Companies should invest their time and resources into developing a diverse patent portfolio as it can act as a vast resource of revenue as well as provide a competitive advantage. In fact, every company must have a patent portfolio as part of its business strategy.

You must have heard some variation of this advice from various sources. But do you ever wonder whether this is indeed wise advice? TBH, it is. Don’t believe me? Let me help you understand this with the help of an example, and then walk you through a taxonomy for classifying your patent portfolio and the benefits of doing the same.

Illumina – The company that soared due to its IP

Illumina Inc, founded in April 1998 is a biotech company that develops, manufactures, and markets integrated systems for the analysis of variation in genes and genomes. The company has witnessed notable growth over the years, reporting a significant percentage increase in revenue in the past few years.

The worldwide demand for Illumina’s products and services is one of the factors responsible for its growth. The other driving force for Illumina’s growth being its steady investment in innovation as indicated by its patent filings.

The patent portfolio of Illumina and its subsidiaries consists of 3,712 patent applications spread across 874 patent families. The patent filing trend of the company for the past 20 years portrays a steep rise (especially after 2011). Further, the average R&D spend of over $1.6M is estimated for each patent, an indicator that Illumina takes strong measures to protect its investment through IP rights.

The company’s biggest advantage over its competitors lies in its technology diversification as indicated by the multiple technology areas in the technology classification of its patent portfolio. With competitors leaning towards globalization of their R&D by collaborating with inventors outside of their home economy, Illumina is also following suit. Such collaborations and joint R&D with other organizations fit in well with technology diversification and innovation that Illumina is known for and is responsible for propelling the growth of revenue of the company.

At this point, having heard all about Illumina’s story, would you agree that having a diverse patent portfolio and a portfolio strategy as a part of the business strategy makes sense?

I bet you answered in affirmative. Because you have realized that in addition to protecting your innovations, your patent portfolio can give you a monopoly position in the market, yield revenue from licensing, and help gain a strategic advantage over your competition.

But let’s be honest, developing a portfolio-based strategy could be tricky.

Why you need a proper portfolio management strategy in place?

To ensure your patent portfolio is a winning one, it is vital to develop a portfolio-based patent strategy that will take into account the company’s size, annual turnover, and research expenditure. Besides, it is vital to avoid over-diversification and only focus on patents that give you a leadership position in a segment or market to keep the number of patents in your portfolio in check.

Therefore, to create and maintain a successful portfolio, you must invest time, research and money into it to gain a business advantage over your competitors.

Wondering how a proper portfolio management strategy can add to the overall value of your company?

You’d agree that there could be a situation when an arm of your business doesn’t remain profitable but the technology behind it might still be relevant and even valuable to the other players in the market. In such a case, your patent portfolio can be auctioned or used as a point of negotiation to extract the maximum value from the dying business arm.

Remember Google’s acquisition of Motorola Mobility that was later sold to Lenovo. Google retained a good chunk of the patent portfolio of Motorola Mobility to defend Android OS and later sold the division to Lenovo for a much lesser amount. But why did Google do that?

Simply put, Google’s main revenue comes from advertising and it was in their interest to get Android onto as many smartphones as possible. Google, therefore, wanted Motorola for the patents, and not for anything else. As Samsung had started building its Android rival – Tizen and Apple’s attack on Android licensees was dying down – Google decided to own Motorola’s extensive patent library that it could use defensively.

However, Google never intended to market themselves as phone manufacturers. So, just as some of its major licensees started developing or buying non-Google operating systems fearing competition from Google-manufactured phones, the company sold off Motorola and continues to provide operating systems to phone manufacturers around the world.

From the above example, it is clear that a quality patent portfolio can be your strongest point to not only protect your products and technology but also boost the worth of your company.

Investing in a solid patent portfolio also promises great ROI through licensing opportunities especially in the case of tech research. Besides, a high-quality patent portfolio will help you survive litigation which often crops up in the lifecycle of a patent.

