking point. Climate change, crop diseases like the black pod, and supply chain instability have driven cocoa prices to an all-time high of $12,906 per metric ton. At the same time, aging cocoa trees, forced labor concerns, and looming regulations like the EU Deforestation Regulation (EUDR) are reshaping sourcing strategies. Chocolate manufacturers can no longer rely on traditional cocoa alone; they need viable alternatives. This space is booming with innovation. Startups and scale-ups are keen to find cocoa alternatives to solve this issue.

Natural options like carob powder lack cocoa’s polyphenol complexity, requiring major recipe adjustments. Fermentation-based cocoa alternatives from startups like Planet A Foods mimic chocolate’s flavor but come with scalability challenges due to bioreactor costs and batch inconsistencies. Meanwhile, cell-based cocoa from companies like Celleste Bio offers a long-term solution but faces steep production costs and regulatory hurdles.

This article explores the most promising cocoa alternatives startups, analyzing how well they replicate cocoa’s taste, texture, and cost efficiency.

While plenty of cocoa alternatives exist, most fall apart in real-world applications. Either the taste isn’t quite right, the texture’s off, or the cost is nowhere near scalable. R&D teams spend months on trials, only to find out that the supply chain won’t hold up.

Our cocoa alternatives startups report dives further into formulations, scalability, process challenges, and cost roadmaps. Get the full report (including 6 more startups working in stealth mode) to evaluate potential suppliers, partners, acquisition targets, or investment opportunities.

Fill out the form to download the report:

