If your products rely on materials like palm oil, soy, or timber, EUDR compliance introduces complex challenges. Gaps in traceability tools, unreliable geolocation data, and limited supplier transparency have delayed product launches and increased costs. Industries are struggling to find compliant materials that still meet functional needs.

In this study, we take a closer look at the EUDR, breaking down what it means, the industries it impacts, and how businesses can adapt to meet its requirements.

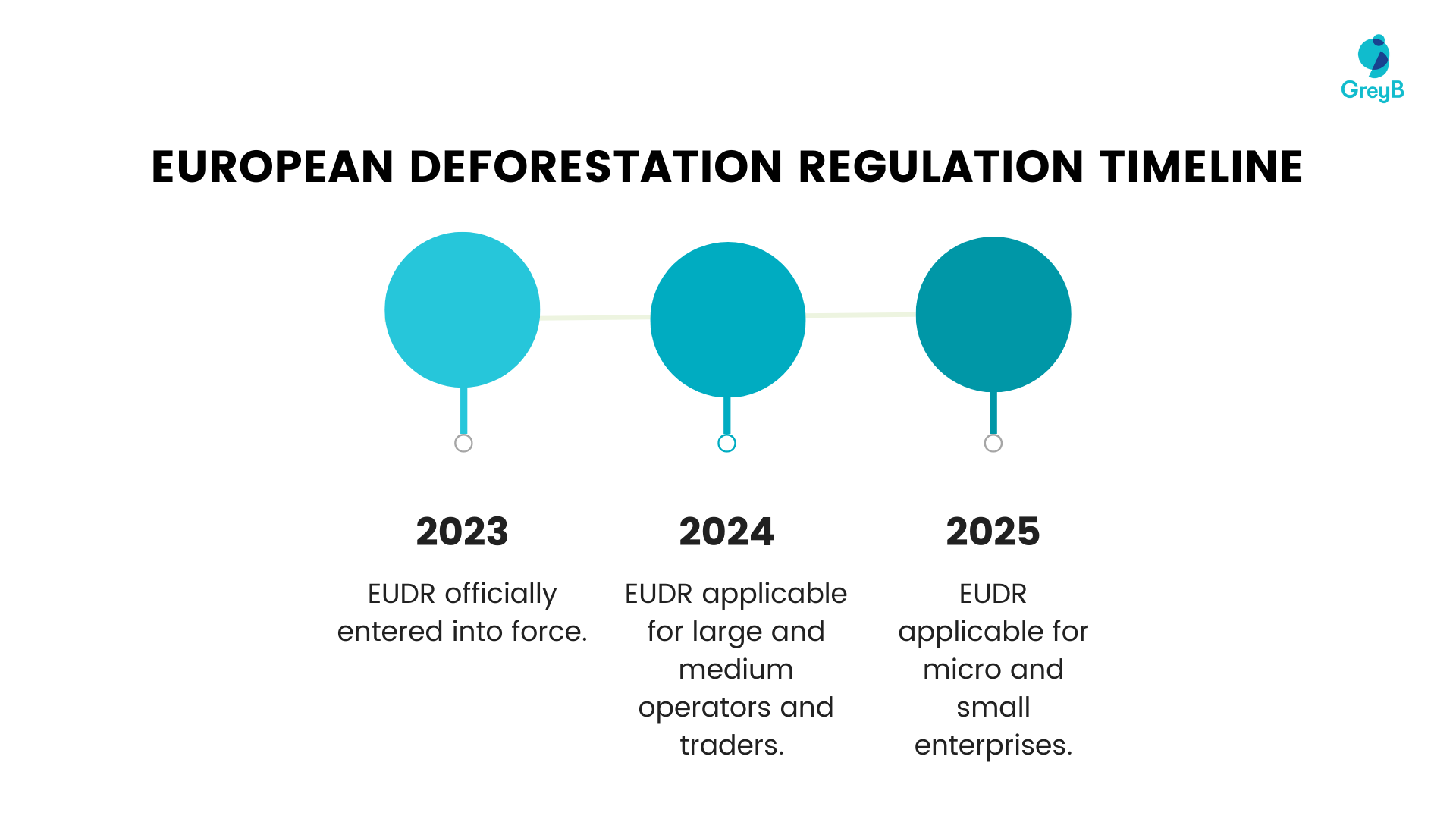

EUDR Timeline

In December 2020, the EU took a bold step against deforestation, launching a public consultation that drew input from 1.2 million citizens.

Fast forward to December 2022, and the European Deforestation Regulation (EUDR) was officially adopted. It took effect on June 29, 2023, laying the groundwork for sustainable practices across industries.

The EUDR has set firm deadlines:

- Large businesses had until December 30, 2024, to comply.

- SMEs have until June 30, 2025.

- Timber products have until 31 December 2027

Missing these deadlines comes with steep penalties—fines, stricter inspections, or even exclusion from the EU market.

As industries strive for EUDR compliance, the search for sustainable material alternatives for commodities like Cocoa is more urgent than ever. Our latest report on innovative cocoa alternative startups highlights the most promising startups that can help you meet sustainability goals and comply with EUDR requirements.

Get the full report (including 6 more startups working in stealth mode) to evaluate potential suppliers, partners, acquisition targets, or investment opportunities.

Key Provisions and Requirements of the EUDR

The European Deforestation Regulation (EUDR) sets a comprehensive framework to ensure commodities and their derivatives are sourced sustainably and do not contribute to deforestation. The regulation focuses on seven “relevant commodities”: cattle, cocoa, coffee, oil palm, rubber, soy, and wood. These commodities are integral to producing everyday items like chocolate, furniture, and cosmetics, making the EUDR a significant step toward sustainable supply chains.

Key Requirements

To comply with the EUDR, companies must meet strict due diligence obligations to verify that their products are deforestation-free:

- Thorough Supply Chain Reviews

Businesses must collect detailed data on suppliers, supply chains, and the exact geographical origin of materials. This involves pinpointing the production location of agricultural or forestry commodities to establish full traceability. Tools like geospatial monitoring and blockchain are often necessary to manage this data effectively. - Risk Assessment and Mitigation

Businesses must evaluate the gathered information to assess whether products are linked to deforestation, illegal activities, or human rights violations. Based on this analysis, they must submit a due diligence statement confirming compliance with the EUDR. This step demands precise frameworks to manage complex supply chains and ensure accuracy. - SMEs’ Obligations

Small and medium enterprises (SMEs) have lighter obligations. Instead of submitting a due diligence declaration, they must maintain and provide supply chain information upon request. - Benchmarking System

The EUDR introduces a country risk classification system:- Low-risk countries: Simplified due diligence requirements.

- High-risk regions: Stricter compliance measures require additional scrutiny, such as satellite imagery or third-party audits, to demonstrate deforestation-free sourcing.

- Dual Role Compliance

Companies acting as operators (e.g., importing raw materials) and traders (e.g., selling processed products) must ensure full compliance by submitting due diligence statements for imports and passing relevant information along the supply chain. - Certifications to Support Compliance

Certifications like FSC (Forest Stewardship Council), RSPO (Roundtable on Sustainable Palm Oil), PEFC (Programme for the Endorsement of Forest Certification), and Rainforest Alliance help businesses demonstrate transparency and align with EUDR standards. However, they are not a guaranteed substitute for due diligence. Companies must still validate certified products against EUDR requirements.

Industry-Wide Implications

The EUDR’s reach extends across various industries:

- Food and Beverage: Affected by soy, palm oil, coffee, and cocoa.

- Fashion: Impacts leather and rubber-based goods.

- Forestry and Construction: Requires sustainable timber sourcing.

- Automotive and Manufacturing: Affected by the use of rubber.

