Amazon recently made quite a buzz as it dethroned Walmart, one of the biggest rivals, for the first time in quarterly revenue with $187 billion compared to Walmart’s $180 billion.

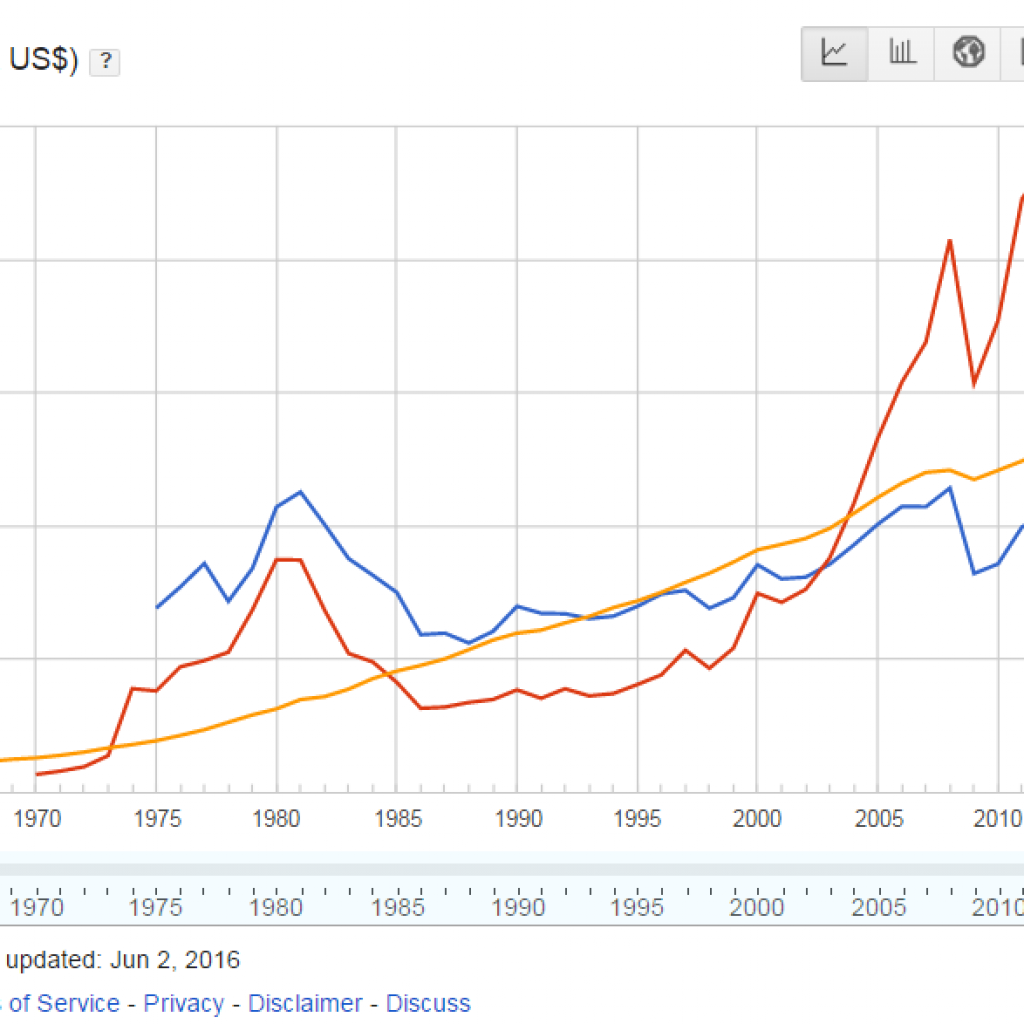

Amazon is rapidly closing the gap with Walmart in annual revenue and could soon surpass them.

Amazon’s rise to its current dominant position is an impressive story.

It started 30 years ago, in 1994 when Jeff Bezos discovered the potential of the Internet. He was stunned after finding the 2300% growth rate of the Internet, which eventually led him to think about starting an online business.

“You know, things just don’t grow that fast. It’s highly unusual, and that started me about thinking, ‘What kind of business plan might make sense in the context of that growth?’.” – Jeff Bezos

When he asked his parents for money after sharing his idea, his dad’s first question was, “What’s the Internet?” This vividly indicates that people weren’t very aware of the Internet then.

Indeed, selling things would be a problem for the young entrepreneur, but somehow, he found low-cost products that could be quickly sold online.

With his parents’ financial help of $245,573, Bezos started Amazon in his garage. Fortunately, their investment is worth over $30 billion – a 12,000,000% ROI.

In 1997, three years after its launch and post-IPO, Amazon’s estimated worth was $438 Million. The startup gradually evolved into a multinational corporation and now is worth a marvelous $1.6 Trillion. The E-commerce giant is the second US company to cross a trillion-dollar valuation after Apple when its stock price reached an all-time high ($2050.50) on September 4, 2018.

The Internet was a huge part of Amazon’s growth. Still, technological innovation, marketing strategy, and, most importantly, its business model make Amazon the most innovative company in the current era.

Amazon has grown significantly since its inception as a book-selling website and spread its wings to other areas like logistics, consumer technology, cloud computing, and most recently, media and entertainment – domains that did and would help Amazon tread the path to emerge as a trillion-dollar corporation.

This Amazon business strategy study compiles the ideas, innovations, technological research, partnerships, and, most importantly, the strategies responsible for growing Amazon to such heights. You will also find their sales numbers in every segment and a summary of their stock prices for the past few years.

Amazon has used and benefited from the strategies over the years. But wouldn’t this information have been immensely helpful to Amazon’s competitors a few years prior? It turns out they could have known Amazon’s moves beforehand.

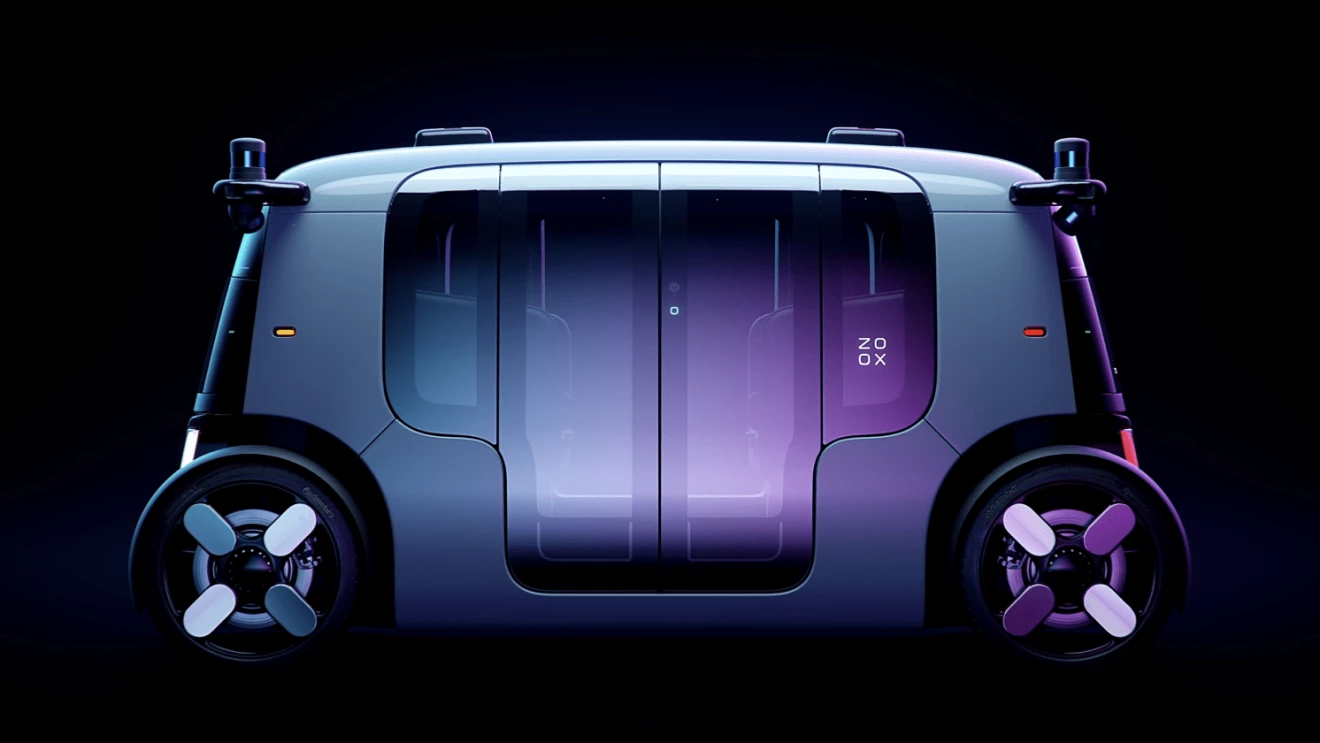

In 2020, Amazon acquired Zoox, but one could have foreseen this decision had they been closely following the trail of patents that Amazon had created. One can find numerous patents on autonomous logistics in Amazon’s Portfolio.

It has been forecasted that this recent acquisition can heavily affect companies in the logistics, ride-hailing, and food delivery domains. Amazon’s patent portfolio held a tell-tale sign of its interest in these domains. Possessing this information before Amazon’s acquisition could have saved these companies from this now-present threat looming over their businesses.

If you wish to know about Amazon’s plans and strategize your business moves accordingly, then going through Amazon’s patent portfolio is quintessential.

Fill out the form below to know which areas Amazon has been focusing on, the tech areas in which Amazon is working, which countries they are securing their IP in, and their acquisitions in various nodes in the form of an interactive dashboard.

Amazon Patent Portfolio

Get Access to Amazon’s Patents with an Interactive Dashboard

While this study will give you more information about Amazon’s business strategy, it will also help you acquire some basic principles that could be applied to any business.

Why is Amazon believed to be the most successful company in the Future?

Milestones after milestones, on the path to striving towards its zenith, Amazon has been recognized as one of the most successful companies. This statement is not a mere theory but purely supported by facts. Let’s have a look at some of them.

Amazon’s Achievements

FastCompany magazine listed Amazon as the most innovative company of 2017. Further, Amazon also ranked 3rd in MIT’s Smart Companies 2017 listing, following Nvidia and SpaceX.

BCG placed Amazon as the 3rd most innovative company in 2022, while Forbes placed Amazon 5th in 2022.

Source: Fortune

That’s not it.

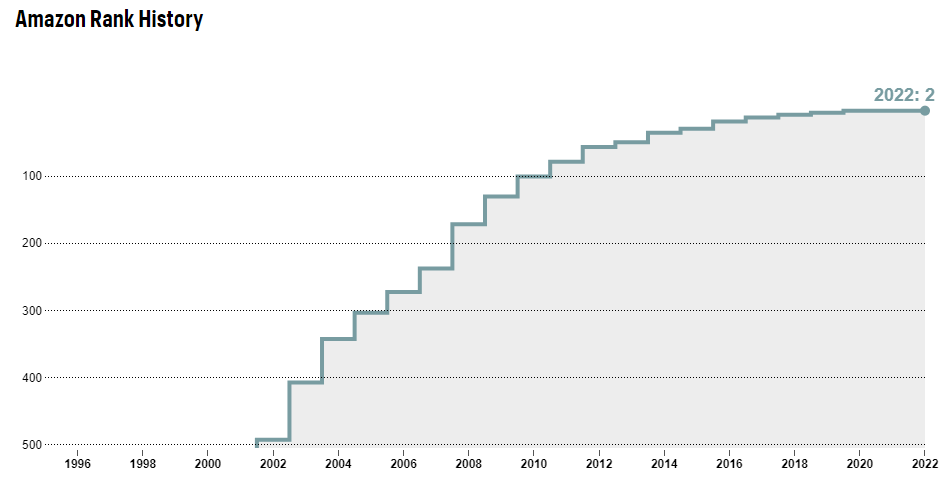

Amazon ranked 8th on the Fortune 500 2018 list, 5th in 2019, and 2nd in the 2021, 2022, 2023, and 2024 lists. Since then, the company has been continuously listed on the coveted list, each with a rank better than the previous year.

