“Despite the high nutritional values of soy milk, only 13% of the households in the USA are reported to purchase it.”

The beany flavor and unique taste are the major reasons for low acceptance. Yet, for the dairy industry, it has become a big challenge to tackle vegan diet trends that are on the rise. Consumers are looking for healthy, sustainable, and eco-friendly alternatives to animal-based products, and dairy companies are preparing for it in full swing.

So, what else is driving the dairy industry?

Last year, we discussed how functional foods, sustainability, and blockchain, among other trends, will influence the dairy industry. Continuing our research, we assessed what ‘trends’ will dictate innovation and research in the dairy industry in 2022.

If you’re from the dairy industry and care about the innovation game here, below are some important questions this report will answer for you:

- Which trends will affect the dairy industry this year that you should know of?

- How should these trends be prioritized for your 2022 R&D cycle?

- What kind of innovations are your competitors bringing to these areas?

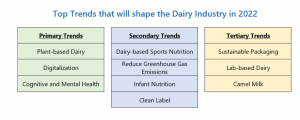

To help you make the most of this report, we’ve divided these trends into 3 categories based on their impact on the industry and how they should be prioritized for research and innovation. We suggest you use these trends according to what best suits your market needs.

Not all these product segments are new, like plant-based milk, reducing greenhouse gas emissions, or lab-based dairy. However, some new ones are slowly starting to impact the dairy market as well.

This article only covers the top 10 trends from our extensive and in-depth report, in case if you’re interested in knowing all the trends and insights, feel free to download the PDF using this form below:

Let’s discuss the top 10 trends in brief. Use the below menu to jump to the trend that catches your attention:

Trend 1: Plant-based Dairy

The dairy sector is constantly bashed — sometimes in the name of sustainability and at others a source of health-related discomforts like lactose intolerance, which is a major factor. It is estimated that 36% of Americans and 68% of the world’s population have some degree of lactose intolerance. (Source).

This year, huge players in the dairy industry have entered the market for plant-based dairy. For instance, Nestlé recently introduced Wunda, which is made from yellow peas, and Wunda is directed to solve taste issues with plant-based milk.

On the other hand, plant-based dairy has received heavy criticism from dairy companies and faces challenges like taste, flavor, and texture not being up to consumers’ expectations. That being said, companies continue to research and innovate in this space – aiming to solve these challenges. Not only this, companies have even started acquiring/expanding to include plant-based dairy in their offerings.

Given all this, what we expect to see here is that in 2022, there will be heavy innovation and market activity in this space, and companies will come up with much better solutions and consequently gain an edge over competitors.

Trend 2: Digitalization

Industry 4.0 is the current buzz, and Digitalization can be seen as the next essential step for the dairy industry – not only to solve the current challenges they face but also to gain efficiency. There are multiple areas in which digitalization could play a pivotal role like robotic milking, cattle management, AI-driven predictive analysis, etc. While some of these areas have already started experiencing digitalization, there are some that we foresee gaining ground this year.

Some of the interesting happenings include Nestle’s partnership with Siemens to create several digital twins for its Juuka factory. Similarly, Danone has partnered with Aveva to create a digital twin of manufacturing operations for specialized nutrition.

Trend 3: Cognitive Health & Dairy

Since the outbreak of the pandemic, there is a rise in concern about the declining cognitive health of the population. The poor work-life balance of the workforce, students overwhelmed due to pressure from studies, health workers, home-makers, etc., are eventually looking towards functional foods that can help them relax and de-stress from their daily routine. Dairy companies are constantly innovating in this space.

Lactalis is already working in this direction. It offers Pronativ® protein rich in alpha-lactalbumin. Alpha-lactalbumin contains tryptophan amino acid, which has a proven effect on sleep and also, therefore, on mental health. Pronativ contains up to 40% more Tryptophan than a classic serum protein. Pronativ is also richer in Cysteine and is a source of good-quality protein that can be incorporated into formulas designed to maintain good mental health. (Source).

Trend 4: Dairy-based Sports and Nutrition

Sports drinks are beverages specially formulated for athletes as an alternative to water for boosting energy and hydration levels. Traditional sports drinks are loaded with artificial ingredients and sugar. With rising health concerns, consumers prefer nutritious ingredients with lower sugar content.

[There is also research behind why sugar reduction and alternatives are a growing trend among dairy companies. We have covered in-depth about it in our other report. Access it from here: Sugar Reduction Technology: What are your options?]

And this is where milk fits in. It has everything that an athlete needs — carbohydrates, electrolytes, calcium, vitamin D, etc. It also contains two proteins — casein and whey — for rebuilding muscle. Milk as a rehydration drink post-exercise is not a new concept (Source). However, with the increased focus of consumers on health, this area has picked up and is seeing interesting innovations.

In 2019, GoodSport Nutrition came up with an innovative shelf-stable hydration beverage comprising a dairy permeate – they went ahead and filed a patent application for the same. A couple of years later, they received the 2021 Breakthrough Award for Dairy Ingredient Innovation award in the “innovative milk-derived or whey-derived dairy ingredient products” category. The award was given for their product GoodSport. As per their claims, GoodSport, “rescues and upcycles” nutrient-rich milk permeates. It also provides three times the electrolytes and 33% less sugar than traditional sports drinks.

