How do you assess for your company, if the risk of patent litigation is ahead on the cards?

Companies, especially the ones based on internet technology face a constantly evolving landscape. This in turn makes them vulnerable to financial and reputational losses if IP risks develop.

As a result, it has created an exigency for their IP department to be prepared and always be ready to identify, manage, and mitigate the IP related risks that may come up in the future.

Sounds similar to your woes? If you just sighed yes then you’ve come to the right place.

Today I’ll walk you through a similar project where we went above and beyond to analyze the risk of patent litigation for our client, John.

John is the standardization expert of a German technology giant specializing in Internet and technology. He recently approached us to help him build a plan to manage the IP risk as his company expands in certain technology areas like Wi-Fi and Bluetooth. The hi-tech industry is litigation heavy and there are many NPEs and large companies that may not want other companies to expand in their domain. His CEO wants the IP department to be fully prepared as they are making a big investment in this area.

He had come to us bearing questions like:

- Can our products face litigation when they come to the market?

- Which companies are likely to litigate?

- Do they have enough patents of high quality to litigate?

- What type of litigation has already been in the past in these technology areas?

- Which companies have standard essential patents in these technologies? Are they litigious in nature?

In short, John wanted us to analyze the patent litigation risks for these technologies.

Analyzing Entities that can pose litigation risks

Now, there are n number of ways in which an entity can pose litigation risks. Like patents previously used in litigations, acquired patents, etc. For some entities, it’s their business model to generate X% of revenue from SEP patents by litigation. Others are non-practicing entities. While some are inventors trying to make money from their patent assets.

So, to find potential litigation risks, we started with background research. Our objective was the understand the ‘why’ behind each litigation so that we can understand the trend and try to project what may happen with John’s company as they enter in the two technology areas.

Defining the set of frameworks based on which the company may face patent litigation.

This was the groundwork. These frameworks would help us draw patterns and insights from the information. We could then assess litigation risks from different companies.

But before we started our search, I wanted to find answers to some unsettling questions. So I took this up for a discussion with my manager, Anoop.

Vincy [Yes, that’s me!] – How to capture companies that can litigate or patents that can be used for litigation? All I can think of is, companies which have litigated in the past will be a threat in the future too. But is that it?

Anoop – What about the newly emerging NPEs?

Vincy – I think we should try to identify what triggers the thought of litigation in the first place? Why do companies litigate? It will get us to the root of it.

Anoop – Interesting, let’s go ahead with it.

Vincy – I read this and that and this … (goes on for 5 minutes), but in the end, I am not sure how we can capture all the companies which may potentially litigate.

Anoop – Hold on. Let’s prioritise and study the highly litigating companies in the start. Figure out all about them, how they got those patents and where are they heading with those patents? We will then slowly move to other companies.

With Anoop’s suggestion, we started our in-depth analysis of the top entities. We aimed to find answers to questions like –

- Who was the original assignee of the patent?

- How many times has the patent been used in litigation?

- What kind of products were targeted?

- Was the patent a standard-essential patent (SEP)?

This analysis helped us to a great extent. We were able to figure out the areas where the potential litigating patents might lie. With that, we were now ready with our list and all set to select the potential litigation risk areas. Well, at every point we were aware that this is an initial list and slowly we may have to expand to those areas and patents which have not surfaced till now.

Selecting the potential litigation risk areas

After much thought and thorough study, we started with identifying the areas where patents likely to be used in litigation come from. We then narrowed them down to three:

- Patent transactions (patent reassignment)

- Already litigated patents in the target technologies – Wi-Fi and Bluetooth

- Patent licensing (specifically Standard Essential Patents)

Our next focus was to find the assignee of the patents in the above 3 scenarios. These are the ones that John should be aware of while evaluating patent risks. With that thought, we sorted the data based on the entities which can cause litigation threats as follows –

- German/European entities

- Foreign entities with DE patents (DE referring to the kind code for German patents)

- German/European NPEs

- Foreign NPEs with DE patents

- Inventors/ Universities with DE patents

Here, you’ll notice that our focus was completely on Germany based entities or the ones owning German patents. Naturally, because we were targeting Germany as the target geography.

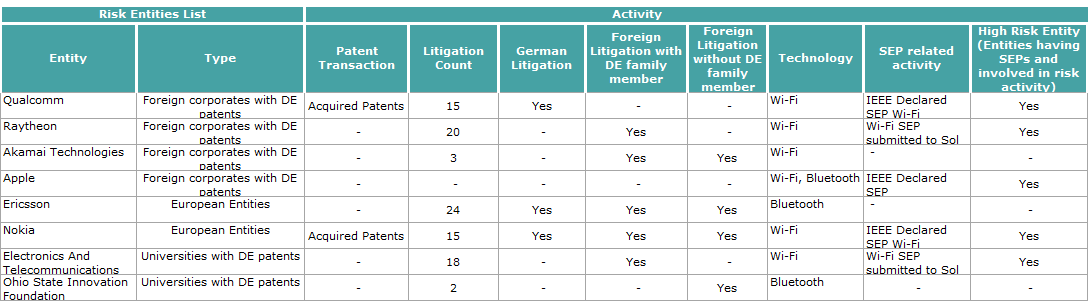

Before we went further into the wild, we decided to prepare a matrix – Listing all the entities concerning their corresponding risk areas like patent transactions, litigated patent, licensing, and SEP related activity.

A Matrix of all the entities causing potential litigation threat

As soon as we were done with the matrix, the picture of frameworks became crystal clear.

Now, this turned out to be an exhaustive list (~ 500). But we had expected nothing less. After all, it covered the target technology areas that are vastly implemented – Wi-Fi and Bluetooth.