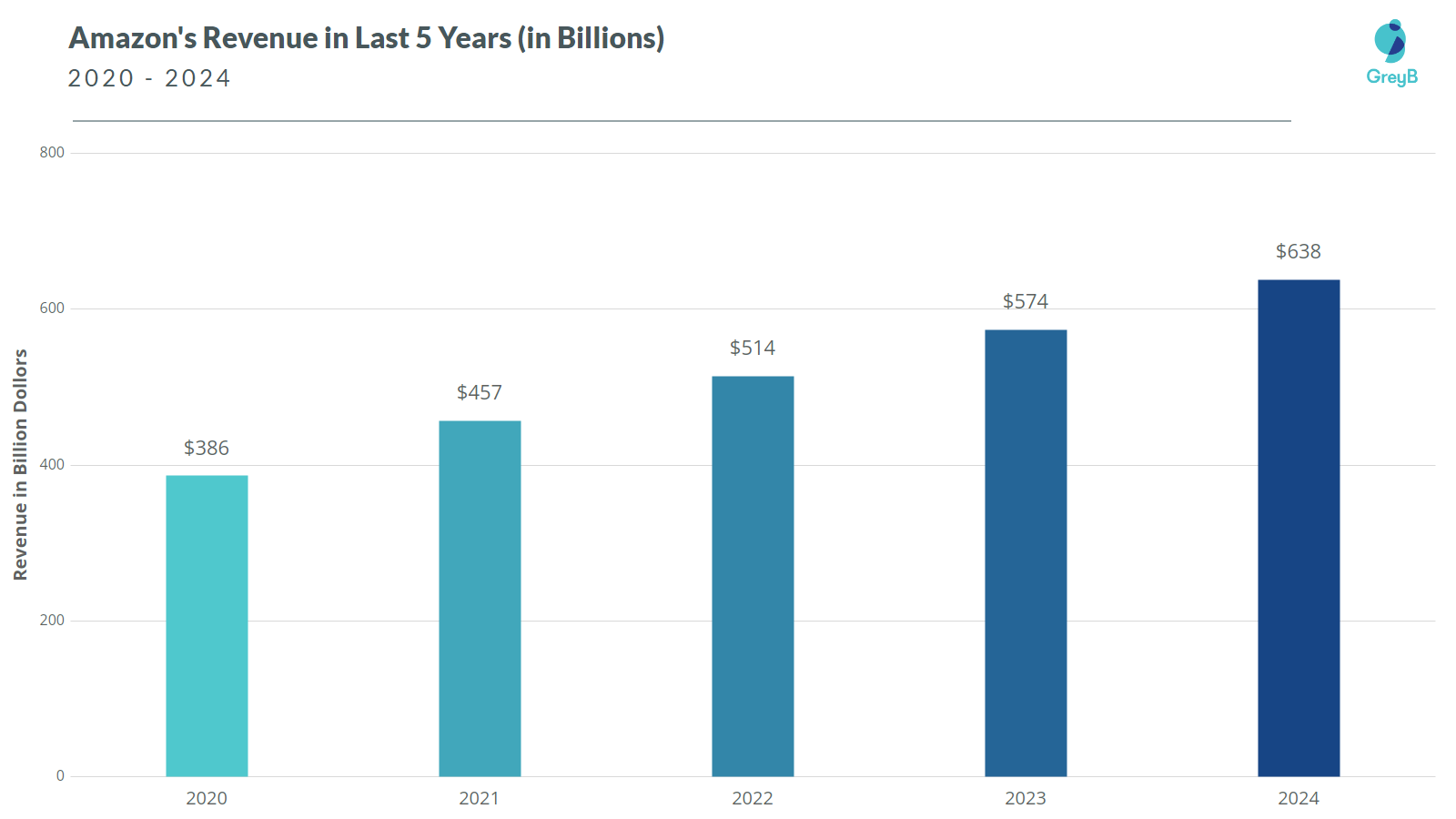

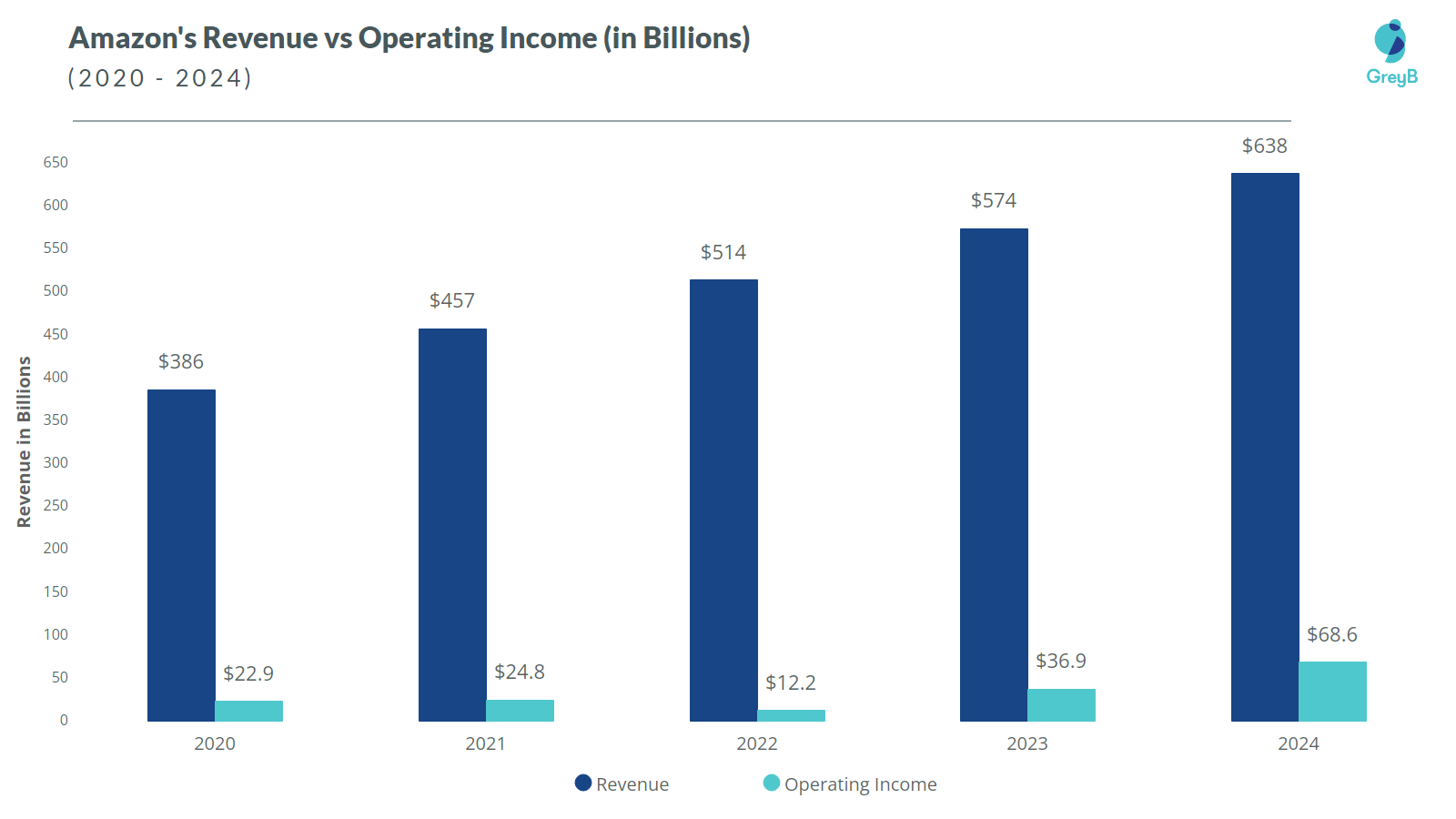

Growing Revenue

Amazon’s revenue increased by 65% in the last five years—from $386 billion in 2020 to $638 billion in 2024. Finally, in 2024 alone, the revenue grew by 11% compared to 2023, touching the $600 billion figure for the first time.

The chart below portrays Amazon’s revenue for the past five years. Approaching Trillions. Mighty numbers, Amazon!

Launching its services to more markets and expanding horizons, Amazon—due to its eCommerce business model—increased its sales numbers, customers, and Revenue. Besides, its AWS business contributes hugely to Amazon’s revenue stream.

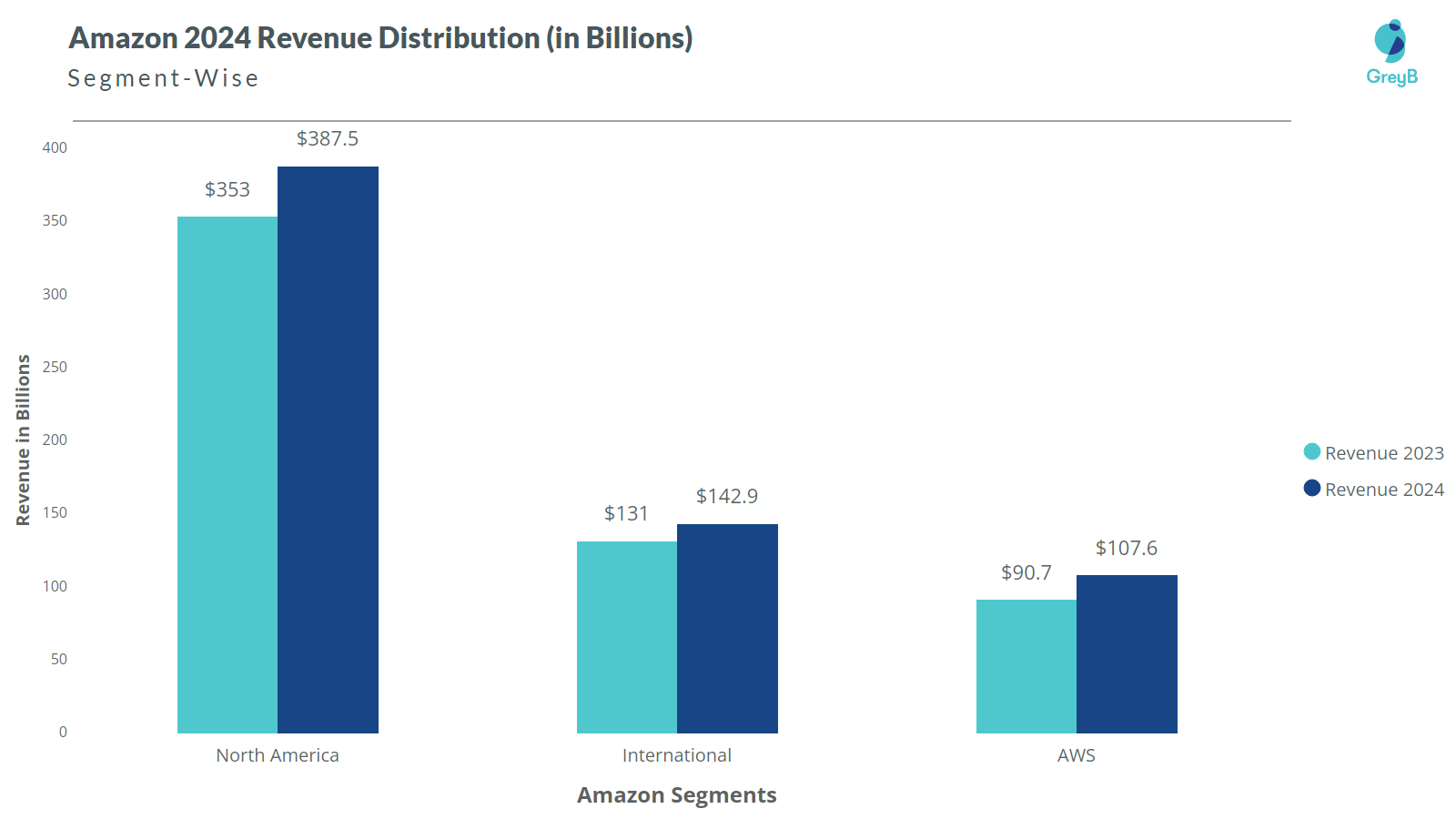

Amazon operates in three segments—North America, International, and AWS—where it offers its products and services to consumers, sellers, developers, enterprises, and content creators.

Below is the revenue distribution of Amazon in 3 major segments.