- Healthcare and Pharmaceuticals: Linked to rubber and palm oil derivatives in medical supplies.

Impact of the EUDR on Industries and Businesses

Sectors such as forestry, agriculture, fashion, automotive, and food and beverages must adapt their practices to meet strict sustainability requirements and ensure compliance throughout their supply chains.

EUDR in construction and furniture

Timber Sourcing:

Smallholders in Indonesia’s Gunung Kidul and Purworejo regions, major teak producers, often lack the digital infrastructure to provide geolocation data. Many are unaware of EUDR requirements, delaying compliance efforts for furniture and construction companies reliant on teak wood.

Country Risk Benchmarking:

While Specific country classifications are yet to be finalized, speculated high-risk regions, such as parts of the Amazon basin, may face stricter compliance for commodities like soy and cattle. In contrast, countries like Costa Rica, with strong reforestation practices, could qualify as low-risk, benefiting from simplified requirements. Nations fear that a high-risk designation could discourage trade and place disproportionate burdens on small-scale farmers.

Countries without established benchmarks are classified as “standard risk,” requiring strict compliance measures. For example, timber exporters in Ghana, where formal land tenure systems are still developing, face extensive audits and documentation requirements to access the EU market, even if operations are deforestation-free.

EUDR in Agriculture

Geolocation Data for Cattle:

Producers must provide geolocation data for every establishment where cattle are raised, from birth to slaughter. For instance, a cow grazing on multiple farms across Brazil could require geolocation data for over 10 separate pastures, creating significant compliance challenges.

Smallholder Compliance:

In Côte d’Ivoire, small cocoa farmers face issues with land tenure formalization, as many operate on inherited or communal lands without formal documentation. Similarly, in Thailand’s Surat Thani region, the rubber industry smallholders struggle due to complex land tenure regulations, limited awareness of the EUDR, and challenges in ensuring traceability through multi-actor supply chains. This makes compliance with EUDR nearly impossible without external support or land registration reforms.

Soy Traceability:

Soy used as cattle feed must also be traced back to its origin. For example, Brazilian soybeans fed to livestock in the EU would require a full traceability report from the soy plantation, increasing the compliance burden for downstream operators like meat producers.

EUDR in Fashion and Apparel

Leather and Hides:

Leather traceability often ends at the slaughterhouse. For example, hides sourced from Brazil’s cattle farms frequently lack documentation on whether the cattle were raised on deforested land. This leaves downstream manufacturers like luxury handbag producers unable to meet EUDR requirements.

Viscose Sourcing:

Viscose production depends on tree pulp from endangered forests. For example, in Indonesia and China, producers often source pulp from mixed-use forest lands without clear sustainability certifications, making it difficult for brands to verify compliance with EUDR.

EUDR in Automotive

Natural Rubber Traceability:

Natural rubber, primarily sourced from Southeast Asian smallholders, faces traceability challenges due to fragmented supply chains. For instance, farmers in Thailand and Indonesia often operate on informal land tenure systems, making it difficult to obtain the geolocation data required under EUDR. Many smallholders are reluctant to share personal information, fearing privacy breaches.

Lack of Clarity on Derived Products:

There is confusion about whether components like stearic acid, used in tire manufacturing but not listed as a primary commodity, must comply with EUDR. This ambiguity has left manufacturers unable to adjust supply chains in time, potentially disrupting production.

Healthcare and Pharmaceuticals

Traceability of Raw Materials:

The pharmaceutical industry depends on plant-derived materials (e.g., cinchona for quinine) and natural rubber (e.g., for medical gloves). Smallholder farmers in Southeast Asia often lack formal land documentation or geolocation systems, creating traceability gaps. Ambiguity in EUDR requirements for processed derivatives like plant extracts further complicates compliance.