Taxonomy for classifying your patent portfolio based on the value

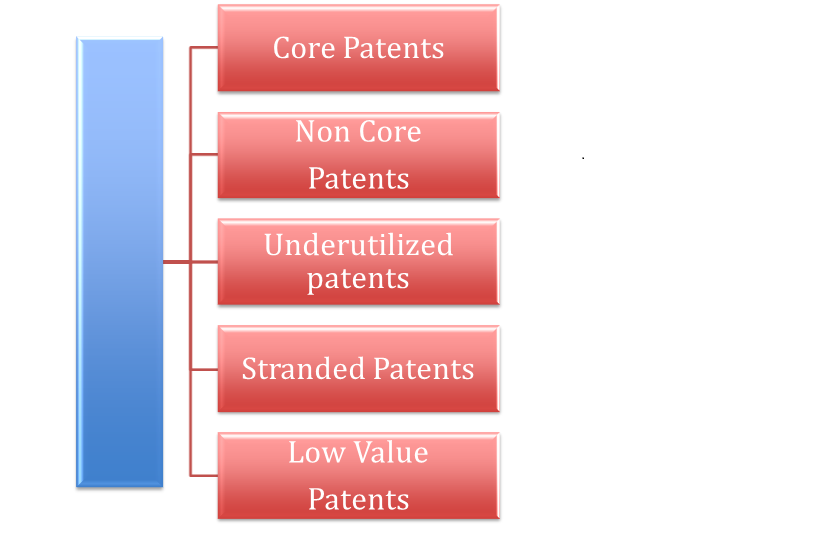

For any business, their patent portfolio is a potent tool for maintaining a competitive edge in the market. It is, therefore, quite important to sort your portfolio according to the value they offer to the business. Below mentioned is one such classification.

Core Patents relate directly to the company’s current and anticipated products, markets, customers or suppliers. The hallmark of core patent is that it provides a strategic advantage over the competition, and is thus best monetized indirectly by ways like product sales revenue, increased market share resulting from product differentiation or increased enterprise value, rather than directly by out-licensing or sale (except to the extent that it may be underutilized).

Core Patents relate directly to the company’s current and anticipated products, markets, customers or suppliers. The hallmark of core patent is that it provides a strategic advantage over the competition, and is thus best monetized indirectly by ways like product sales revenue, increased market share resulting from product differentiation or increased enterprise value, rather than directly by out-licensing or sale (except to the extent that it may be underutilized).

Non-core patents offer less value to a company’s operations and potentially could have more economic value to a third party than to the present owner. The core patents can become non-core due to a change in the company’s strategic direction, a shift in the relevant market, discontinuation of a business unit or product lines. They are often acquired, along with core patents via corporate M&A transactions.

Underutilized Patents also covers non-core markets or applications.

Stranded Patents are non-core patents that have significant current or potential economic or strategic value to third parties in non-competitive markets or applications.

Low-value Patents are non-core patents that have little or no current or prospective value either to the owner or to third parties.

Benefits of classifying your patent portfolio according to value

Before we dive into the benefits of a value-based classification, let’s see how global giants view their patent portfolio using the above-mentioned taxonomy.

Let’s take the example of Apple Inc., a multinational technology-based firm centered in Cupertino, California. Apple designs, develops and sells consumer electronics, computer software, and online services.

Apple does not license its patent portfolio generally and creates products that run only on its proprietary OS. The company has a diverse patent portfolio and aggressively enforces its IP rights through various methods including litigation. The company does not license its technologies to third parties, and its portfolio can be seen as:

- Core technologies that are developed in-house or licensed from third parties.

- Secondary technologies such as iTunes to support the core technologies

The company actively engages in litigation to enforce and protect its intellectual property.

Microsoft is another American multinational software corporation headquartered in Redmond. It develops, manufactures, licenses, and supports an array of computing products and services.

Its portfolio comprises an extensive suite of core technologies developed in-house as well as those purchased or licensed from third parties. These form a major source of revenue for the company as it licenses its proprietary mobile OSs to non-affiliated wireless handset original equipment manufacturers (OEMs).

In the case of Apple and Microsoft, both the companies have portfolios based on the core technologies that they assert to defend and/or expand their market share. Google, another global giant, does not derive much revenue from its patent portfolio but only leverages it for defensive purposes.

Competitive analysis is yet another significant advantage of portfolio classification. By classifying your portfolio by value, you can review competitor portfolios with the same yardstick, and employ one of the following methods to outdo your rivals if you think your patent growth is getting blocked by competition:

- Buy the patent or the company

- License or swap the IP (cross-license)

- Create better technology and patent it

- Sue for infringement or invalidate patent through legal action

- Oppose pending applications

A nick in time saves nine

It is quite clear that all successful businesses classify their patent portfolios in line with their business objectives. Indeed, your patent portfolio is like an investment and it is essential to use it like one.

Classifying your portfolio according to the value of each class of assets (or patents) can help you to not only manage your portfolio better but also identify areas that need more development. Besides, you can accurately evaluate your portfolio in this manner and get an estimate of which technologies or assets you can use to establish dominance or earn revenue through licensing.

Patent portfolio management is important to not only protect but also use your intellectual property to its maximum potential. However, patent portfolio management is not a one-day affair – it is not feasible or a good idea to update your portfolio once a year or bi-annually because to maintain a competitive advantage you need to be on top of your patent portfolio at all times.

Remember, patent management must be a regular feature of your organization and not a one-time exercise. In fact, when you apply for patents, they should be immediately filed under relevant heads so that the entire system becomes intuitive, saving you time and hassle.