Unsurprisingly, the most significant share of Amazon’s revenue comes from North America. Despite tough competition in big markets like India and China, the company’s revenue has increased internationally. This was also the first time the international segment’s operating income rose positively.

Further, AWS brings significant revenue yearly as it becomes the most prominent cloud service provider. AWS revenue crossed the $100 billion mark for the first time, cementing itself as a backbone for Amazon.

As per its CEO, AWS is betting on AI to reach a new level. The platform has already launched services like bedrock to offer cloud consumers access to foundation models built by AI companies, including Anthropic and Mistral.

Investors’ Expectations

Amazon is worth over $2 trillion, yet it makes little profit. In 2022, Amazon was at a loss; in 2024, its profit grew to $68 billion, a huge improvement.

The reason for its vast market cap is investments. Investors took a massive interest in Amazon and bet big money as they believed that Amazon could grow faster, longer, and bigger than almost any other firm.

Even though in 2022, Amazon stocks poorly performed, the investor’s hope suggests Amazon be the most profitable firm than any other, at least in America. And they are expecting big profits in the future. Its sales already crossed $600 billion. 2024 was a good year in terms of stock performance and revenue. However, it still failed to surpass Walmart in revenue.

However, 2025 seems like the most likely year for Amazon to surpass Walmart in revenue.

What is Amazon’s Business Strategy?

“When we look back on this quarter several years from now, I suspect what we’ll most remember is the remarkable innovation delivered across all of our businesses” – Andy Jess, CEO, Amazon.

Amazon’s business strategy consists of investing in technologies, enhancing its logistics applications, improving its web services by fulfillment capacity, M&A strategy, R&D activities in logistics, experimenting with Fintech, and securing its inventions using patents.

Let’s have a brief look at some of those.

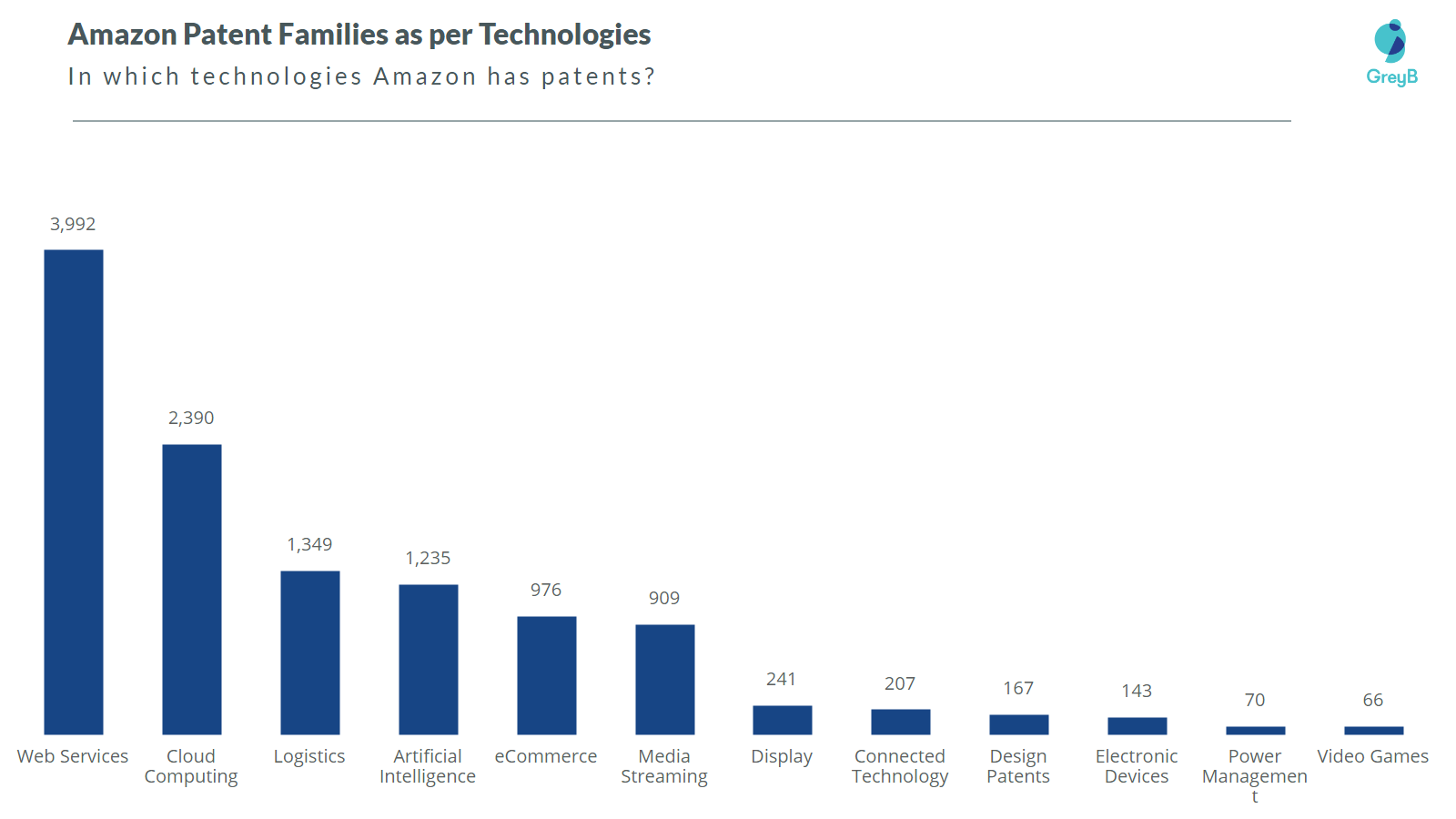

Amazon’s Diversified Patent Portfolio

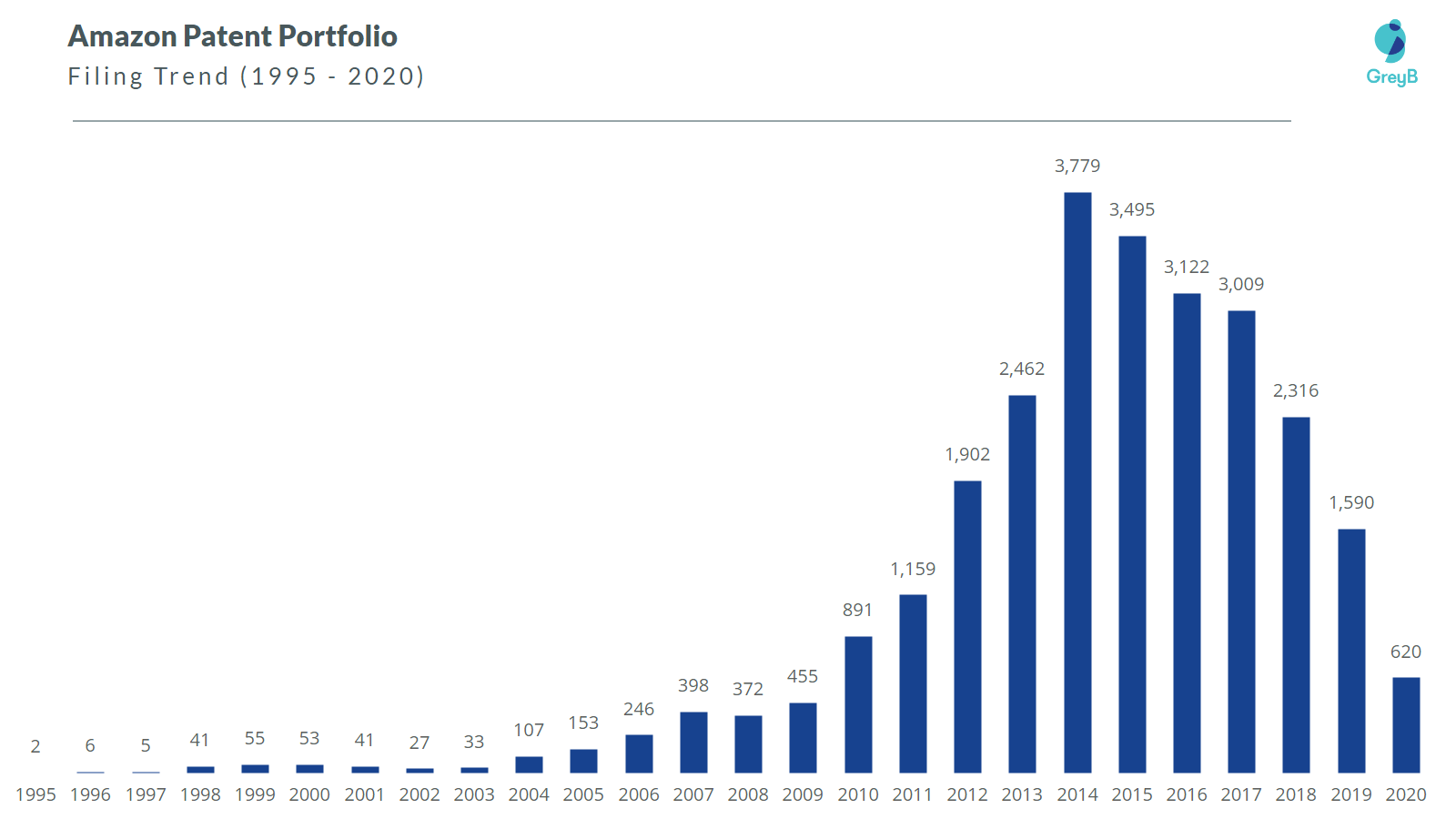

Amazon’s patent history is as old as the company itself. With the first patent filed in 1995, it is easy to guess that the company now owns thousands of patents. Amazon gradually increased its patent filing activities in the company’s early years.

The significant increase in filing activity can be noticed from 2010, when Amazon became more than an online retailer.

By 2011, Amazon had filed patents for multiple technologies, such as Cloud Computing, which was Amazon’s third most significant source of revenue. Amazon has also started filing patent applications for Augmented Reality, Speech Analysis (Alexa).

Amazon’s most significant patent share is in Logistics and Artificial Intelligence. In addition, Media Entertainment and E-commerce applications hold a fair share of the Amazon Patent Portfolio.

Amazon is a very diversified company, so the range of its patents can be very vast.

However, it is clear that in some sectors, Amazon wants to be at the top.

In Logistics, Amazon now competes with traditional logistics companies such as FedEx and DHL.

During the Pandemic, when all businesses were down, Amazon had something else to plan to make the global crisis an opportunity.

Amazon leased 12 Boeing 767-300 cargo aircraft, bringing its air fleet above 80 jets. According to an industry consultant, it added 220 package facilities since the start of the year, ranging from urban delivery stations to giant warehouses.

The company is close to building a logistic system to deliver one-day packages for customers and overtake its logistics rivals.