1. Planet A Foods (QOA/NoCoa) Makes Chocolates From Sunflower And Grape Seeds

| Startup Name | Planet A Foods |

| Location | Planegg, Germany |

| Founding Year | 2021 |

| Technology | Fermentation-based cocoa-free chocolate |

| Investors | Burda Principal Investments, Zintinus |

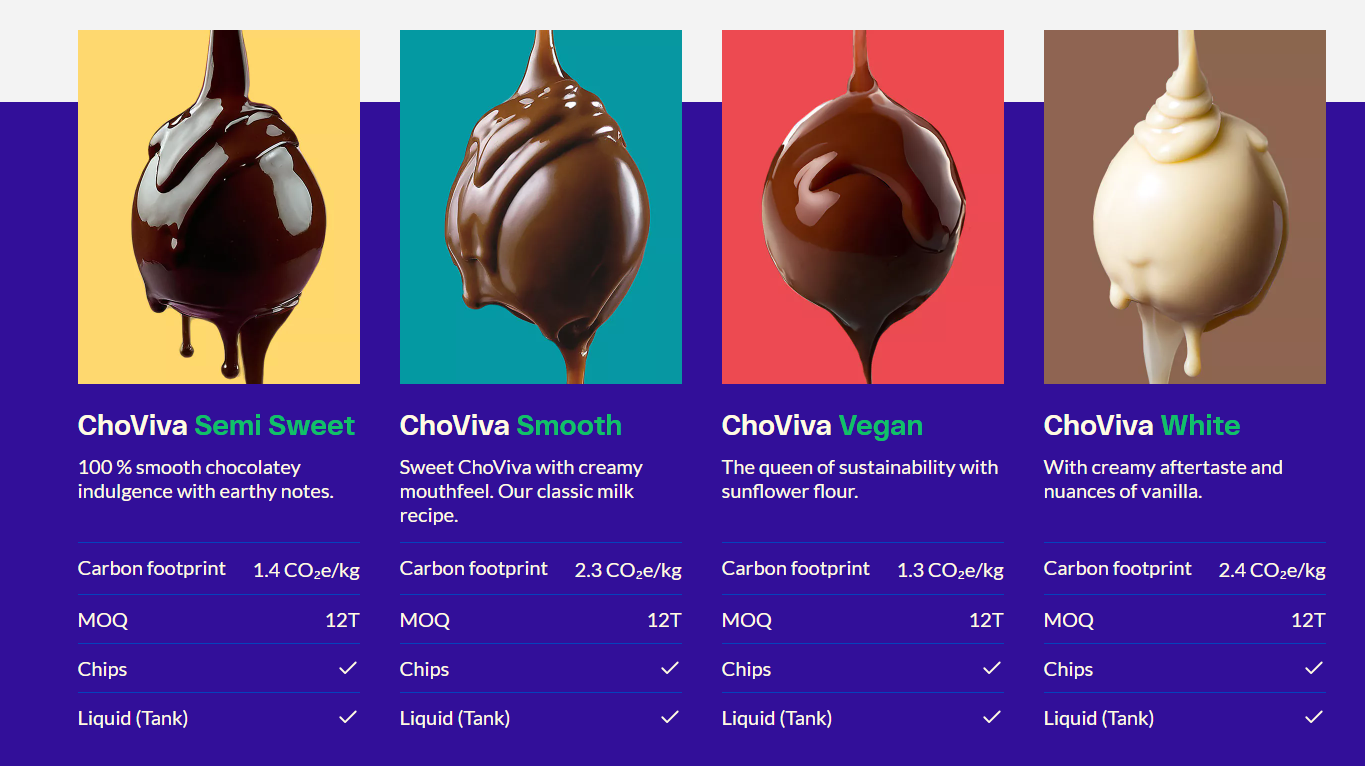

Dr. Maximilian Marquart (CEO) and Dr. Sara Marquart (CTO) founded this food tech startup that uses fermentation technology to create a chocolate-like product, ChoViva. This cocoa-free chocolate alternative is derived from plant-based ingredients such as sunflower and grape seeds.

Source: Planet A Foods

Cocoa Alternative Development: Dr. Sara Marquart worked with the University of Zurich to study cocoa’s flavor formation during cultivation, fermentation, drying, and roasting. Using mass spectrometry, she identified key compounds responsible for chocolate’s signature taste. She found that 80% of its flavor comes from processing, not the cacao bean.

Based on the research, Planet A Foods replicated the fermentation-based process, replacing cocoa seeds with sunflower and oats. The seeds are fermented, roasted at low temperatures, and blended with emulsifiers, flavors, and fat to create ChoViva, a cocoa-free chocolate alternative.

A cocoa butter and palm oil alternative: The startup also screened yeast strains and selected Yarrowia lipolytica for cocoa butter alternative production. Through CRISPR gene editing, they modified the yeast to create ChoViva Butter, a fat molecularly identical to cocoa butter. This fat improves ChoViva’s texture and mouthfeel, and the startup is considering using it as a palm oil alternative.

Collaborations and market acceptance: ChoViva is currently available in 20+ chocolate and confectionary products across 40,000 European stores. It has partnerships with brands including Lindt, Lufthansa, Peter Kölln, Deutsche Bahn, and Lambertz.

ChoViva and (Treets) Piasten’s collaborated product, the crunchy crown, has won the Consumer Award 2025 at ISM Cologne – the world’s largest trade fair for sweets and snacks. This shows consumer appreciation and acceptance for ChoViva products.

The startup recently collaborated with Seidl Confiserie to develop an alt-chocolate Dubai bar.

Funding and future plans: Planet A Foods is raising funds to solve scalability challenges caused by limited production facilities. The startup plans to use the recently raised $30 million Series B funding, co-led by Burda Principal Investments and Zintinus. It plans to increase production from 2,000 to 15,000 metric tons annually using this funding.

2. Voyage Foods’ Plant-based Alternative Chocolate Is Available in Walmart Stores

| Startup Name | Voyage Foods |

| Location | California, USA |

| Founding Year | 2021 |

| Technology | Roasting and Processing |

| Investors | Level One Fund, Horizons Ventures, SOSV, Collaborative Fund, Nimble Partners |

Voyage Foods has developed cocoa-free chocolate from sunflower seed protein, grape seeds, and RSPO-certified palm and shea kernel oils.

Cocoa Alternative Development: The startup’s patented technology and production process include gently roasting and processing these plant-based ingredients. The aim is to replicate the taste and texture of traditional chocolate while focusing on sustainability. It claims the products are cocoa-free, dairy-free, nut-free, and allergen-free.

Collaboration and market acceptance: In April 2024, Voyage Foods formed a commercial partnership with Cargill to scale and distribute their cocoa-free chocolate and nut-free spreads globally. The startup products are currently available in various markets, including Walmart stores, with plans to expand further.

Funding and future plans: The startup has raised a total of $94 million in funding from investors, including Level One Fund, Horizons Ventures, SOSV, Collaborative Fund, and Nimble Partners. It plans to use this funding to expand production and increase staff to meet growing demand.

Voyage Foods is also supported by The US Department of Agriculture (USDA) with a $25 million loan to open a large-scale production facility in Mason, Ohio. The 284,000 sq ft facility will produce 10,000 tons of cocoa-free chocolate annually.