Administrative Burden for Compliance:

A Due Diligence Statement (DDS) is required for every shipment. For manufacturers sourcing raw materials like rubber, this could mean submitting hundreds of DDS reports monthly, significantly increasing costs without reducing deforestation risks.

Business Adaptation to EUDR Requirements

To comply with the EUDR, businesses across these industries are enhancing traceability and adopting innovative technologies:

Supply Chain Mapping: Companies are identifying the geographical origins of their products, collecting geolocation data, and verifying legal land ownership to ensure deforestation-free sourcing. For instance:

- Danone: Achieves 100% traceability for its Alpro soybeans, identifying their geographical origins and verifying compliance with sustainable practices. By partnering with suppliers, Danone ensures that its sourcing aligns with both EUDR requirements and its sustainability goals.

- Nestlé: Focuses on palm oil and cocoa supply chains, mapping materials back to their source to confirm compliance with deforestation-free criteria. Nestlé aims to achieve complete traceability by 2025, using technologies like satellite monitoring and blockchain to enhance supply chain transparency.

Technological Solutions: Businesses are leveraging advanced tools like satellite monitoring and blockchain to improve transparency:

- Blockchain Technology: Mondelez uses blockchain to track 99% of its palm oil to the mill and 90% to the plantation, ensuring a transparent and tamper-proof supply chain.

- Satellite Monitoring: Companies like Nestlé employ satellite technology to monitor deforestation risks in real-time, identifying potential violations early.

Due Diligence Systems: Regular risk assessments and robust data management systems are becoming standard to meet EUDR’s requirements:

- Risk Assessments: Danone and Mondelez conduct regular evaluations to identify and mitigate risks linked to deforestation in their supply chains.

- Data Management: Nestlé and Danone use advanced platforms to store, analyze, and report compliance data, ensuring alignment with EUDR requirements.

Financial Implications

Compliance with the EUDR has significant cost implications. Implementing traceability systems and monitoring technologies will collectively cost over $1.5 billion for businesses operating in palm oil and rubber supply chains. Non-compliance risks include fines of at least 4% of turnover, confiscation of non-compliant products, and restricted market access.

Key Compliance for Industry Professionals

Here are the critical components for ensuring deforestation-free supply chains:

Supply Chain Audits: Verifying Raw Material Origins

Businesses must trace the origin of the targeted raw materials. This involves:

- Mapping their journey from the source to the final product.

- Documenting each stage of processing, trade, or transportation.

- Providing precise data for each component in multi-ingredient products, like cocoa, sugar, and milk in chocolate bars.

For instance, businesses must trace wood back to the specific forest for harvesting in the timber industry. This ensures compliance with deforestation regulations and supports sustainable practices, preserving biodiversity and minimizing environmental harm.

Technology and Traceability: Tools for EUDR Compliance

Innovative technologies ensure transparency and enhance traceability in supply chains:

- Geolocation Data

- Businesses must collect geographical coordinates for production areas, accurate to six decimal places, submitted in GeoJSON format.

- For larger plots (over 4 hectares), polygons must outline the land’s perimeter.

- Geographic Information Systems (GIS)

- GIS integrates data sources such as satellite imagery and ground surveys to create detailed maps.

- It analyzes deforestation rates, land use changes, and environmental impacts, offering a clear view of compliance.

- Blockchain Technology

- Blockchain creates an immutable record of supply chain transactions.

- It provides verifiable evidence of sourcing, ensuring tamper-proof traceability for regulatory reporting.

- Remote Sensing and Real-Time Monitoring

- Drones and satellites provide real-time data on land use and environmental conditions.

- These tools enable early detection of deforestation risks and continuous monitoring.

Third-Party Certifications: Simplifying EUDR Compliance for Businesses

Third-party certifications provide documentation and traceability, reducing the burden of direct audits. Popular certifications include:

Forest Stewardship Council (FSC):

Ensures timber and forest products come from responsibly managed forests. FSC-certified businesses meet rigorous environmental and social standards, supporting biodiversity and sustainability.