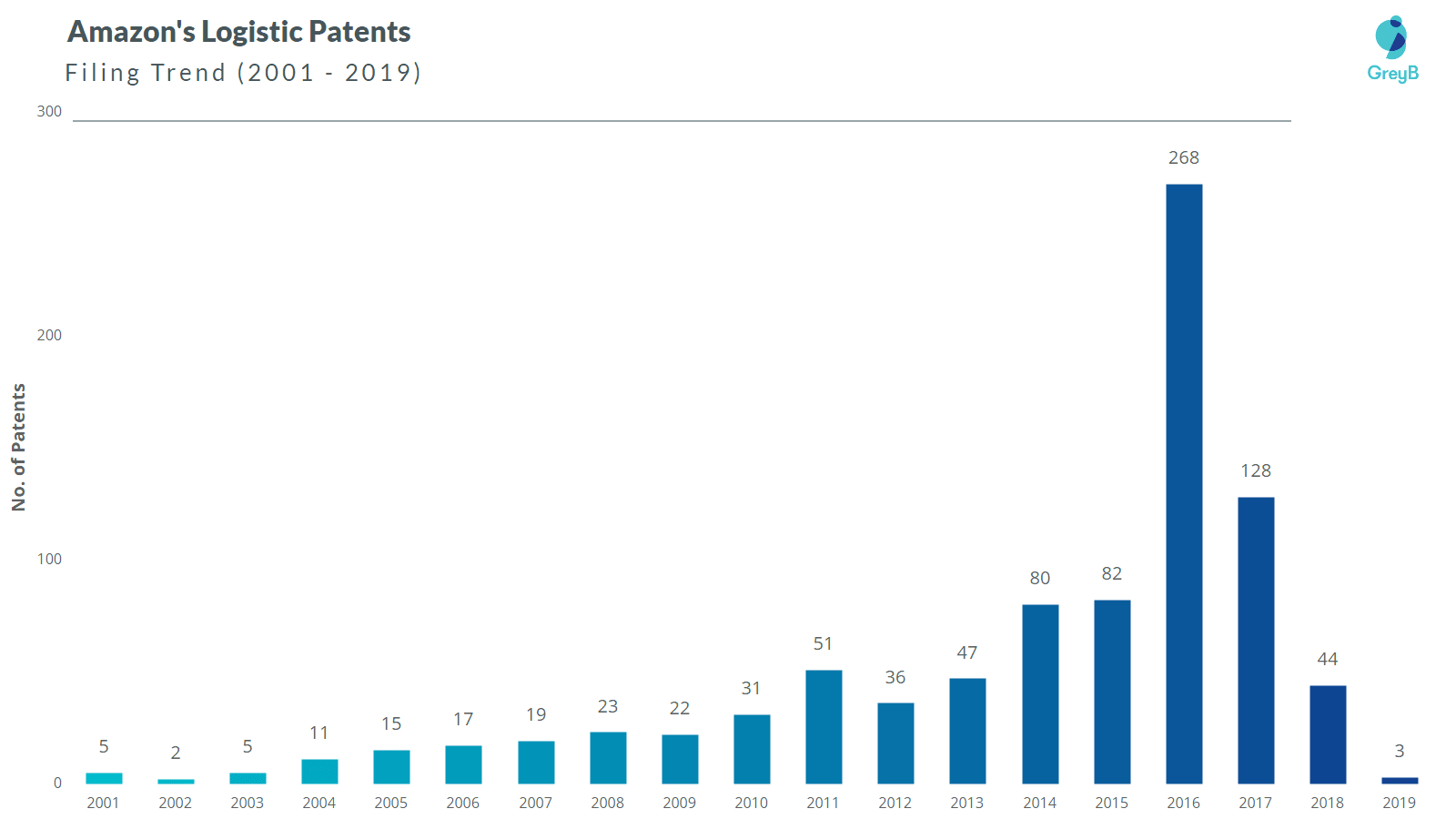

Amazon has been filing patents for logistics for a long time, but the increase in activity can be seen after 2010.

In 2016, Amazon filed a record of 268 patents alone for Logistics. Amazon has been filing logistics patents for a long time, but in 2016, it went for big numbers.

Amazon has covered almost everything for logistics, whether air, land, sea, or underground. Amazon has filed patents to deliver a shipment from any medium.

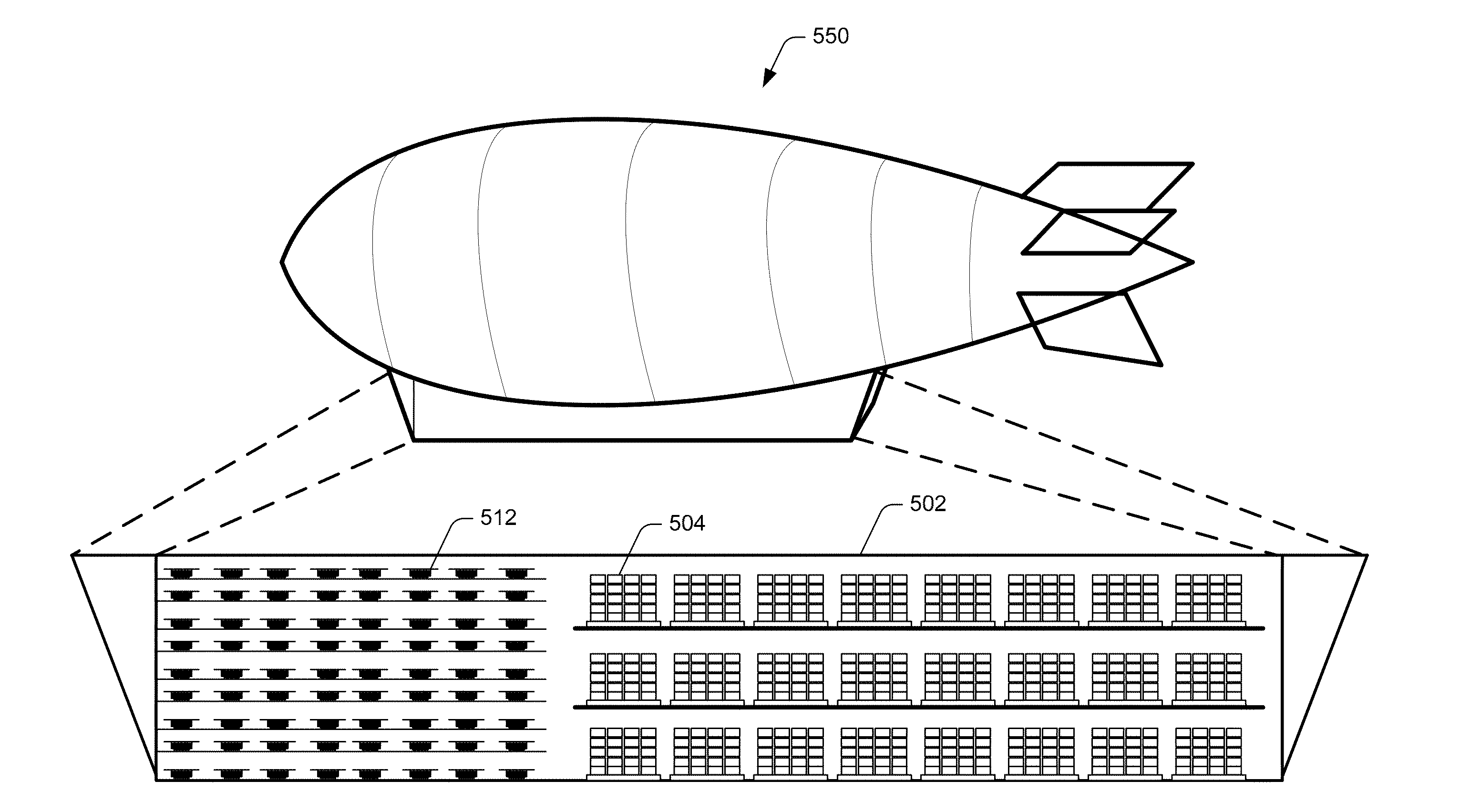

Amazon has hundreds of fulfillment centers all over the world. Also, Amazon wishes to be flying fulfillment centers that house drones to deliver packages.

In Dec 2014, Amazon filed a patent for an Airborne Fulfillment center with drones for package deliveries.

The idea seems futuristic, but it’s one of Amazon’s pillars, long-term thinking. This idea could become a mainstream medium for package delivery in the future. The important thing is that it shows how innovative Amazon can be when making item delivery as simple as it is.

Further, Amazon filed for other fulfillment centers that house drones and cargo trucks.

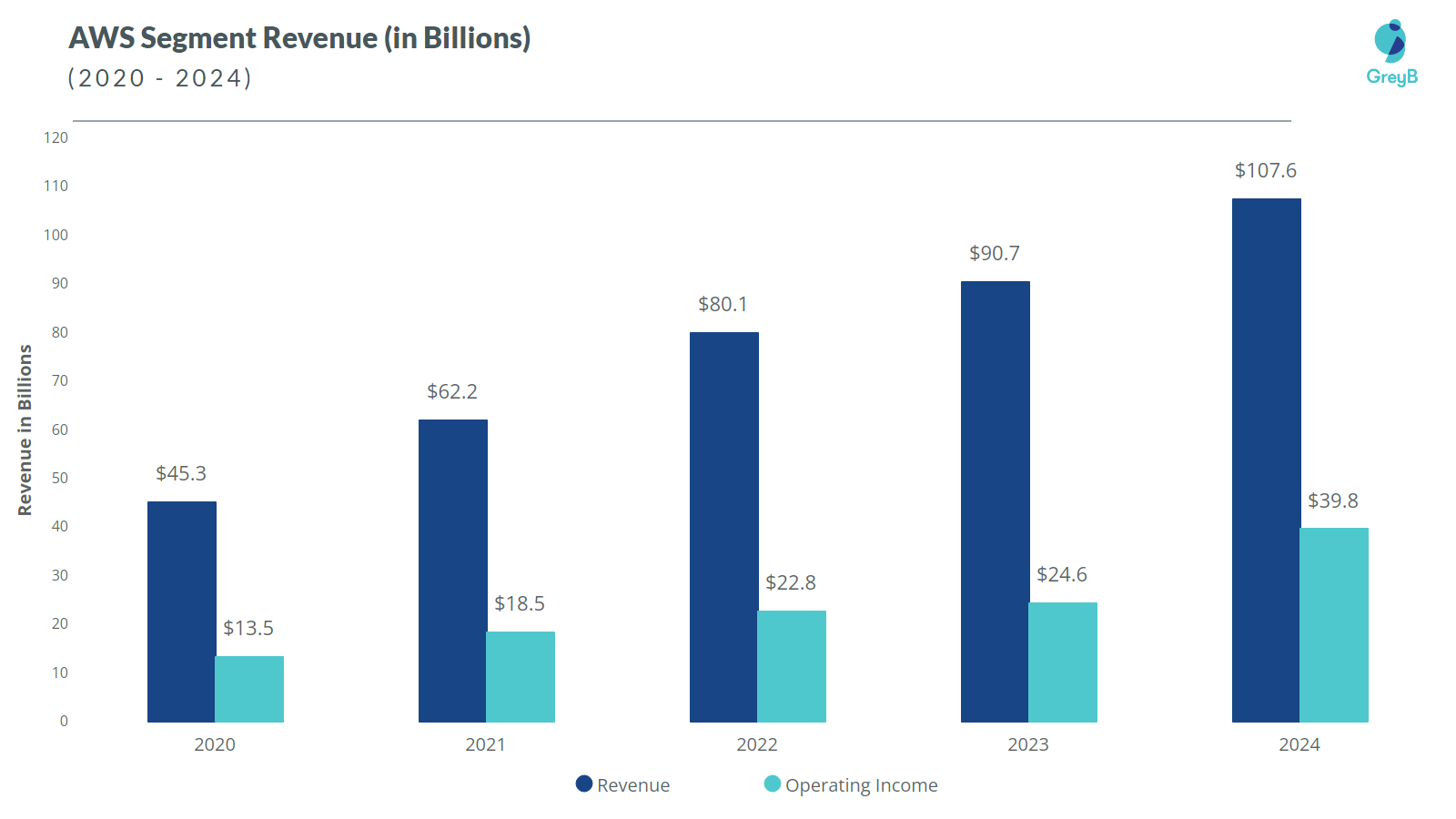

Besides Logistics, Amazon’s AWS arm is significantly bigger than many big corporations, as it generated $90 billion in revenue with a $24 billion Operating Income in 2023.

Amazon has been filing patents for Cloud Computing since 2010. Regarding revenue, Amazon is probably the biggest cloud computing company compared to Microsoft.

Also, Amazon is one of the top companies in Edge computing. With enough resources to build an edge portfolio, Amazon also owns tens of patents in Edge computing.

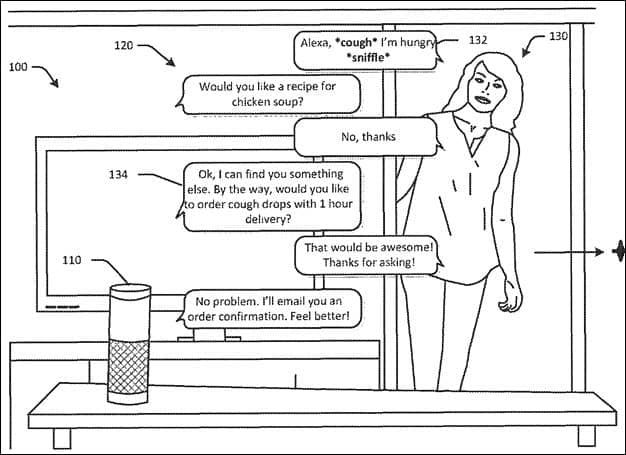

Further, Amazon’s Alexa Everywhere strategy seems to work, as the company is adding more features for its assistant and Alexa-enabled devices. Amazon has filed significant patents on Speech Recognition.