Navigating industry shifts like cocoa shortage and alternative adoption requires access to innovations before they enter the market. However, with loads of ongoing research, it is nearly impossible for R&D heads to keep track of these innovations. This is where Slate by GreyB comes in.

Just ask the AI assistant, “What are the emerging innovations in cocoa alternatives?” it’ll give you the latest innovations to track, compare, and adapt.

Source: Slate

3. Celleste Bio’s Lab-grown Cocoa Can Replace 10,000 Square Meters of Plantations In 1 Year

| Startup Name | Celleste Bio |

| Location | Israel |

| Founding Year | 2022 |

| Technology | Lab-grown/Cell-cultured cocoa |

| Investors | Supply Change Capital, SnackFutures Ventures (Mondelēz International), The Trendlines Group |

Celleste Bio is developing cell-cultured cocoa by extracting cells from a single cocoa bean and growing them in a controlled environment with water, sugar, and vitamins. This system creates a continuous cycle and requires no additional beans for a longer time. While it’s not entirely cocoa-free (since cells are initially extracted from cocoa beans), it is a tree-free alternative to traditional cocoa farming.

Process Impact and scalability: The startup claims that one bioreactor can replace 10,000 square meters of cocoa plantations and produce two tons of cocoa per year—equivalent to 1,736 trees that typically take four to seven years to grow. This shows how quick and easy it is to scale cocoa production with this method without conventional cocoa production’s unpredictability, volatility, and compromises.

The startup also uses AI in its production process to provide chocolate manufacturers with customized cocoa, optimizing consistency and supply. It also claims that using AI will reduce costs related to formulation trials and waste.

Source: Celleste Bio

Market Availability: Celleste Bio’s tree-free cocoa products are not yet commercially available. However, the startup plans to produce cocoa butter at around $7,000 per tonne and cocoa powder at $3,000 per tonne by 2027. It is aiming to match pre-2024 cocoa prices.

Funding And Future Plans: In December 2024, Celleste Bio raised $4.5 million in a seed funding round led by Supply Change Capital, with backing from SnackFutures Ventures (by Mondelēz International) and The Trendlines Group. The startup plans to use these funds for research and development, expand infrastructure, and scale production.

4. Win-Win (WNWN) Makes Chocolate Using Carob, Oats, and Barley

| Startup Name | Win-Win |

| Location | London, England, UK |

| Founding Year | 2021 |

| Technology | Fermentation-based cocoa-alternative |

| Investors | PeakBridge, FoodLabs, Mustard Seed, HackCapital, MSM |

Win-Win, formerly known as WNWN Food Labs, is founded by Ahrum Pak and Dr. Johnny Drain. The startup creates cocoa-free chocolate alternatives using vegetables (fat), Carob, oats, and British barley. It uses traditional cocoa fermentation, roasting, mixing techniques, and equipment to make plant-based alt-chocolate product ‘choc.’

Source: Win-Win

Cocoa Alternative Development: Win-win invested heavily in R&D and experimented with Ghanaian shea butter to algae-based fat to achieve the texture and smoothness of chocolate in choc. The startup claims its products are vegan, caffeine-free, gluten-free, and produce about 80% fewer CO₂ emissions than standard chocolate.

Collaboration and Market Acceptance: Rebranding from WNWN to Win-Win, it now sells its cocoa-free chocolate in wholesale packs to bakeries, food service operators, and the confectionery sector. It currently offers dark, milk, white chocolate, and vegan oat milk chocolate as B2B. Toad Bakery, a Lyaness bar in London, and Sem, a wine bar in Lisbon, use win-win cocoa-free choc.

In blind taste tests, consumers found their cocoa-free chocolate was similar to conventional chocolate in taste and texture.

Win-Win CEO and co-founder Ahrum Pak said in an interview:

“We’ve been able to scale rapidly, due in part to the use of widely available ingredients and production methods that don’t require regulatory approval or expensive platforms.”

5. ForeverLand

| Startup Name | ForeverLand |

| Location | Milan, Lombardia, Italy |

| Founding Year | 2023 |

| Technology | Fermentation-based cocoa from Carob |

| Investors | CDP Venture Capital, Exor Ventures, Kost Capital, Eatable Adventures, Grey Silo Ventures, Kost Capital, FoodSeed |

Foreverland is founded by Massimo Sabatini, Riccardo Bottiroli, Giuseppe D’Alessandro, and Massimo Brochetta. The company develops cocoa-free chocolate alternatives with its double patent-protected product, Choruba (formerly Freecao).

