This post – Competitive Intelligence – is a part of the series Digital Oil Field Study based on the patent landscape in which we have already discussed the innovation timeline and the research and marketing potential of the field. The innovation timeline provides us with a perspective of how technology has evolved in the last 20 years and the later post unravels the potential of technology in different countries around the world.

For your ease, we combined all four articles of this series in a single printable PDF so that you can save it for later use, which you can download using the form below:

The Competitor analysis gives insight into the top players on the field, their expertise, market information, and a glimpse of the external strategies they are using to hold the market.

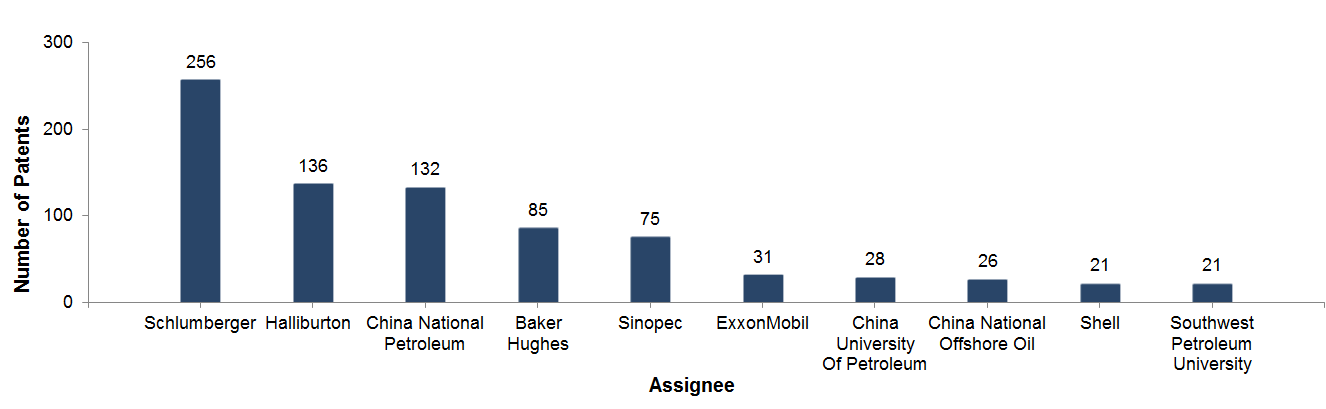

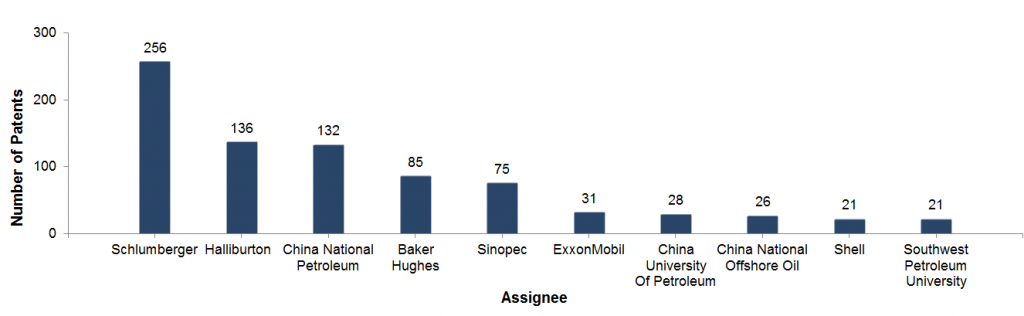

Top Companies actively researching in the domain of Digital Oil Field

What could be the best way to understand what companies are doing internally other than by analyzing patents? We scoured through all the patent families filed in the last 20 years to identify the companies continuously innovating in this space.

We found that Schlumberger, with 256 patents, is dominating the patent landscape of the Digital Oil Field technology. Halliburton with 136 patents, holds the second position followed by China National Petroleum and Baker and Hughes at #3 and #4 respectively. Does this mean that now Oil & Gas players are thinking about how to make themselves more efficient by using the latest sensors and digital techniques?