The next challenge was to zero down on entities that are of a critical or comparatively higher threat to the company than the others.

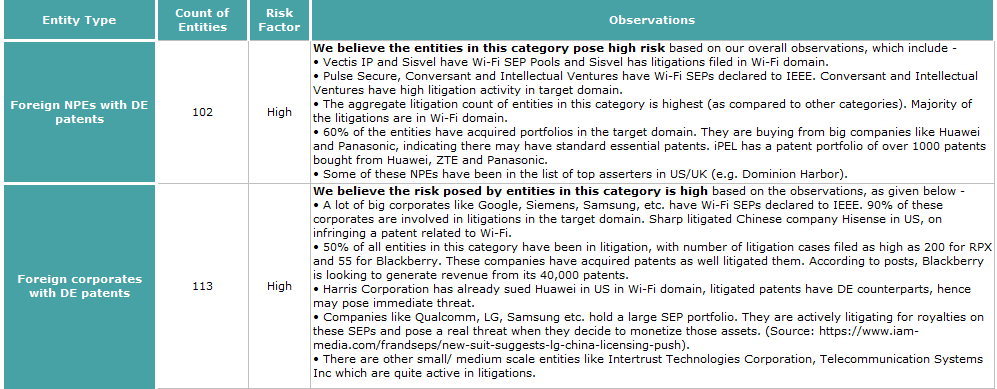

For this, we gathered the observations on the entities, category wise. We studied the activities of companies in each category, including geographies where they have litigated, collaborations, SEP pool participation, etc. Based on this, overall observations on each category were gathered. The categories were then ranked based on their risk factor.

And that set course for our next step.

Categorizing and shortlisting potential risk entities

We focused on the high-risk categories and shortlisted entities based on patents litigated, transacted, and SEPs. We gave weightage to each entity based on participation in litigation, transaction, and declaring SEPs. Based on it, we were able to narrow down our list to 150 entities.

Moving on, this brought us a step closer to circling in on a few entities that could be of high risk.

With that came the second phase of our analysis – Risk Confirmation and Profiling i.e. a detailed analysis of selected risk entities.

Digging Deep into details

For each risk area, patent litigation, patent transaction and SEP declaration, the shortlisted entities were analyzed on the following parameters –

- Reasons for litigation,

- Product targeted,

- Litigation timeline,

- Public statements on their business plan,

- Geographic expansion,

- Activities in China,

- Mergers and Acquisitions,

- Reasons for the patent transaction,

- Patent Transaction timeline

- Contribution in SSO (standard-setting organization)

- Patent royalty assertion activities, etc.

For each technology area, we followed two different approaches to analyze the above parameters for the selected entities in detail.

- Analyzing the activities of entities from public search (articles, blogs, news, PR release, etc.). These activities included risk factors like patent transactions, litigations, licensing, etc.

- We then covered the patents which are transacted and litigated from a dedicated patent database. This would complement the information extracted from the public search.

Finally, to cover all bases and avoid last-minute surprises, we additionally covered the German patent litigation database. The list of potential risk entities was ready, but, quoting Robert Frost here, we had miles to go before we sleep.

There were Technology specific Challenges to overcome in parallel

As for Wi-Fi, we knew that the technology is quite broad and also pretty mature. So measures like risk mitigation were already taken care of by pools like Sisvel and Sol IP. However, we focused on digging risks that were under cover like NPEs or budding players, especially in the European region.

Our next hunt was Bluetooth. With no SEP data available publicly, it was difficult to differentiate whether litigation is based on the standard or Bluetooth-based products and standard-based litigations were very few to conclude. So we focused majorly on patent data, analyzed its relevance to Bluetooth standard and identified risk entities.

Only the inquisitive survives

Once we had all the info, we used it to draw insights into the entity’s behavioral patterns –

How have they acted in the past?

What steps they may take in the future that can pose litigation risk to ABD Inc.?

This helped us forecast the probable threats. For each entity, we were, therefore, able to attach risk profiles namely –

Red Flag – These entities need immediate attention as they are either already litigating in Germany or plan to enter Germany. They may have High/Medium risk associated with them.

Yellow Flag – These entities are a potential threat and may become red-flagged soon (or once they enter Germany). They may have High/Medium risk associated with them.

Green Flag – These entities are safe for now or pose a low threat but should be known from an awareness standpoint. So that nothing comes around as a surprise in the future. They may have low or medium risk.

Closing with a detailed storyline

With all this done, the output was shared with John. He now has a list of entities that may pose a danger immediately and the ones which may become a threat 4-5 years down the line. We also shared a detailed storyline on each entity related to their history in litigation, how the pattern showed their potential of litigation in the future, in which areas they can pose threat, etc. He is now equipped to build a plan that can mitigate the future risk identified through this study.

Well, you can never have a definite answer for the risk, but that’s why we all studied probabilities. If you know the logic behind why a certain event may occur, you can build your plan accordingly. So in short, if you have explored the area, understood the obstacles in the way, you can squint your eye a little, and aim before you throw your dart.

Concluding Note

Stepping into a new domain is akin to throwing a dart. Exploring IP related risks are just as important before you aim to expand your business into a new domain. That’s where litigation predictive analysis using large volumes of case precedents come into play. Companies usually follow patterns and you can use them to understand the risk and plan the right measures to mitigate them.

A piece of advice – Don’t throw your darts in the dark. Evaluate the litigation risks before you put your finances at stake.

Want to know more about litigation predictive analysis or need our help in evaluating litigation risks for your next technology expansion project? Fill the form below and we’ll get back to you in no time.

Authored by: Vincy Khandpur, Patent Infringement, and Nidhi, Market Research.