Cocoa Alternative Development: Choruba is made from carob, a Mediterranean legume, along with grains, sugar, and vegetable fats. Its life-cycle assessment shows it has 90% less water consumption and 80% less carbon emission than conventional chocolate.

Strategic Advantages: The startup’s production process combines fermentation with other food-processing technologies adapted to raw materials. This approach allows it to bring its products to market without regulatory approval.

It also has the strategic advantage of a continuous supply of source ingredients, as Italy (where ForeverLand is based) is the second-largest carob producer. The local carob supply helps in low transportation and production costs, easy-to-scale production, and quality control.

Collaboration and Market Acceptance: ForeverLand has previously released limited-edition chocolate alternatives, including Easter eggs, pralines, and panettone. With a partnership with Pioppo, a nut producer, the startup recently introduced chocolate-covered almonds.

Source: ForeverLand

It is also working on vegan milk, dark chocolate, white chocolate alternatives, and spreadable creams. Its established partners from the bakery and confectionery industries are testing Choruba in liquid and drop form for different food applications.

Recognition: The startup was among the seven agrifood startups in 2023 chosen for the FoodSeed Accelerator, a state-backed CDP Venture Capital network. It also won the PNI “Premio Nazionale Innovazione” in the industrial category. In 2024, it won the Food Tech World Cup in Lausanne.

Funding And Future Plans: In 2024, Foreverland raised €3.4 million in seed funding from Grey Silo Ventures, Eatable Adventure, and Kost Capital. With this funding, the startup plans to establish its first production facility in Puglia, Italy, where carob is widely grown. It will be part of its plans to increase production, expand into new markets, and develop new formulations.

Co-founder and CMO Giuseppe D’Alessandro said:

“These funds will primarily be used to set up our first production facility in Puglia, expand into new markets, and accelerate the development of new products featuring Choruba. We’ll also continue to invest in R&D, particularly to enhance the scalability and versatility of our ingredient, Choruba.”

6. California Cultured Is Supplying Lab-grown Cocoa and Coffee to Companies Like Meji

| Startup Name | California Cultured |

| Location | Davis, California, United States |

| Founding Year | 2020 |

| Technology | Lab-grown cocoa |

| Investors | SOSV, SVG Ventures, Blue Horizon Corporation, IndieBio, Cult Food Science, Meiji Ltd. Co, Agronomics, Sparkalis (by Puratos) |

California Cultured is a food tech startup founded by CEO Alan Perlstein. It specializes in producing sustainable chocolate and coffee by cultivating plant cells.

Cocoa Alternative Development: The process involves extracting a small number of cells from selected cocoa plants and growing them in a nutrient-rich broth within controlled tanks that mimic rainforest conditions. After 3-4 days, these cells are harvested, fermented, and roasted to develop the complex flavors characteristic of traditional chocolate.

The cell-cultured cocoa of California Cultured replicates conventional chocolate’s taste, texture, and aroma and provides a familiar sensory experience to consumers.

Collaboration and Market Acceptance: California Cultured has secured a 10-year supply agreement with its investor Meiji, a major Japanese chocolate company, to provide its Flavanol Cocoa Powder.

The startup is working towards bringing its products to market, with plans to start selling in the near future. It is working on securing Generally Recognized as Safe (GRAS) in the US for its lab-grown products like Flavanol Cocoa Powder.

Funding And Future Plans: Investors like CULT Food Science, Meiji Ltd. Co, and Agronomics back the startup. It received an investment (undisclosed amount) in October 2024 from Sparkalis, the food tech venture arm of the Belgian international group Puratos. This fund will be used to scale operations in its newly opened facility in the US to bring a cell-based cocoa powder product to the market.

“California Cultured is producing real chocolate and cocoa, which gives us a distinct advantage in taste and texture. From a marketing perspective, these products can not be labeled chocolate, which can harm customer acceptance.”

– Steve Stearns, Head of strategy, California Cultured

A lot of companies are betting big on cell-cultured cocoa, but here’s the reality: It’s not just about taste or cost—it’s about navigating approvals. The US market is relatively smooth (GRAS approvals), but Europe’s novel food regulations? That’s a whole different battle.