They even filed an Alexa patent to recognize your physical and emotional states and suggest relevant solutions.

For more Amazon Alexa Patents, Click here.

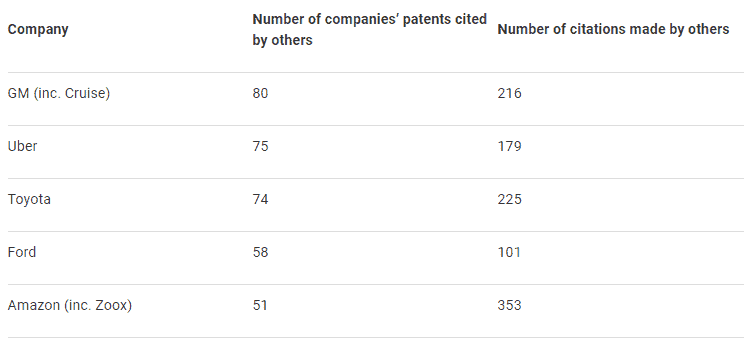

Amazon is not just dependent on in-house patent filing but also acquires patents. The famous Zoox acquisition is said to have made Amazon enter the self-driving vehicle market. However, besides Zoox’s position in the market, Amazon found its patent portfolio amazing.

IAM also says that Zoox patents are the fifth most cited patent for self-driving technology by others. Further, it owns two of the three most-cited grants by other levels 4 and 5 patent owners.

“Amazon’s plans to put a fleet of autonomous taxis as well as delivery vehicles on the road, the acquisition appears to have handed it a powerful stockpile of IP to secure freedom to operate in what is only going to become a more crowded field.”, says IAM.

Amazon Patent Prosecution Stats

We looked at Amazon’s pending patent applications in the US patent office. Below are our findings on how their patents perform in the patent office and their prosecution process.

Amazon has an impressive 97.26% grant rate for its patents.

Amazon has filed 14316 patent applications at USPTO so far (Excluding Design and PCT applications). Out of these 12764 have been granted leading to the grant rate of 97.26%. Not only this, the application Abandonment/Rejection rate of Amazon is meager at 2.47% and only 299 applications have faced abandonment or rejection. – Insights;Gate by GreyB

The data below is a bird’s eye view of Amazon’s pending patent applications at the US Patent Office. Our in-house intelligence tool – Slate – was used to perform this analysis. You can explore Slate here.

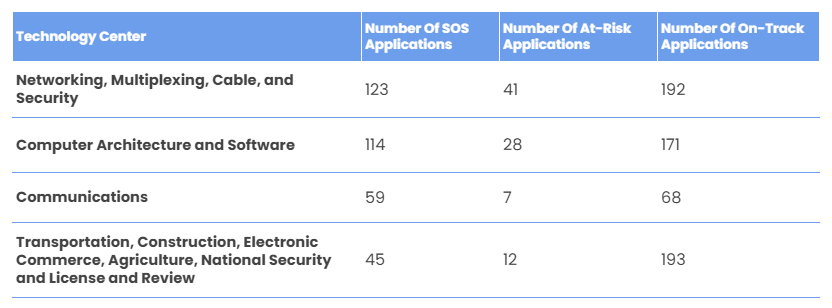

Currently, Amazon has 1108 patent applications pending at USPTO. Under the lens, 654 patent applications are on the right track to a smooth grant; however, the rest of the 454 applications are facing great difficulty at the office. Some of them are already in the danger zone.

These patent applications are getting more than an average number of rejections or taking longer than the average time than other applications in similar tech areas. We segregated all these applications into 3 categories:

- SOS – Facing High difficulty at USPTO

- At-Risk – Applications that were running smoothly but of late have started displaying high probabilities of turning into an SOS application.

- On-Track – Running smooth as butter

Below are the patent applications based on their group art units, how many of them are on the right track, and which ones need intervention:

These are the Top 4 tech areas where Amazon’s maximum number of applications is currently pending at the USPTO. The applications under the SOS column need immediate intervention from Amazon’s IP team.

This overviewed Amazon’s patent applications and their performance at USPTO. As mentioned above, the insights here were extracted from our in-house Slate tool. Slate also suggests the actions Amazon or any applicant can take to help their patent application get granted smoothly.

If you’re interested, read more to strengthen your patent prosecution process from here.

Fill the form below to know which areas amazon has been showering its attention on, the tech areas in which Amazon is researching, which countries they are securing their Patents in, and their acquisitions in various nodes in the form of an interactive dashboard.

Amazon Patent Portfolio

Get Access to Amazon’s Patents with an Interactive Dashboard

Amazon’s Investment in Different Technologies

Amazon Robotics

For the past decade, Amazon has invested considerably in robotic and drone technologies and acquired many patents on them. Its warehouses alone house more than 45,000 robots.

In 2012, Amazon acquired Kiva Systems – a company that designs robots for picking and packing – for $775 million. By 2014, the company had 14,000 robots for its 10 warehouses. The following year, the count increased by 114% to 30,000 robots, and in 2017, the number increased by 50% to 45,000 robots across 20 warehouses.

In addition to acquisitions, Amazon also organizes challenges in different universities and institutes worldwide, offering a large sum of money for inventing a next-generation robot. In 2017, the prize money was $250,000.

Amazon Drones

Amazon is also researching drones for its initiative and future drone delivery service. In Britain, Amazon started its drone delivery service under Amazon Prime Air.

In October 2017, the US Federal Government also approved a drone delivery program. The administration wanted to open new opportunities and commercial uses for drones to create jobs.

Amazon recently filed numerous drone patents on package delivery, a parachute, and a floating airship warehouse. Also, it has patents on drone design for better maneuvering, secure landing, and long flights.

On an advanced level, they got a patent for a method to charge electric vehicles through drones. This shows their interest in automobiles as the future will require many methods to charge an EV. Further, there would be no surprise if Amazon ventures into the automobile domain.

But in Aug 2021, Amazon shut down the drone delivery program Prime Air in the UK as it removed more than 100 employees from the program, according to a report by Wired.

Five years ago, it was a big deal for Amazon, but the focus slowly shifted to autonomous vehicles, which saw Amazon make a huge acquisition. According to Amazon, people are still working on the project, but it is unclear and less likely that Amazon is prioritizing drone delivery.

Amazon Alexa

“These big trends are not that hard to spot (they get talked and written about a lot), but they can be strangely hard for large organizations to embrace. We’re in the middle of an obvious one right now: machine learning and artificial intelligence.” – Jeff Bezos

Artificial intelligence is one tough area in which, despite having many competitors, Amazon got a big draw. It’s continuously focusing on AI and machine learning to enhance the customer experience. The segment AWS and its venture Alexa Internet is a big part of their investment in AI.

In October 2017, the company announced a new research center in Germany focused on developing AI. During the same month, the company and Microsoft partnered to roll out new tools to make it easier for developers to use open-source artificial intelligence software. Developers can use Gluon, a Python-based application programming interface, to quickly work with MXNet, the AI framework backed by public cloud market leader Amazon Web Services.

Amazon’s partnership with Microsoft also ensures collaboration in researching AI, where their personal assistants Cortana and Alexa would communicate with each other and offer services to the users.

“Ensuring Cortana is available for our customers everywhere and across any device is a key priority for us. Bringing Cortana’s knowledge, Office 365 integration, commitments, and reminders to Alexa are a great step toward that goal.” – Satya Nadella, CEO, Microsoft

In Jan 2021, Amazon announced Alexa Custom Assistant, a new service that lets device makers, automakers, and service providers create custom-branded voice assistants that are powered by and work in cooperation with Alexa. The Alexa Custom Assistant can be built into automobiles and consumer electronics, including smart displays, speakers, set-top boxes, fitness devices, and more, providing a complete, managed voice solution that substantially reduces cost, complexity, and time to market.

Alexa Everywhere – Strategy

Amazon announced its Alexa Everywhere strategy in 2017, and surprisingly, it became a massive success despite the presence of other top personal assistants in the market.

Alexa, Amazon’s AI-infused voice assistant, was first released with the original Amazon Echo smart speaker in November 2014. Since then, it’s been giving head-to-head competition to its rival Google Home, and now Apple has joined the race with its Siri-enabled speaker, Homepod.

In 2017, Amazon announced that it would install Alexa (AI) in every Echo device and launched several new products. Amazon Echo and Echo Dot hold 2/3 of the market share of smart speakers, beating Google Home and Apple Homepod significantly. Amazon also announced two major Alexa integrations for non-Echo devices. Amazon further revealed that Alexa would be supported in BMW cars next year.

Further, the Fire TV set-top box was launched with microphones embedded so consumers can shout Alexa commands across their homes.

Alexa, Play The Boys.

If that was not it, Alexa-based in-house drones were released, which could be called from anywhere around the house.

Alexa, Where’s my drone?

Alexa became more multilingual, allowing household members to interact with Alexa in two languages without changing the settings. In the U.S., the multilingual mode enables bilingual customers to code-switch from English to Spanish and vice versa. Amazon also launched a multilingual mode in new languages and countries, including Germany, Spain, France, Italy, and Japan.

Further, Amazon added new Alexa features that make customers’ daily lives more convenient, including sharing a shopping list with Alexa contacts by voice, video calling on Fire TV, and new Alexa Routines on Fire TV.

Amazon Go

In Dec 2016, Amazon demonstrated the world’s most advanced physical store. In 2018, Amazon officially opened the store to the public and showed the world that its machine-learning research could eliminate jobs.

In Feb 2020, Amazon opened the first cashier-less grocery store using “Just Walk Out” technology that powered 25 Amazon Go stores.

The store has no checkout point and, therefore, has no cashier to make payments for your purchases. The payment can be added automatically to the cart whenever you take a product from the shelves. After the purchase, the fee is automatically deducted from your account or digital wallet.

Amazon Web Services (AWS)

Amazon has recently acquired companies in the cloud computing space and invested in businesses based on the cloud. In early 2017, the company acquired many companies to strengthen its AWS Cloud business. Some of these include GameSparks, Thinkbox Software, and Harvest.ai. Additionally, Amazon invested in Grail, which is a potential future customer of Amazon’s cloud services.

Amazon Web Services (AWS) is investing some money in opening data centers in Britain and France to increase cloud technology usage.

In 2020, Amazon’s cloud segment, AWS, accounted for 58.9% of the company’s overall operating income.

Autonomous Vehicles

The tech and automotive industries are abuzz with the news that Amazon is acquiring Zoox. This California-based startup develops autonomous driving technology in a deal estimated to be worth over $1.3 billion.

Amazon announced in late June that they are acquiring Zoox “to help bring their vision of autonomous ride-hailing to reality.”

Although it was Amazon’s first strong move to participate in autonomous vehicles, certain pieces suggest the company’s interest in driverless cars before this deal.

The company has invested in Aurora, one of the top autonomous driving startups, and it has tested self-driving trucks powered by Embark, a self-driving freight startup.

Amazon has been aggressively investing and researching in the domain of autonomous vehicles and various automated delivery methods.

In December 2020, Zoox revealed the first look at its fully functional, electric, autonomous vehicle, which features bidirectional driving and can reach up to 75 miles per hour.

Want to know about Zoox Patent Portfolio? Here is a glimpse: Zoox Patent Portfolio.

Amazon In the Entertainment Sector

Amazon Prime Video

Amazon has been investing in TV series and movies through acquisition or production as it strives to compete with streaming rivals Netflix, HBO, Hulu, and Disney. In 2022, Amazon bought MGM and acquired the rights to big franchises like James Bond.

Though Amazon Prime members can enjoy their streaming service as part of the membership, Amazon also launched a video-only plan for non-prime members at $8.99/month.

“Amazon planned to triple the amount of original content over the rest of the year, and it’s probably safe to assume that its torrid investment pace will continue into 2017.” – Amazon CFO, Brian Olsavsky,

In 2017, Amazon acquired many TV shows and movies. Amazon acquired Marvel’s Inhumans and Runaways to give good competition to Netflix, which also owns the right to stream some of Marvel’s shows.