You can find the patent information for this and other companies in our report by filling out the form below:

Trend 5: Reducing Greenhouse Gas Emissions

Animal-based food (including livestock feed) is responsible for 57% of the GHG emission caused by the food industry. Interestingly, it is twice as much as plant-based foods.

At a global level, the food industry accounts for 35% of total GHG emissions. (Source 1, Source 2)

One of the areas where the dairy industry has started working is reducing methane emissions from ruminants. And for this, they are trying out multiple ways – like innovating to produce sustainable feed, partnering with companies that can help them capture methane, etc.

And with governments of multiple countries picking climate change as one of their priority missions, it is for sure that in 2022, we will see a lot of research and innovation in this direction.

Trend 6: Infant Nutrition

The growing awareness of children’s health and the importance of the first 1000 days of early nutrition in infants has led to a demand for nutrition products (Source). Hence, dairy players are constantly innovating in the baby formula space to be in the spotlight and catch hold of consumer sentiments in some way or another.

Fascinating innovations are happening under this trend, for instance:

BiomilkQ, a North Carolina-based startup, cultures human mammary cells to produce milk, which is not exactly breast milk but significantly closer to that than any infant formula on the market.

Trend 7: Clean-Labels

A 2020 New Hope Network NEXT Data and Insights survey found that 77% of consumers said they were placing more importance on both personal health (77%) and environmental or planetary health (67%) during COVID-19. (Source).

Consequently, dairy companies are taking steps to go clean. For example, Nestle rebranded Dreyer’s and Edy’s Slow Churned ice creams by removing artificial colors and flavors, high fructose corn syrup, and GMO ingredients, shortening the ingredient list to mere eight elements, and using milk from cows that were not treated with any growth hormones (Source).

Trend 8: Packaging

“70% of consumers said recyclability is important to them, and 47% found the milk jug difficult to recycle, and 32% of those consumers reported they didn’t trust it will actually be recycled.”, as per a recent study on Californian customers, (Source).

What does this mean for companies? The companies must be mindful of the packaging to meet this requirement of the consumers.

In addition to this, strict regulations are being implemented by the US Environmental Protection Agency and the European Commission to reduce carbon emissions. That’s why producers of dairy products are now moving to environmentally-friendly packaging materials (Source).

Companies like Arla and Valio have set up goals for achieving sustainable packaging.

Are you looking for sustainable packaging solutions for your products and need external help? Click here – Sustainable packaging, to explore what you can do to reach your sustainability goals.

Trend 9: Lab-based dairy

A dairy alternative beyond plants, lab-based fermented dairy products are starting to create a buzz in the industry.

There are companies such as Eden Brew that have developed a cow-free milk product using yeast (where yeast is used for the production of the casein protein found in cow’s milk). The product has no lactose, no cholesterol, and does not cause allergies. (Source)

The lab-based dairy has received attention from consumers in the last few years. However, research/commercialization is still at a very nascent stage. Additionally, the segment is still in the hands of a few start-ups and is untouched by the top dairy giants. However, if the segment succeeds, it can very easily disrupt the dairy industry or at least pose good competition.

Want in-depth research on this segment? Reach out to us for more information on key players and how you can build an edge here.

Trend 10: Camel Milk

When we talk about the dairy industry, camel milk is not the first topic that comes up. However, camel milk has a considerable market – it was valued at USD 10.2 billion in 2019, (Source). Now, camel milk has been a staple for countries like the Middle East and North Africa for thousands of years. But, it remains estranged in Western countries.

Some of the major companies that produce camel milk include Camelicious, Desert Farms, The Camel Milk, Vital Camel Milk, and Camel Dairy Farm Smits, (Source).

However, with properties like anti-diabetic, anti-microbial, anti-oxidative, anti-hypertensive, anti-inflammatory, and immunomodulatory, it is slowly gaining popularity. The forthcoming years could determine whether dairy companies should add another product segment—camel milk—on their shelves.

Wish to dive deeper into these trends?

The landscape in these segments will become more competitive this year. With the arrival of new players, acquisitions, and the constant influx of new products by dairy giants to maintain their footing, industry competition is real!

In order to establish a stronghold, you first need to know the competition and what they have been up to:

What trends are they working on? What technologies are they adopting or innovating? And what solutions are they offering to their consumers?

Now that’s not read-and-go content. In order to strategize your R&D plan for the year, you need to go back and forth to analyze this information. To make the process frictionless, we decided to get all these answers to you in a detailed report.

The report not only throws more light on the primary, secondary, and tertiary trends of the dairy industry but also discusses various company-specific insights that you wouldn’t want to miss.

Get the report using this short form below:

Authored by: Nidhi Balodi, Dr. Megha Agarwal, Sabarna Choudhury Research Analyst, Patent Landscape. Edited by: Annie Sharma, Marketing team.