If you’re considering lab-grown as part of your roadmap, it’s worth looking at:

- Which companies already have a regulatory strategy in place?

- How are they handling cost parity with conventional cocoa?

- What’s the realistic timeline for widespread adoption?

We’ve mapped out such landscapes before and can walk you through what’s coming.

Fill out the form to contact our experts

7. The Kokomodo (Acquired by Pluri) Cultivating Premium Cocoa Beans to Produce Tree-free Alternatives

| Startup Name | The Kokomodo |

| Location | Tel Aviv, Israel |

| Founding Year | 2024 |

| Technology | Lab-grown cellular cocoa |

| Investors | EIT Food, The Kitchen – FoodTech Hub, Israel Innovation Authority |

CEO Tal Govrin and CTO Dr. Dario Breitel founded Kokomodo. The startup emerged from a joint venture between The Kitchen FoodTech Hub and Plantae Bioscience, with its technology developed in stealth mode for two years. It aims to create a stable, climate-resilient, and high-quality cocoa supply, addressing supply chain instability and quality inconsistencies in traditional cocoa farming.

Cocoa Alternative Development: The startup develops cell-based cocoa, extracting cells from premium cacao beans grown in Central and South America and cultivating them in bioreactors under controlled conditions.

Funding And Future Plans: Kokomodo raised $750,000 from The Kitchen FoodTech Hub and the Israel Innovation Authority to scale its production in 2024 and come out of stealth mode. It has completed lab-scale production and is expanding to pilot-scale bioprocessing to reach cost parity with conventional cocoa.

In an interview, co-founder and CEO Tal Govrin said,

“We are moving to produce biomass in a scalable bioreactor to further increase production volume and optimize it. In 18 to 24 months, we plan to produce hundreds of liters in bioreactors, working toward reaching commercial scale.”

Source: Kokomodo

Collaboration and Market Acceptance: The startup is targeting premium brands in consumer goods, including chocolate, beverages, spreads, and protein bars. It offers cocoa powder and cocoa butter tailored to different market needs.

Kokomodo is aiming for regulatory approvals in its target markets and moving toward commercialization. The U.S. market is a priority due to its simpler GRAS (Generally Recognized as Safe) process than the EU’s complex novel food regulations.

“We are currently working with regulation advisors who can provide the required support to build our regulation strategy and application. Submission will take place once the growth process in bioreactors is established,”

– Tal Govrin

Acquisition: In January 2025, Biotechnology firm Pluri Inc. initiated a transaction to acquire 71% stakes in the Kokomodo. The acquisition, valued at $4.5 million, was made through 976,139 Pluri common shares. Pluri is purchasing these shares from Chutzpah Holdings and Plantae. Both are controlled by health and tech investor Alejandro Weinstein, who has concurrently poured $6.5M into Pluri’s business.

The transaction is subject to regulatory and shareholder approvals, with completion expected in Q2 2025.

8. Nukoko Creating Cocoa Alternatives Using Fava Beans And Its “Unique Biotransformation” Process

| Startup Name | Nukoko |

| Location | Guildford, Surrey, United Kingdom |

| Founding Year | 2022 |

| Technology | Fermentation-based Cocoa from Fava Beans |

| Investors | SOSV, Innovate UK, IndieBio, The Mills Fabrica, Döhler Ventures |

Nukoko was established by chocolate entrepreneurs Ross Newton and Kit Tomlinson, as well as Cocoa research scientist Professor David Salt. It specializes in producing cocoa-free chocolate using fava beans.

Cocoa Alternative Development: The startup’s patent-pending fermentation process replicates traditional cocoa fermentation to transform locally sourced fava beans into a sustainable chocolate alternative. It puts fava beans through a “unique biotransformation” process and then ferments them in a controlled environment.

These fermented beans are dried, roasted, and ground into cocoa powder for cocoa-free chocolate formulations. This method reduces CO₂ emissions by up to 90%.

Strategic Advantages: Fava beans are already used in various regions, including Egypt, Peru, and China, in falafels and fūl as a high-protein base. The fermentation is also a replica of the cocoa fermentation process. Therefore, it doesn’t require approval from regulatory authorities as a novel food.