Amazon also spent a considerable amount on some small-budget movies with excellent reviews. They paid $12 million for ‘The Big Sick’ even before its theatrical release. The amazing reviews—98% Rotten Tomatoes—made Amazon pay the price.

Amazon has over 126 million Prime members in the U.S., while Netflix has 73.94 million subscribers. After the success of Prime in the U.S., Amazon is pushing the same playbook in Europe.

Prime Video continues to launch Amazon Original series and movies globally. Amazon’s Original movie Borat Subsequent Moviefilm, starring Sacha Baron Cohen, generated tens of millions of customer streams globally on opening weekend.

In 2022, Amazon released the most expensive TV series, Lord of the Rings: The Rings of Power. Its superhero series, The Boys, is also regarded as the best superhero show of the year despite having big competition from Marvel and DC franchises.

Recently, its Fallout series, a video game adaption, is getting favorable reviews from the audience.

Amazon MGM Studios

Creating a video-streaming service alone will not help; that’s why Amazon created its own film and TV series production distributor, Amazon Studios, now Amazon MGM Studios. Amazon’s original content is too low compared to other services such as Netflix, Hulu, and HBO. However, Amazon has planned to produce its content with a significant number.

The Studio focuses not only on English content but also on content related to a particular geography.

Much of Amazon’s original content has won major awards. For example, Manchester By the Sea, nominated for six Academy Awards, made Amazon Studios the first streaming service to nominate for the Academy Award for Best Picture. The Marvelous Mrs. Maisel and Fleabag are some top-performing and award-winning TV series created by Amazon.

Amazon Studios announced deals for upcoming Prime Video series and movies, including the Eddie Murphy comedy Coming 2 America, which premieres in March 2021 on Prime Video globally, and an unscripted docuseries and new coming-of-age series based on Jessica Simpson’s best-selling memoir Open Book.

On May 26, 2021, Amazon acquired MGM for $8.45 billion. With this acquisition, Amazon also acquired MGM’s vast content library of 4000 films, including classics such as 12 Angry Men, Basic Instinct, Legally Blonde, Silence of the Lamb, Rocky, and the James Bond franchise, as well as 17000 TV shows – including Fargo, Vikings, and The Handmaid’s Tale.

Prime Music

Amazon is not limited to providing video streaming; the company also has its music streaming platform—tough competition for Spotify, YouTube Music, Apple Music, etc. Amazon has millions of songs in its library, which it offers to its Prime members. Prime Music is a gift for its prime members, as the company isn’t charging any extra cost for this music platform.

Even for a better experience, Amazon integrated Alexa into its music app, which can help you find the songs you are searching for.

Further, Amazon Music signed an agreement to acquire an innovative podcast publisher, Wondery. Through this acquisition, Amazon Music aims to accelerate the growth and evolution of podcasts by bringing creators, hosts, and immersive experiences to even more listeners across the globe.

Becoming A Logistics Powerhouse

Amazon is opening small warehouses to support its grocery delivery service, Prime Now and Amazon Fresh. In Germany, where a rapid expansion in online grocery delivery is expected, Amazon has been running warehouse purchase plans to tap into the market opportunity.

Amazon Fulfillment Centers

In Jan 2020, Amazon said it had 110 active fulfillment centers in the US and 200+ globally.

Its plans include investing heavily in expanding fulfillment centers and other logistics capabilities. A key focus is driving further growth in sellers and packages through Fulfilled by Amazon (FBA).

Amazon Logistics App

To strengthen its logistics and delivery network, Amazon announced the development of an app to help truck drivers. Amazon aggressively hired for the project and announced its launch in 2017. In November 2017, they secretly launched the app Relay. The app makes it easier for truck drivers to pick up and drop off packages at Amazon warehouses. Besides, Amazon is also working on a second app that could connect truck drivers with cargo.

Amazon Prime Air

In March 2016, Amazon gave a public demo of its Prime Air delivery drones in the US. The concept has multiple regulatory barriers. However, the situation may improve, as in October 2017, the Trump Government issued an order giving local governments more authority to conduct tests of such new technologies.

Amazon is experimenting with a new delivery service offering more products with free two-day delivery, relieving warehouse overcrowding.

The service, Seller Flex, began two years ago in India, and Amazon has been slowly marketing it to US merchants in preparation for national expansion.

Amazon will oversee the pickup of packages from warehouses of third-party merchants selling goods on Amazon.com and their delivery to customers’ homes. Handling more deliveries is expected to provide Amazon with greater flexibility and control over the last mile to shoppers’ doorsteps.

In October 2023, Amazon announced it would expand its drone delivery service, Prime Air, to new locations. In addition to the existing locations, they plan to begin service in the UK, Italy, and a third US city by the end of 2024. The rollout will be gradual, starting in one location in each country and expanding over time.

Logistics Partnership

In October 2017, Amazon approached French supermarket operator Leclerc about a possible logistics partnership. This probable collaboration shows Amazon’s intentions to expand in the supermarket sector.

The partnership and other logistic investments became an immediate reason for the fall of other services as companies like UPS and FedEx’s share prices dropped drastically. UPS shares fell as much as 2.1% to $116.52, trading down 1.3% in New York on October 4th, 2017. FedEx dipped by 1.6% to $217.77 before recovering somewhat to $220.09 on October 4th, 2017.

Amazon Acquisition Strategy

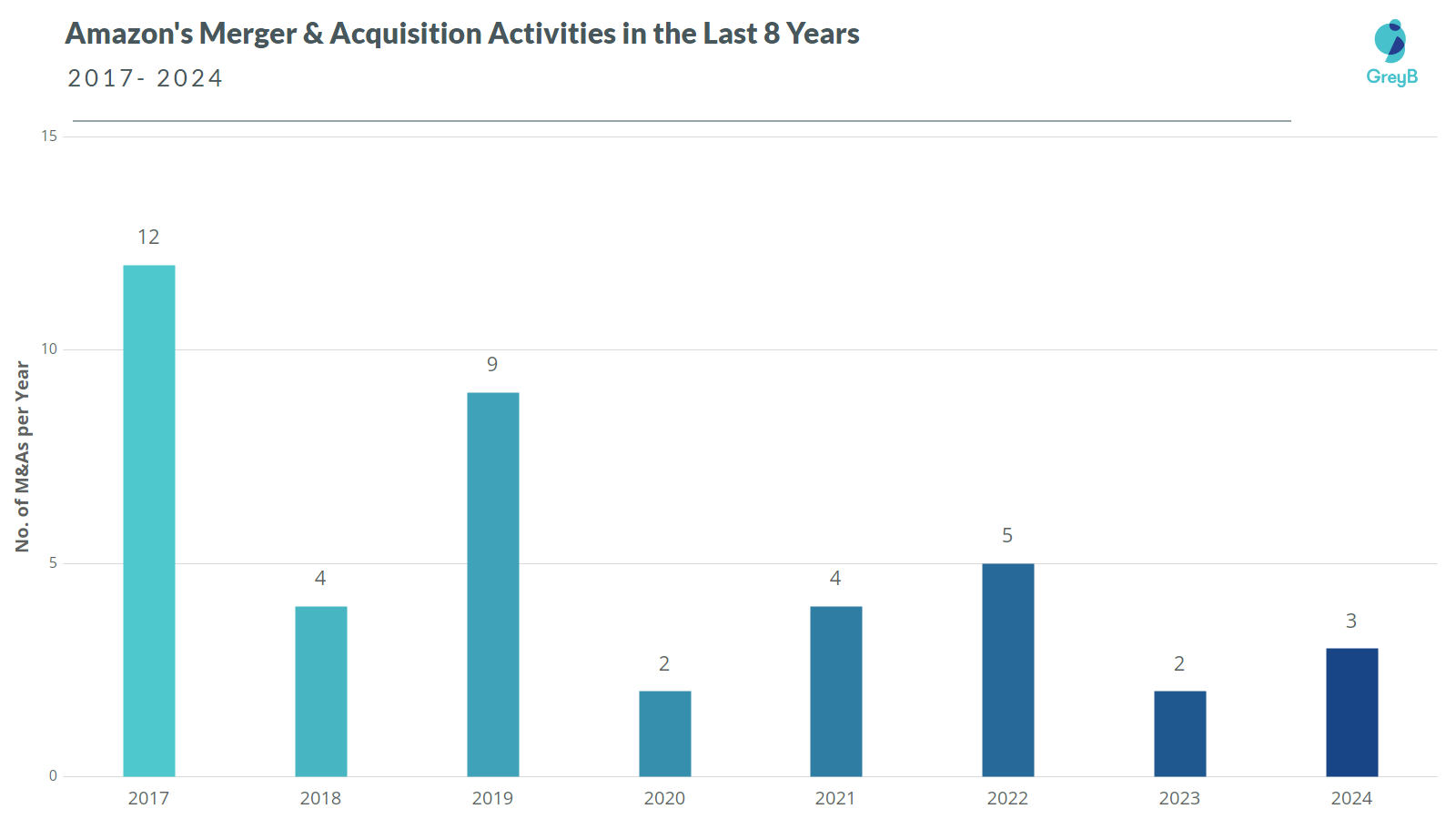

Amazon has aggressively harnessed its merger and acquisition strategy, closing 40+ deals in the past 8 years. But the trend has been on the downward side since 2017, especially after COVID-19.

The chart below summarizes Amazon’s M&As from 2017 to 2024.

2020 saw a significant drop in M&A activity, but it was also when Amazon surprised the world by acquiring Zoox for more than $1 billion, making it the company’s biggest acquisition. With it, Amazon entered the self-driving industry as well.

2021 saw the second-biggest acquisition of Amazon when it acquired MGM for $8.45 billion to boost its streaming service Prime Video. MGM owns 4000 movie titles and 17000 TV series, enough to attract customers to its streaming platform to binge on some classic movies such as 12 Angry Men, Basic Instinct, Legally Blonde, Rocky, and the evergreen James Bond movies.

Over the last few years, Amazon has made multiple acquisitions to strengthen its core e-commerce operations. It has also invested in technology companies such as Harvest.ai, a cybersecurity player, and Do.com, software for meeting productivity needs.

In June 2017, Amazon acquired grocery giant Whole Foods for a whopping $13.7 billion. This was a big step forward for Amazon, strengthening its grocery e-commerce segment and opening doors to new opportunities.

Internationally, Amazon expanded its operations by acquiring other businesses, such as Souq.com, in the Middle East to grow e-commerce in the region.

Amazon made its first acquisition of 2018—its second-biggest ever—in a deal valued more than $1 billion, purchasing Ring, a video doorbell maker. This shows its interest in robust home security to flourish its Amazon Key service.

In 2022, Amazon announced two big acquisitions, i.e., One Medical and iRobot, both billion-dollar acquisitions. With One Medical, Amazon could create a healthcare ecosystem that it could include in its retail store, prime memberships, etc. Consider it similar to what Amazon has done with Whole Foods.

With iRobot, the company could potentially collect data from people’s homes, such as mapping and layout, thus raising concerns for privacy by the FTC. Eventually, the deal failed.

In 2024, Amazon’s acquisition was mainly related to its entertainment business. It acquired MX Player, an Indian VOD site.

Here are the 10 biggest acquisitions of Amazon:

New Businesses and Emerging Markets

Amazon has been experimenting with fintech initiatives and intends to become a prominent player in the segment. In 2016, Amazon nearly lent out $1 billion in small loans.

In India, the company has been offering thousands of loans to e-sellers so suppliers can expand their operations and manage seasonal spikes.

Amazon expanded its financial reach by launching Amazon Cash, which allows users to add to their Amazon.com balance by showing barcodes at brick-and-mortar checkout locations.

“Amazon is the most formidable. If Amazon can get you lower-debt payments or give you a bank account, you’ll buy more stuff on Amazon.” – Alex Rampell, Partner, Andreessen Horowitz

Amazon has also made significant moves in emerging markets. One of the key international markets Amazon targets is India, which is perceived as one of the fastest-growing e-commerce markets globally.

In Late 2016, Amazon’s CEO, Jeff Bezos, announced an additional investment of $3 billion in India, taking its net investment to over $5 billion in the country. This is more than the company’s total capital expenditure of $4.5 billion in 2016. It looks like Amazon sees enormous potential in India.