One insight worth giving consideration is the patent activity of two of the top three players. On one hand, we have Schlumberger, who has been filing patents since 1960 and on the other hand is China National Petroleum, who has filed 85% of its total patents after 2009. This implies that the other companies are taking this domain seriously and innovating much faster than the old players. This also means that this landscape may look very different in the next 5 years where we may see many new companies ending the dominance of the traditional players.

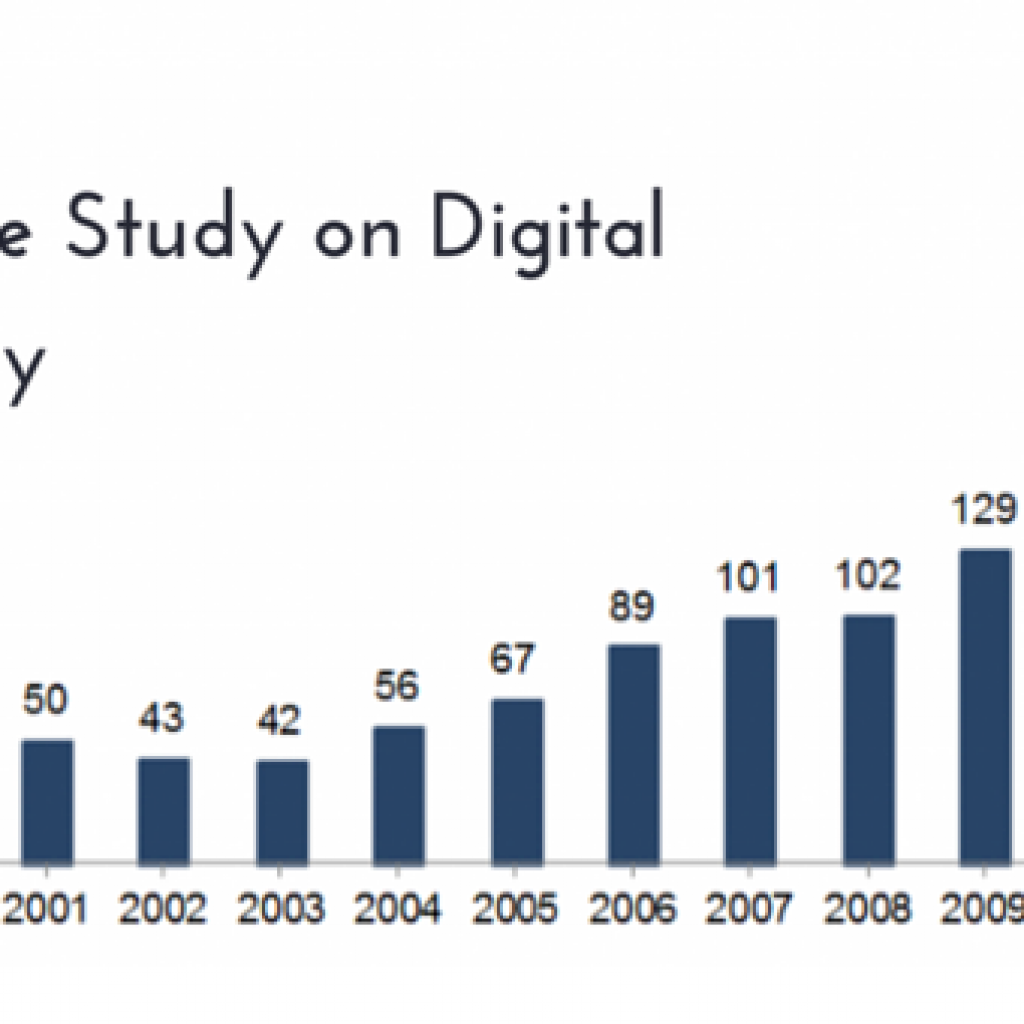

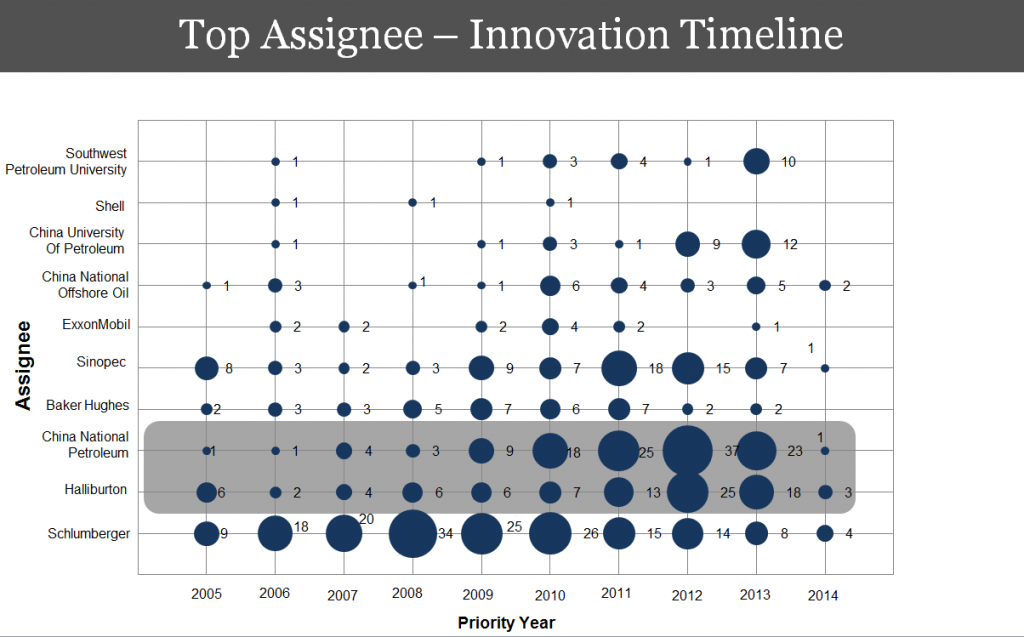

If we are looking at the competitors, we should also look at their innovation timeline – How are they innovating over the period of time. The bubble chart below shows the patent activities of the top competitors in the last 10 years where the numbers next to the bubble indicate the number of unique patents filed by a particular company.

The consistent increase in the patent filing by China National Petroleum and Halliburton after 2009 clearly shows their interest in becoming a market leader in this space.