Kit Tomlinson mentioned in this video on Nukoko’s website that they will use other domestic beans in other markets like Asia. This process flexibility will make the production easily scalable and keep the costs low:

“Here in Europe, we’re using a fava bean because they’re abundant, they’re cost-effective, and really beneficial to the soil. But as we grow into Asia, for example, we’ll use a domestic bean. That makes our technology truly flexible and scalable.”

Sugar reduction: Nukoko’s alt-chocolate also solves the industry’s sugar reduction problem. Its chocolate contains 40% less sugar and offers higher protein, fiber, and antioxidants than conventional chocolate. The startup claims this sugar reduction does not affect the flavor as fava beans contain Vicilin, like cocoa. It is a seed-storage protein that breaks into peptides, and roasting them gives chocolatey flavors without adding sugar.

Funding And Collaborations: The startup secured over €1.3 million in a 2024 seed funding round led by Oyster Bay Venture Capital, with SOSV and The Mills Fabrica as participants. It also secured development agreements with the Coop Group, a Swiss food company with over 2,500 retail sites. Döhler, a fermentation and manufacturing industry giant, also backs this startup with a strategic partnership.

Future Plans: Nukoko plans to move from pilot-scale production to industrial-scale batches by 2025 using Döhler’s expertise in fermentation scale-up and ingredient systems. It aims to move from 500kg pilot batches to 10,000-litre fermentation batches, increasing production capacity of thousands of tonnes per month. This partnership will also help Nukoko with regulatory approvals and food safety requirements for its market launch.

Co-founder Ross Newton mentioned in an interview:

“We aim to launch in the first half of next year (2025). Our focus is EU/UK, and we are purely a B2B ingredients supplier. We will start supplying milk and vegan milk alternatives initially.”

The milk chocolate would contain 23% fava bean powder, shea butter, sugar, and sunflower lecithin. Nukoko is finalizing its first batch of dairy-free and milk chocolate alternatives for manufacturer sampling.

Sugar Reduction Report

Download the Report9. Food Brewer Growing Latin American Cocoa Varieties in Labs Using AI and Brewing

| Startup Name | Food Brewer |

| Location | Horgen, Zurich, Switzerland |

| Founding Year | 2021 |

| Technology | Plant Cell Culture with brewing system and AI |

| Investors | Zürcher Kantonal Bank, Sparkalis, Felchlin |

Food Brewer is a food-tech startup that specializes in producing cocoa through plant cell culture technology. The startup approach involves cultivating cocoa biomass in bioreactors under controlled conditions using microscopic analyses and artificial intelligence (AI).

Cocoa Alternative Development: Food brewers use cells from Latin American cocoa bean varieties for cultivation instead of Ghana and Cote d’Ivoire. It is currently working on dark chocolate formulations with fat derived from non-tropical alternatives like microalgae fat.

CFO Mathilde Dupin mentioned in an interview with FoodNavigator:

“We’re currently working on cultivating microalgae fat. We have three pillars: we’re pushing cocoa and coffee significantly and are developing sustainable fat as an enabler of cocoa and coffee.”

Source: LinkedIn

Funding: In a recent seed extension funding round, Food Brewer secured CHF 5 million (approximately $5.6 million), bringing its total funding to CHF 10 million ($11.1 million).

Notably, this round included investments from renowned chocolate manufacturers Lindt & Sprüngli and Sparkalis, the corporate venture arm of Puratos, a major bakery ingredients and chocolate producer.

Future Plans: The startup operates at a pilot scale with an 800-liter bioreactor. It plans to scale production by retrofitting existing brewing facilities or partnering with clients with adaptable production capabilities. The startup plans to establish large-scale plants with bioreactors of up to 50,000 liters on a long-term basis.

The startup aims to position itself as a B2B supplier of cocoa ingredients in global markets. It is trying to get Generally Recognized as Safe (GRAS) status from the FDA within the year. The goal is to enter the US market and commence sales by late 2026.

In parallel, it is also exploring European markets, but getting novel food approval from the European Food Safety Authority (EFSA) is lengthy and tough.

Source: Agritechdigest

Collaborations And Market Acceptance: Felchlin, a Swiss chocolate maker and food brewer’s investor, is testing the cell-based cocoa powder in its chocolates. Lindt and Sparkalis also joined as strategic collaborators to enhance the startup product development and accelerate market entry. It also partnered with Fruitful AI to use its advanced algorithms to monitor plant cell growth through controlled imaging.