Roundtable on Sustainable Palm Oil (RSPO):

It focuses on sustainable palm oil production, addressing environmental concerns, and promoting fair labor practices.

Programme for the Endorsement of Forest Certification (PEFC):

Assures sustainable sourcing of wood and wood-based products, emphasizing collaboration with local communities.

Rainforest Alliance:

Certifies a wide range of agricultural products, ensuring they are produced sustainably while conserving biodiversity and protecting forested areas.

Global Organic Textile Standard (GOTS):

Certifies organic textile products, promoting sustainable farming and eco-friendly production methods.

Risk Mitigation and Documentation

To further align with EUDR standards, businesses should:

- Regularly monitor and update supply chain data to stay compliant with evolving regulations.

- Implement robust documentation systems to provide clear evidence of compliance during inspections.

- Conduct regular risk assessments to identify and address potential deforestation links.

Challenges of EUDR Compliance

- Compliance Complexity

- Tracing the origin of products and verifying compliance with local laws requires substantial investment in supply chain transparency, technology, and data management.

- Businesses must collect extensive geolocation data and maintain rigorous documentation, which can be resource-intensive, especially for small and medium enterprises.

- Risk of Displacement

- The regulation could lead to “leakage” effects, shifting deforestation to regions with weaker environmental standards if suppliers in non-compliant countries are excluded. This displacement undermines the EUDR’s goals of reducing global deforestation.

- Exporting Country Opposition

- Some exporting nations may view the EUDR as challenging their sovereignty and economic interests, potentially resulting in trade disputes.

- Governments in affected countries might resist implementing stricter standards, hindering collaborative efforts to combat deforestation.

- Impact on Smallholders

- Small-scale farmers and producers in developing countries face barriers such as limited access to technology, lack of awareness about the regulation, and challenges in meeting documentation requirements.

- Without adequate support, these groups risk being excluded from EU supply chains.

Opportunities of EUDR

- Driving Sustainability Leadership

- The EUDR incentivizes companies to adopt sustainable sourcing practices and align with global environmental goals, positioning them as industry leaders in sustainability.

- Companies that demonstrate transparency and compliance enhance their reputation among consumers, investors, and other stakeholders, gaining a competitive edge.

- Encouraging Innovation

- The regulation promotes the adoption of advanced technologies like blockchain, geolocation systems, and satellite monitoring to improve supply chain traceability.

- These innovations not only ensure compliance but also increase operational efficiency and resilience.

- Market Expansion for Farmers

- Farmers who adopt deforestation-free practices gain access to premium markets and financial incentives.

- The regulation supports smallholders in building long-term business relationships with buyers who value sustainable practices, improving their financial stability.

- Fostering Collaboration

- The EUDR encourages stronger partnerships between businesses and suppliers based on shared values and trust.

- Clear legal frameworks and sustainable sourcing requirements create opportunities for joint initiatives to promote environmental conservation.

- Resilience and Risk Mitigation

- Compliance with the EUDR helps businesses anticipate and adapt to future regulations, reducing risks associated with environmental non-compliance.

- By addressing deforestation risks early, companies strengthen their supply chains against environmental and economic disruptions.

Conclusion

As the EUDR evolves, it will likely expand to additional sectors, amplifying its impact on global sustainability efforts. Collaboration among governments, industries, and stakeholders will be crucial, drawing lessons from initiatives like the Roundtable on Sustainable Palm Oil (RSPO) to create a deforestation-free supply chain.

Facing product development delays because of supplier data gaps, unclear material origins, or missing traceability systems for EUDR compliance? GreyB can help you navigate complex supply chains, identify sustainable material alternatives, and implement effective traceability systems tailored to your industry.

Talk to our sustainability experts today.

Also Read: Make your company EUDR compliant and save forests with this nut

Authored By: Vipin Singh and Ridhima Mahajan, Market Research