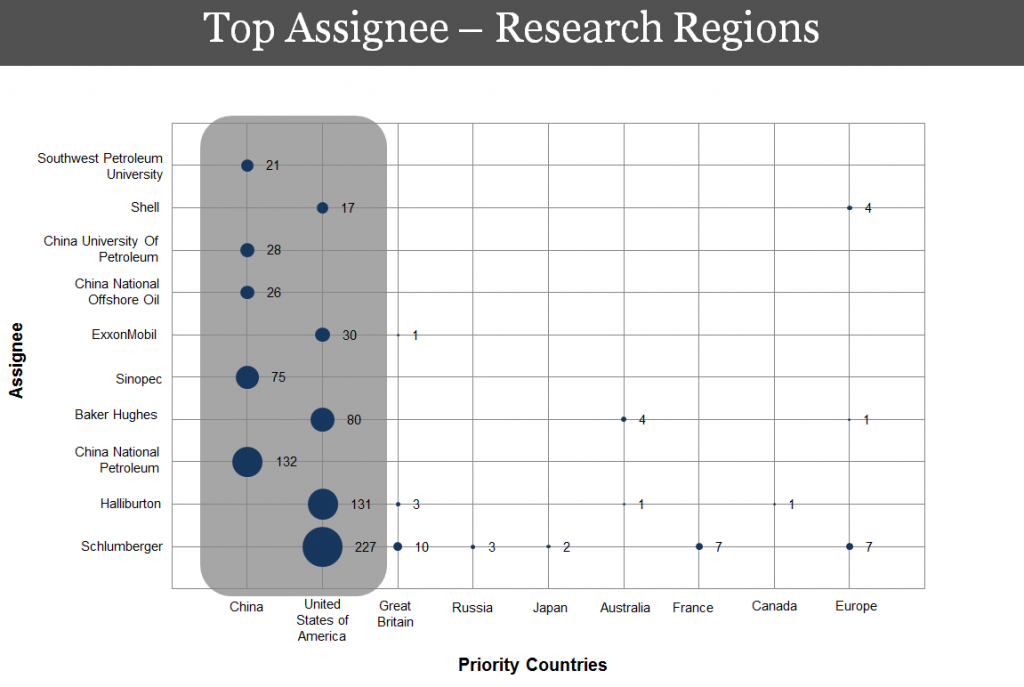

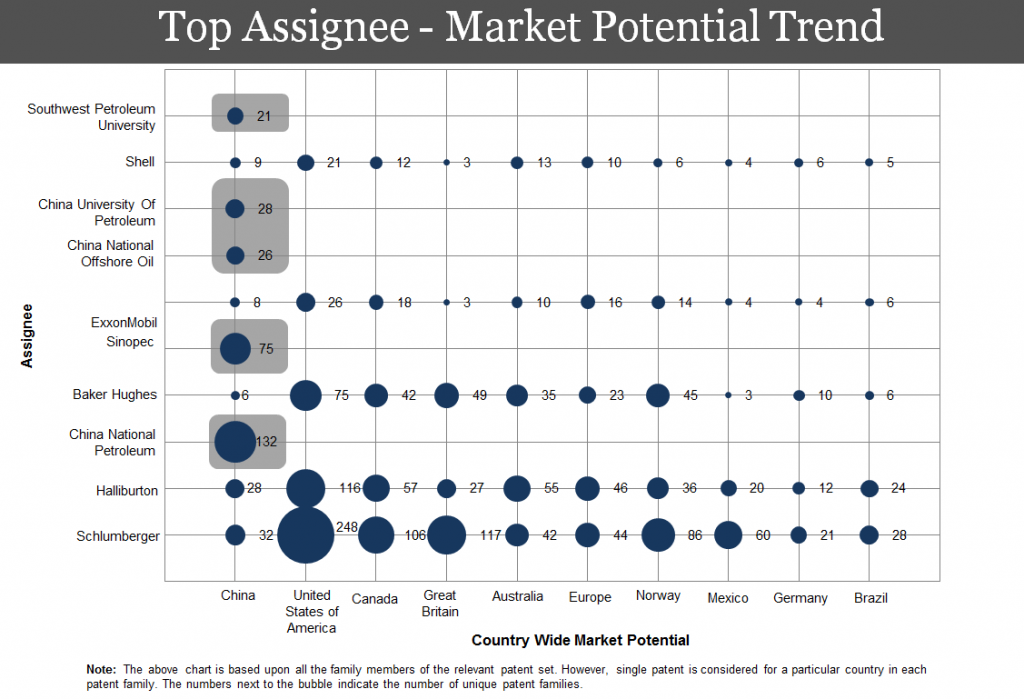

We thought it would also be interesting to check the countries where these companies are performing the research. Since the major companies in this domain are based in China or the United States of America, the research is highly restricted to these regions.

If we look at the countries from where these top players are innovating, Schlumberger, the gas exploration behemoth has not been researching from Great Britain since 2005. This implies they have shifted most of their research centers in the USA.

Apart from that, almost every company except Schlumberger has been totally ignoring Russia for the research base which is a third-largest oil producer. This is one of the reasons that make Russia a sleeping oil giant as the state-of-art technologies required remain out of reach.

Competitive Intelligence on the Top Companies in Digital Oil Field Domain

If we summarize again, we can say that the following corporations are the Top Ten corporations actively researching in the Digital Oil Field domain:

- Schlumberger

- Halliburton

- China National Petroleum (CNPC)

- Baker Hughes

- Sinopec

- ExxonMobil

- China University of Petroleum

- China National Offshore (CNOOC)

- Shell

- Southwest Petroleum University

Out of these top ten players, we have provided brief details of Schlumberger, Halliburton, and CNP, the top three players in the Digital Oil Field domain.