In October 2017, Amazon announced an expansion in Brazil to enter the electronics and appliances marketplace. Amazon also expanded its operations in the Middle East, one of the fastest-growing e-commerce markets in the world. It acquired Souq in the UAE to serve the local market. In September, Amazon-owned Souq acquired Wing.ae, a startup building a network for Prime-style same-day and next-day deliveries for various e-commerce marketplaces.

On May 21, 2020, amid a pandemic, Amazon launched a food delivery service in India. The service, known as Amazon Food, is currently available in Bangalore. Still, with top players having a setback, the company has enough resources to go big and be a worthy competitor.

In Nov 2020, Amazon opened another venture called Amazon Pharmacy that could disrupt US healthcare. With the service, the company offers prescription medications to customers’ doorsteps. Customers can now browse medications, create a secure pharmacy profile, and request or manage prescriptions on Amazon.com. Like other services, Amazon offers Prime members unlimited, free two-day delivery on Amazon Pharmacy orders with their membership.

Amazon Investment Landscape

Amazon is investing in a broader variety of industries. From 2011 to 2013, Amazon slowed down its investment activities as it mainly invested in internet companies.

During 2014-2016, the company changed its investment strategies and started channeling investment in other industries like Media, Auto & Transport, and Mobile. Amazon also made a few other big investments, as they invested in the UK-based Yodel Delivery Network to expand its logistics network in the UK.

In 2016 Amazon partnered with Twilio to strengthen its text and voice messaging communication platform.

In 2017, Amazon invested in Grail, a healthcare startup that specializes in genomics for cancer diagnostics. This is Amazon’s first investment in the life science segment.

In the last few years, Amazon focused on late-stage deals where most of the investment amount fell into the $10M-$20M range.

However, Amazon’s largest investment was in Anthropic, totaling $8 billion across two rounds: $4 billion in 2023 and another $4 billion in 2024.

Amazon Financial Analysis

Amazon Revenue Analysis

In Feb 2024, Amazon announced its revenue for the 4th quarter of 2025, and with that, we found its overall revenue for 2024. AWS arm was the most profitable segment, raking in $39.8 billion operating income alone, leading to record-breaking sales in 2024.

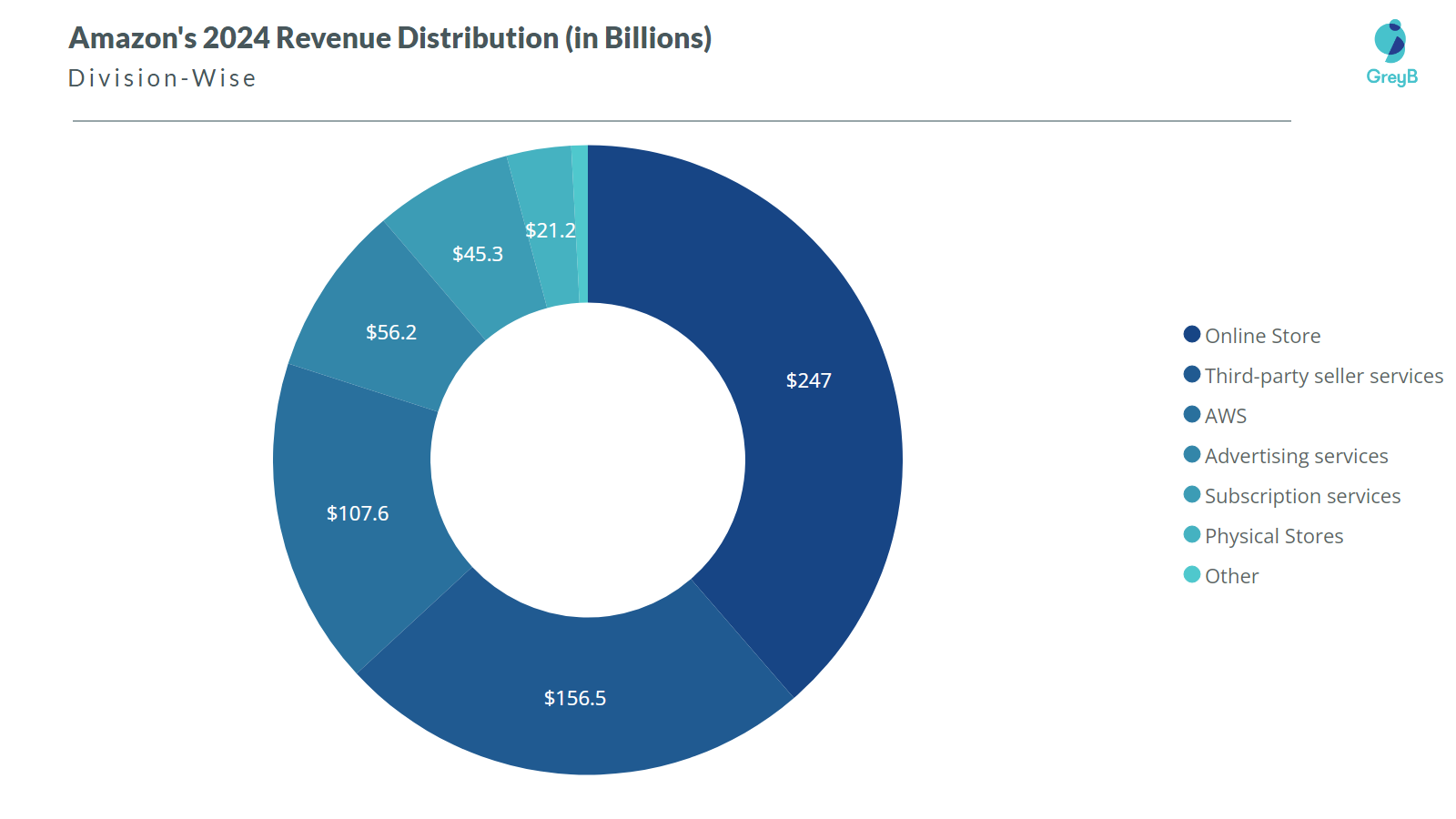

There are several reasons for Amazon’s immense revenue growth. Its online shopping business is the primary source of revenue as it held a record-breaking Black Friday Week and Cyber Monday deal event that was also the largest ever for independent sellers in Amazon’s store.

The subscription service also grew, but a significant growth happened due to third-party sellers, which accounted for 156.5 billion dollars. Amazon is a big marketplace, and one can sell their products via Amazon, for which the company takes a margin of 15 to 20%.

Its online stores also achieved a record of almost touching the 250-billion mark. Amazon now has three divisions with more than $100 billion in revenue.

Furthermore, advertising on Amazon is also increasing faster and accounted for $56.2 billion in 2024. The potential of Amazon’s advertising business is such that analysts have affirmed that it could surpass AWS revenue by 2021. Naturally, it didn’t surpass AWS revenue but saw immense growth. Considering the AWS revenue, it’s highly unlikely that Advertisement can surpass AWS in the next 5 years.

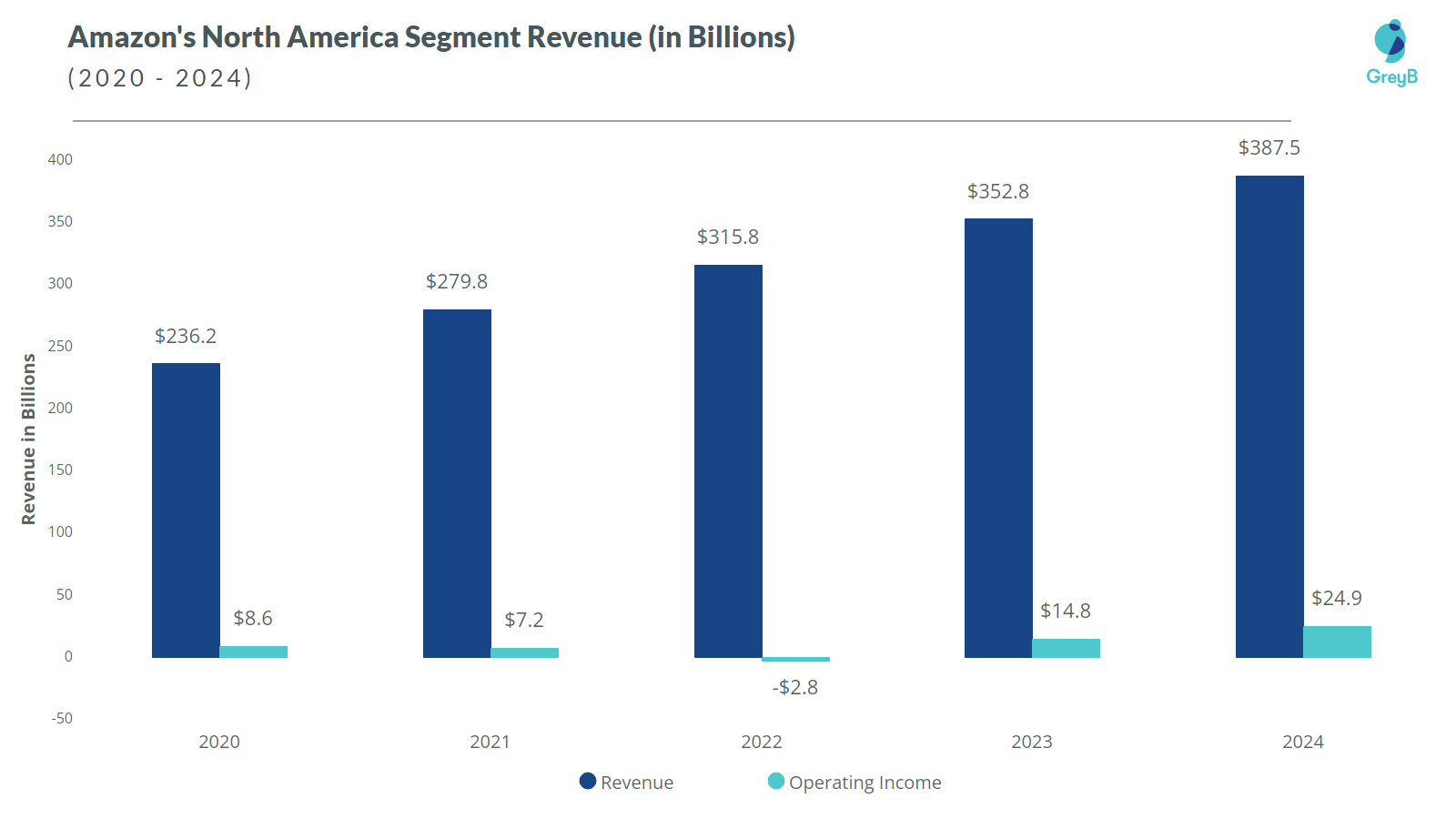

From the revenue perspective, Amazon operations can be divided into three major segments: North America, International, and AWS.

North America Segment

The segment includes earnings from retail sales of consumer products (including sellers) and subscriptions through North America-focused websites. The major competitors in the North American region are Best Buy, Target, eBay, Peapod, and Netflix.

The chart above shows Amazon’s sales and operating income in North America over the last three years.

The segment is responsible for 61% of the total revenue.

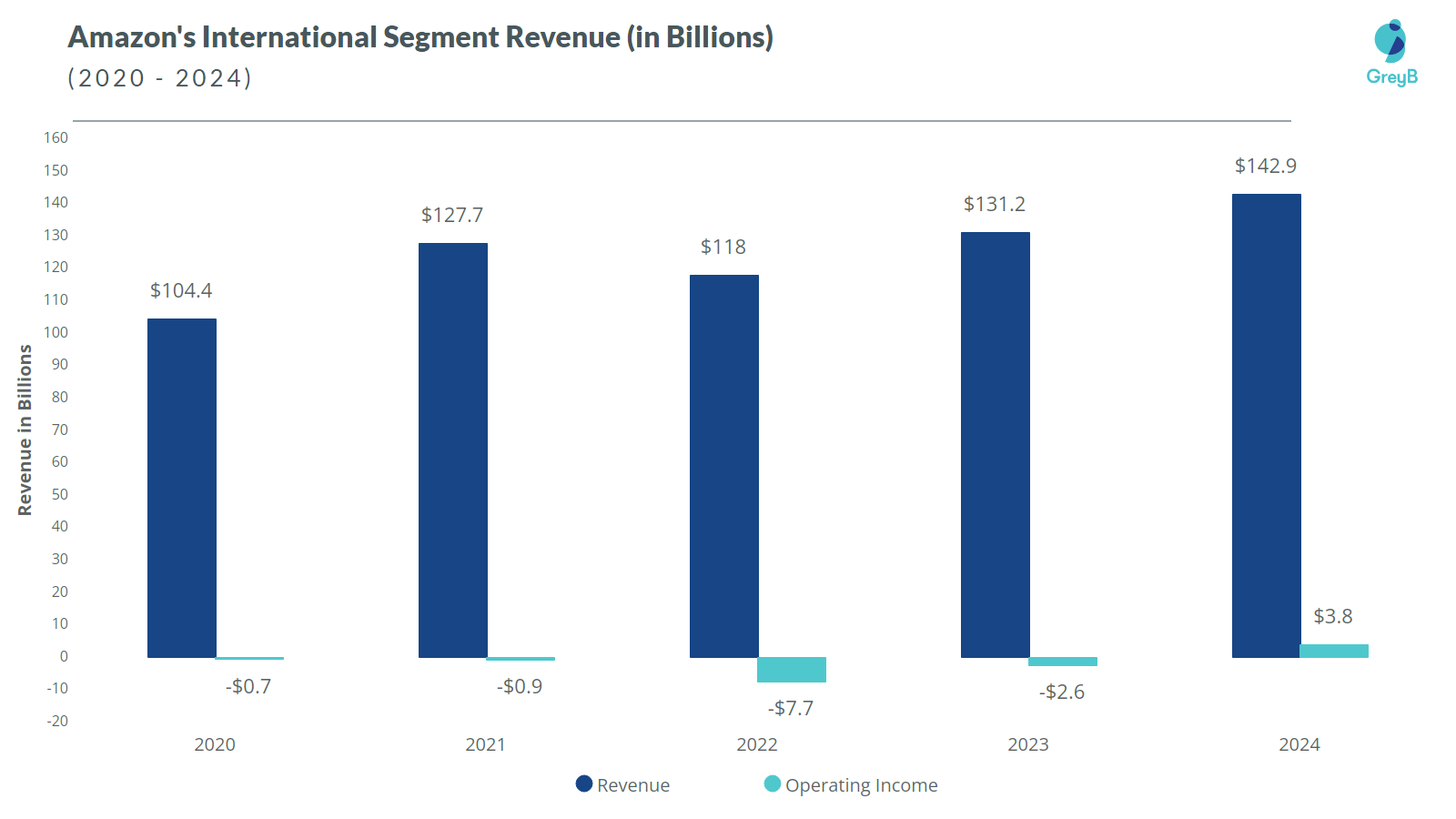

International Segment

The international segment includes earnings from retail sales of consumer products and subscriptions through internationally-focused websites. The chief challengers are Alibaba Group in China, Woolworths in Australia, Rakuten in Japan, Flipkart in India, and JD.com in the United Kingdom.

Amazon International Segment Revenue increased to $142.9 billion in 2024, with an operating income of $3.8 billion. The segment has become profitable for the first time, thus opening the gates for more profits for Amazon in the coming times.

The sales growth was due to increased unit sales, including sales by marketplace sellers. Changes in foreign currency exchange rates impacted International net sales. Increased unit sales were driven mainly by continued efforts to reduce prices.

AWS Segment

Like every year, AWS was the most profitable segment in 2024, thanks to the Amazon B2B strategy, which generated almost $40 billion in operating income.

The AWS segment is earning from global sales of computing, storage, database, and other service offerings for startups, enterprises, government agencies, and academic institutions. The primary rivals in this segment are Microsoft, Google, Oracle, and IBM.

Amazon has added many capabilities to its AWS, which AI primarily drives. A new AWS platform, Amazon Nova, offers a family of foundation models with lower latency, lower price, and integration with Bedrock features.

AWS further signed new agreements with the US Army, Intuit, PayPal, Medtronic, etc. It shows AWS’s impact on the world’s renounced organizations when it comes to cloud computing services.

Amazon Stock Analysis

The year 2024 was generally a positive year for Amazon’s stock price.

The stock rose from $150 in Jan to $216 by the year’s end. The year 2024 was primarily an upward trend for Amazon stock, with a decline in Aug, but it rose again and crossed $200 in November.

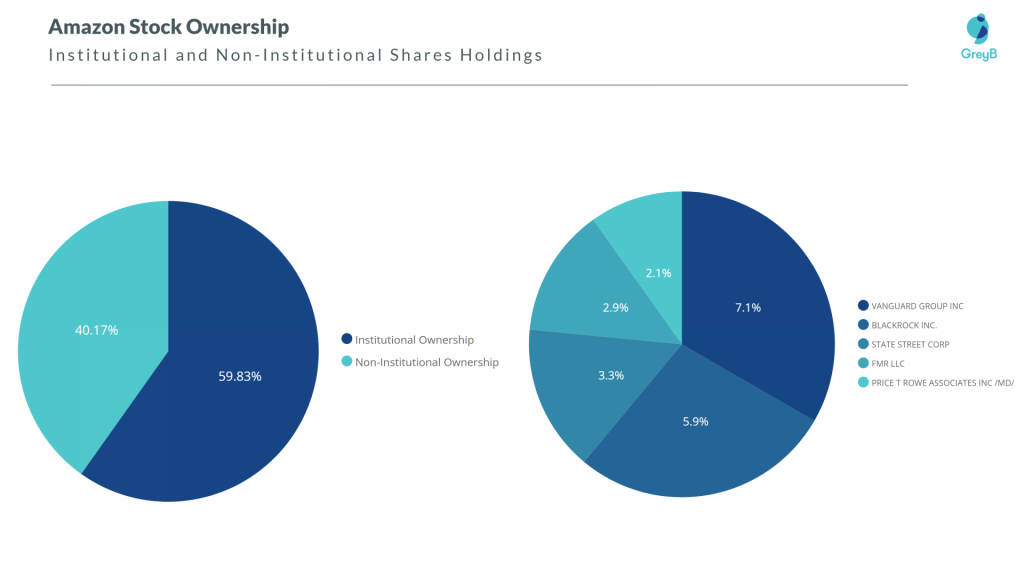

Amazon has 10.24 billion shares, or 60% of the total. Institutional holders hold 6.13 billion shares, or $1.1 Trillion.

Undoubtedly, the world’s richest man holds the most shares—909 million—which makes his net worth $230 Billion. His net worth surpassed the $100 billion mark for the first time on November 24, 2017, when share prices increased by 2.5%. In November, he sold 1 million shares when the price reached an all-time high of $1100/share, which helped him make $1.1 billion.

With 230+ million shares, Mackenzie is Amazon’s 2nd largest individual shareholder, making her net worth more than $30 billion.

Conclusion

For quite some time, Amazon has been focusing its efforts on cloud services and its assistant, Alexa, for which it has raised millions in Funding. Further, it is also trying to make Alexa a smarter assistant by hiring more AI talents.

With Gen AI making noise, Amazon shifted its focus like many companies and invested heavily in AI startups like Anthropic.

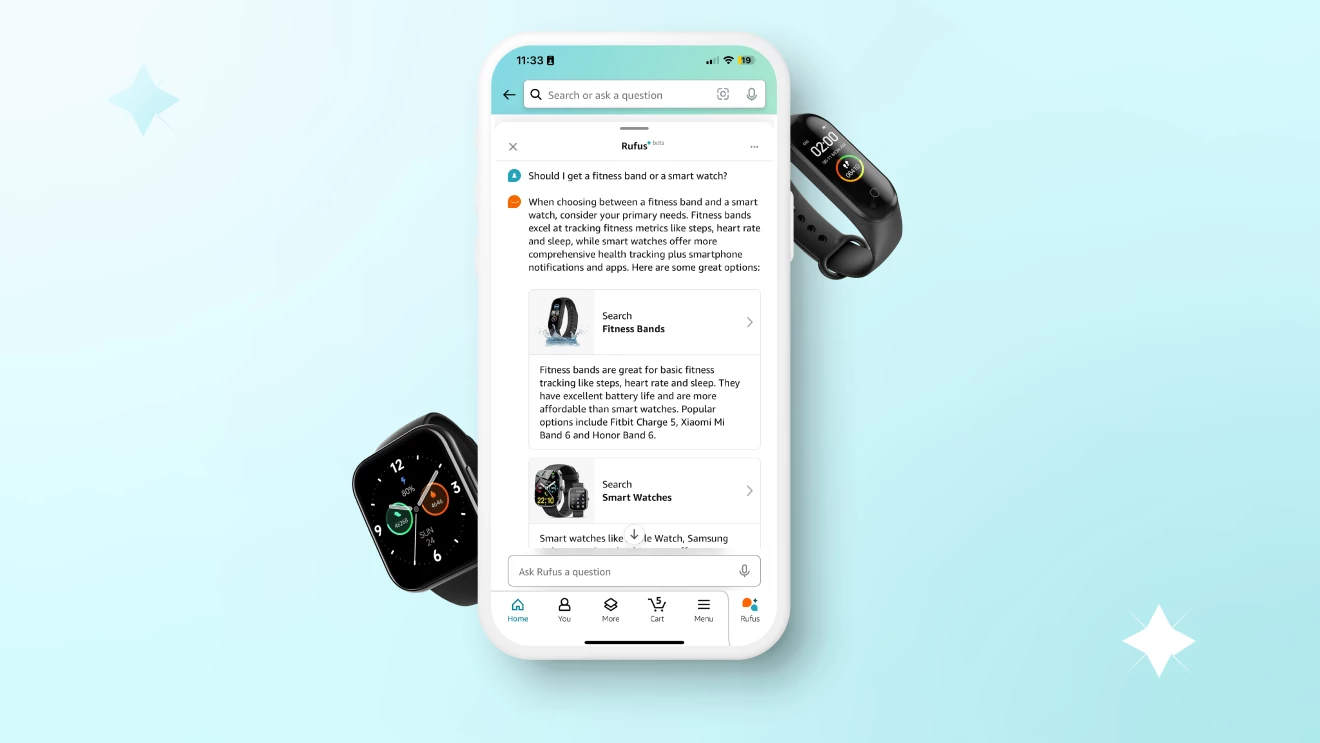

Hence, we can now see AI assistants in Amazon’s apps. In India, its conversational shopping assistant Rufus has already chatted with 10 million users since its launch in August.

Naturally, AWS is another focus for implementing AI.

Further, after record-breaking sales, Prime is getting bigger in India and the Middle East. Further, the company is trying to get a hold of the Indian Fintech market, for which, in December 2017, it funded a digital lending startup, Capital Float. It recently acquired Axio, an online platform providing working capital finance to small and medium-sized enterprises (SMEs).

In 2023, Jeff Bezos announced its $1 billion investment in India for the next five years. It makes sense for Amazon to invest in India, as the country is in the growth stage and could help Amazon to generate record-breaking sales.

The company has hit $638 billion in revenue and has more than $2 Trillion in market capitalization.

Such massive sources could allow Amazon to enter any business it wants, which could be a problem for players in different domains. Zoox acquisition is a solid example as it could make other autonomous vehicle companies a run for the money.

However, when discussing Amazon’s most noteworthy competitor, Walmart is the prime choice.

Even though Amazon is way ahead of Walmart regarding market capitalization, it’s still behind Walmart in revenue. Sources predict that Amazon will overtake Walmart’s revenue by 2022, but it would take another year or two for Amazon to overthrow Walmart from Fortune 500 rank 1.

Amazon surpassed Walmart as the world’s largest retailer in 2019 and quarterly revenue in 2025.

However, after its downfall, Walmart took new steps to become more than a retail company and collected resources to give Amazon tough competition. Walmart now understands the value of technology, as the company has started investing in technologies and patents to take on Amazon.

Related Study: Walmart Strategy: A Combination of Innovation and Price Game

Authored by: Vipin Singh, Market Research.