Cost optimization: Food Brewer is incorporating brewing technology from Steinecker, the brewing division of German manufacturing giant Krones, into its bioreactor platform. The startup aims to cut production costs and improve efficiency with this process change.

It further optimizes the costs by harvesting the entire cell biomass rather than using precision fermentation that requires expensive downstream processing. The growth media it uses in the lab for cocoa cell development also consists mainly of low-cost sugars and essential nutrients.

Strategic Advantages: Food Brewer also has the strategic advantage of being based in Switzerland, which has a well-developed chocolate industry. It benefits from proximity to major chocolate manufacturers, allowing regular exchanges and collaboration.

10. Endless Food Producing THIC Cocoa-free Chocolate from Beer Industry Residue

| Startup Name | Endless Food Co. |

| Location | Copenhagen, Hovedstaden, Denmark |

| Founding Year | 2022 |

| Technology | A fermentation-based cocoa alternative using BSG |

| Investors | Rockstart, Nordic Foodtech VC, Export and Investment Fund |

Culinary experts Maximillian Bogenmann, Christian Bach, and Matt Orlando used their experience in renowned restaurants like Noma and The Fat Duck to co-found the startup Endless Food Co.

Cocoa Alternative Development: The idea was to upcycle the byproduct of industries to create a cost-effective and environmentally friendly substitute for traditional cacao-based chocolate. They chose Brewer’s Spent Grain (BSG), a byproduct of beer brewing, to develop a patent-pending chocolate alternative called THIC (This Isn’t Chocolate).

Impact: The startup claims its product is cost-effective, with 80-90% lower greenhouse gas emissions, land use, and water consumption. It also contains 50% less sugar, higher fiber, and protein, with similar nutritional value to traditional chocolate.

In its initial days, the Innovation Fund Denmark backed the startup. This Danish government incubator has a record for successful startups like Pleo, Trustpilot, Zendesk, Lunar, and Labster.

Collaborations And Market Acceptance: Endless Food partnered with 7-Eleven Denmark to introduce THIC-based products, including a co-branded cookie with TIM’s Cookies. It serves nearly ten B2B clients from bakeries, restaurants, and the chocolate industry.

Jesper Østergaard, CEO of 7-Eleven Denmark, said about the partnership:

“In our eyes, THIC is a truly exciting product because it’s a more sustainable alternative to chocolate – without compromising on great taste. We’re excited to offer our customers THIC in our cookies as early as next month – and without giving it all away, I’m quite sure they can look forward to more of this kind in our stores in the future.”

The startup supplies cocoa-free chocolate to restaurants like La Banchina, Il Buco, and Kaf and bars like Kihoskh in Copenhagen, Lisbon (Sem), and Stockholm. It aims to integrate its cocoa alternative into food production while continuing product development and expanding into new markets.

Funding And Future Plans: In December 2024, the startup secured €1 million in pre-seed funding, led by Nordic Foodtech VC, with participation from EIFO and Rockstart. The startup plans to scale production, establish a pilot plant, and expand the team using this fund.

Louise Rørbæk Heiberg from Nordic Foodtech VC claims:

“Endless Food Co is a great bet in the alternative cacao space.” He added, “They’ve nailed the taste and quality from the beginning.”

Read our recent report

What’s Next?

Most startups in cocoa alternatives lead with two main approaches: lab-grown cocoa derived from cocoa cells and fermentation-based substitutes using upcycled and plant-based ingredients.

Lab-grown cocoa, like that from Celleste Bio and Kokomodo, eliminates the need for traditional farming but faces inherited high production costs. Regulatory approvals vary by region, which is also a factor of uncertainty in the large-scale adoption of these alternatives.

On the other hand, startups making fermentation-based cocoa alternatives, such as Planet A Foods’ ChoViva and Nukoko’s fava bean chocolate, struggle with scalability and consistency. Differences in taste, texture, and fat composition are another challenge with these fermentation-based plant-driven cocoa alternatives.

Ongoing research in the fermentation process, low-cost lab growth mediums, and fat alternatives are helping startups improve these cocoa alternatives and their potential for large-scale production. With better processing methods, improved ingredients, and supply chain changes, a few stealth-mode startups are making cocoa alternatives that match consumer expectations and the production prices of conventional chocolates.

Our experts at GreyB can help you spot these lesser-known cocoa alternatives and startups, just like we helped this Fortune 500 FMGC company find inspiration for lab-grown proteins.