Want an in-depth report that digs deep into what their companies are doing?

Schlumberger

Schlumberger, founded in 1926, is the world’s largest oilfield service company. It has been involved in real-time monitoring and delivery of data from the well site since the late 1970s and has been incorporating the digitization of the oil field in its business since 2000.

Schlumberger has been filing patents since 1963 and has filed 24% patents of its entire patent portfolio in the last five years. Apart from that, Schlumberger has filed patents in collaboration with various entities like Prad Research and Development (9 patents), Petroleum Research and Development (2 patents), etc.

Services offered by Schlumberger include:

- Real-time data analysis of drilling and production processes.

- Downhole equipment and sensors

- Software tools and Interpretation techniques

Acquisitions

In the last 5 years, Schlumberger has acquired 4 companies to add more services to its business. Some of the acquisitions by Schlumberger in the domain of Digital Oilfield are –

- Smith International (2010)

- Gushor (2013)

- Rock Deformation Research (2014)

- Saxon (2014)

Halliburton

Halliburton is one of the world’s largest oilfield companies. It caters to the need for the energy industry involved in the exploration, development, and production of oil and natural gas through its products and services.

Halliburton has been filing patents since 1975; however, it has filed a 42% patent of its patent portfolio in the last 6 years. This is a very important trend to note – 42% of its patent in the last 6 years. In the last 6 years, Halliburton has been primarily focusing on the digitization of optimization and drilling techniques in the oil and gas industry. You know why because 60-70% of their patents were on optimization and drilling techniques. We believe it would be a very good insight to see how exactly they are trying to optimize their current methods.

Services offered by Halliburton include:

- Hydrocarbon Location

- Geological Data Management

- Drilling and formation evaluation

- Well construction and Completion

- Production Optimization.

Acquisitions

In August 2014, Halliburton publicly announced its plans to expand its product portfolio through acquisitions of companies providing technological solutions for oil and gas drilling. Halliburton’s future plans also include acquisitions in markets where it has no presence.

Halliburton has acquired the following companies in recent times.

- Petris (2012)

- UReason Solution Environment (2014)

- Netflex Petroleum Consultants (2014)

- Europump Systems (2014)

China National Petroleum

China National Petroleum Corporation (CNPC) is the largest integrated company in China, which produces and supplies oil and gas. CNPC, established in 1999 as a part of the restructuring of CNPC, is a parent company of Petrochina and is one of the major assignees in the oil field domain.

After filing the first patent in the year of 2002, CNPC has exponentially increased its patent filling in the oilfield domain. CNPC’s focus on software/algorithms patent indicates its growing interest in enhancing its operations using IT.

CNPC has filed patents in collaboration with entities like Beijing Petroleum Machinery Plant (1 patent), China National Offshore Oil and Yangtze University (1 patent), Daqing Petroleum Administration Bureau (1 patent), and Tuhao Petroleum Exploration and Development (1 patent).

Services offered by CNPC include –

- Geophysical prospecting

- Well Drilling

- Logging

- Oil and gas field surface construction

- Petroleum and petrochemical engineering

- Manufactures equipment and supplying raw materials

Acquisitions

In 2013, Petrobras sold its Peru unit to Petrochina (CNPC) for $2.6 billion. The acquisition of the assets will help CNPC to expand the oil services in Latin America.

Does the provided information ring any bell? Doesn’t it help to predict the business strategies of these companies and their expansion strategies?

Or are you looking for deeper analysis?

Do you want to know:

- What your competitors are working on behind the curtains?

- Which new products may hit the market in the next 1 to 2 years?

- What are the key issues most of the players in your industry are trying to solve?

- Where you should channelize your efforts?

Patent analytics can bring insights that seem distant and hard to reach at first within your hands. Let us show you how!

Analysis Performed By: Deepika Kaushal, Manager, Patent Landscape

Access Any of the Four Parts: