I faced a similar situation recently. Had I struck off this small company on my list, our client could have potentially lost millions of dollars.

So today, I am here to share some points that can help you decide whether to target specific small players for patent monetization.

The patent licensing project

I was working with a US patent attorney with over 25 years of experience in patent licensing. The project required identifying overlapping products for certain patents related to memory systems recently granted to the company. Additionally, we were to create claim charts for the companies with complete overlap—a fairly routine task.

While analyzing one of the patents, I identified that it was related to Processing-In-Memory (PIM) technology. On further research, I deduced that PIM is a relatively new technology. Currently, a handful of companies manufacture these types of memory devices. Many prominent semiconductor (memory) companies are still researching this technology.

Anyway, after research, I could determine overlap with three target companies. I was happy, but I also had a specific dilemma. To understand my dilemma, I’ve briefly explained what each company was up to.

Three Target Companies and the Dilemma

Note: For confidentiality reasons, I have codenamed the companies using alphabets.

- Company A:

Company A is one of the most prominent players in the memory industry. It is also one of the first companies currently selling PIM-based memory devices, having launched a product based on PIM in 2021.

However, the client had blocklisted Company A. That means the client did not want charts against Company A.

- Company B:

We identified this company as having published a couple of research papers on PIM-based memory systems. Further review revealed that Company B’s technology seemed to overlap with the patent.

However, Company B has not yet launched a product based on this PIM technology. Therefore, it is still researching this technology and may launch a product soon.

Company B is another big company in the memory domain. However, there are no products in the market that use this PIM-based technology. A claim chart is generally more powerful when targeting a company if the company is selling those products in the market. So, the only option was to prepare a claim chart against Company B using the information from the research papers. ‘Please keep it on the watchlist,’ my manager suggested. ‘Then, once Company B launches any product using PIM technology, update the chart with the product info.’

- Company C:

Company C is a startup that focuses on PIM technology and manufactures products based on it. We identified a complete overlap with the target product of Company C. This was a bullseye!

But Company C is a startup, so it was a small target for patent monetization. Our client expected to target big companies in the memory domain, so I was a bit skeptical about whether this company would be useful for the client and whether I should share it with them.

You understand my dilemma.

I considered dropping this patent and moving on to the next one in the portfolio, but I had a gut feeling that Company C was a good target. The question was how to prove this to the client.

I shared this with my manager. We brainstormed a bit and decided to dig a little deeper into Company C to see if we could find any supporting evidence for my feelings.

Investigating Company C

I started thoroughly researching the company. I aimed to identify leads that show good current/future value of Company C. And here’s what I found:

- One of the big players in the memory industry has invested considerably in Company C. This was an indicator of its future growth potential. Maybe this big player will acquire it in the future.

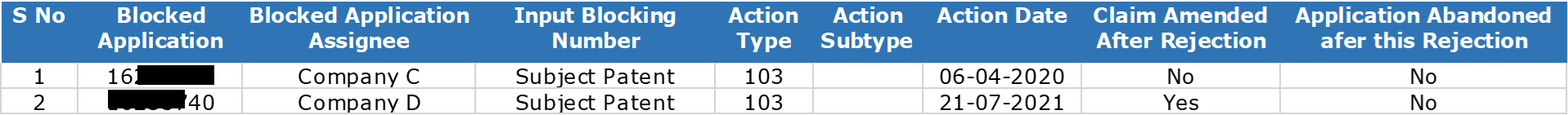

- I wanted to establish a relationship between the patent and Company C. For this, I entered the respective patent number into our BOS tool. Using the patent input, the tool quickly provided me with a list of 3 companies whose patent applications were rejected by the examiner (102/103 rejections). (By the way, you should check out BOS!)

I was surprised to identify that a patent application by Company C received a 103 rejection citing the respective patent. This was another indication that Company C was trying to patent something similar to what was already protected by our client’s patent.

I discussed these 2 points with my manager. And the results convinced us that Company C is a good target for the patent and the client.

Sharing my Analysis

We shared this with the client. He was pleased to see this information, and we convinced him that even though it is a small target, creating a claim chart against Company C would be beneficial.

I was more than happy that I followed my gut feeling and was able to crack something big.

This case made me realize that companies may lose a lot of money by not targeting such small players for patent licensing.

So, before you strike any small targets off your patent licensing list, examine every slight advantage the target may have.

Authored by – Harsh Garg and Rohit Sood, Patent Monetization Team.