December’s patent deals have set the stage for major legal battles in the semiconductor and telecom industries. Oak IP’s purchase of 36 semiconductor patents has already led to a lawsuit against GlobalFoundries. These very patents cost Samsung $25 million in a past lawsuit. With Oak IP now asserting them other chipmakers face similar risks.

Meanwhile, Ofinno has strengthened its 5G patent licensing position by acquiring 64 patents from Comcast, potentially influencing future negotiations.

This article dissects the December patent transactions, highlighting the most significant ones, and identifies the industries that should be on high alert.

Companies are making moves that could reshape your industry before you even realize it. A patent changes hands today, and six months later, it’s at the center of a lawsuit. That’s exactly what happened with the Oak IP patent transaction. Track these shifts so you know what’s coming before it lands on your desk, subscribe to GreyB’s newsletter today.

Subscribe To Our Newsletter

Stay Updated With The IP Shifts

Oak IP’s Patent Acquisitions Heighten Litigation Concerns for Chipmakers

Oak IP, tied to Dominion Harbor, bought 36 patents from Acorn Semi. Cited by TSMC and Intel, these patents remain highly relevant as the semiconductor industry moves toward smaller nodes and more advanced technologies. Soon after the acquisition, Oak IP sued GlobalFoundries on February 4, 2025.

The semiconductor companies must assess their exposure to these patents and develop risk mitigation strategies. A deeper analysis of the key patents revealed their potential risks, impact on semiconductor firms, and technical significance.

Analysis of key patents in Oak IP’s December 2024 patent transaction

Litigation History

Six of the patents in the portfolio —US9905691B2, US10090395B2, US9461167B2, US7084423B2, US9209261B2, US8766336B2—were previously asserted against Samsung. The lawsuit resulted in a $25 million settlement.

The patents targeted Samsung’s 14nm FinFET transistor technology. The same technical issues, Fermi level depinning and metal-semiconductor contact improvements, remain critical for 12nm, 10nm, and sub-7nm technologies. This was demonstrated in the GlobalFoundries case.

Source: https://insight.rpxcorp.com/litigation_documents/16007959

Contact resistance remains a major challenge in advanced semiconductor manufacturing. IBM Research confirms that reducing this resistance is crucial for improving transistor performance at 10nm, 7nm, and beyond. A 2023 study, Overcoming the Fermi-Level Pinning Effect in the Nanoscale Metal and Silicon Interface (Su & Lin, 2023), supports the patented solutions.

Although these patents date back to 2002, their relevance remains high. They describe inserting an interface layer between metal and semiconductor materials to reduce Fermi level pinning and lower contact resistance. This method aligns with modern research, reinforcing its applicability in next-generation transistor designs.

Today’s manufacturing processes involve contact areas just a few atomic layers thick. To achieve ultra-low contact resistances (≤10 Ω‑μm², even ≤1 Ω‑μm²), precise interface engineering is essential. These patents address this challenge directly, making them valuable for sub-10nm technologies.

Key Patents to Watch for Infringement Risks from Oak IP’s December 2024 patent transactions

Among the 36 patents in Oak IP’s portfolio, several stand out due to their past litigation success, strong prosecution records, and relevance to semiconductor manufacturing. Their GAU classifications, Track One prosecutions, and CPC codes highlight their significance in the industry.

Family 1 – US11355613B2, US10950707B2 (Expired)

- These patents belong to the same family as US9905691B2 and US10090395B2, previously litigated against Samsung and GlobalFoundries.

- They were prosecuted through Track One, reinforcing their commercial importance.

- These patents were granted under GAU 2815, one of the strictest art units (76% approval rate) for semiconductor technologies.

- Their CPC classifications indicate relevance to semiconductor fabrication:

- H10D30/60 – Insulated-gate field-effect transistors (IGFETs)

- H10D30/87 – FETs with Schottky gate electrodes

- H01L21/28537 – Deposition of Schottky electrodes

- The claims of US ‘707 closely resemble those of previously litigated patents, increasing its likelihood for assertion.

Family 2 – US9620611B1 (still active)

- This patent, prosecuted via Track One, has been used by USPTO examiners to block eight patent applications from major players, including IBM, Sanken Electric, Tokyo Electron, and UMC.

- It shares a CPC classification (H10D30/0277) with previously litigated patents. This classification relates to manufacturing IGFETs and Schottky barrier source/drain regions.

- US’611 focuses on achieving low contact resistivity (≤10⁻⁵ – 10⁻⁷ Ω-cm²) through an ultra-thin dielectric layer (<4 nm) placed between a metal oxide and a semiconductor.

- Like Family 1 patents, US ‘611 uses an ultra-thin dielectric layer to enhance metal-semiconductor contact.

US ‘611 may have strong infringement potential due to its similarities to previously litigated patents. Foundries that rely on ultra-thin interfacial layers for metal-semiconductor contacts could be at risk of litigation.

Ofinno Strengthens 3GPP Presence with Strategic Acquisition of 64 New 5G Patents from Comcast

Comcast transferred 64 patents to Ofinno, strengthening Ofinno’s 5G patent portfolio. The transaction includes patents covering key wireless technologies, such as:

- Beam management

- Power optimization

- Resource scheduling

- Digital signal processing

This move expands Ofinno’s presence in the 3GPP standards domain. Ofinno has a history of acquiring and licensing patents to major players like Samsung, Huawei, and Comcast.

The portfolio includes assets with high forward citation counts, signaling strong technological relevance and licensing potential. Many patents also have international filings, covering jurisdictions like the U.S., Canada, and Europe. This increases their value in global licensing and enforcement efforts.

Ofinno’s latest acquisition aligns with advancements in 5G new radio technology. These patents may play a role in future licensing negotiations and potential enforcement actions. Their focus on power control, beamforming, and network efficiency further strengthens their strategic value in the evolving telecom landscape.

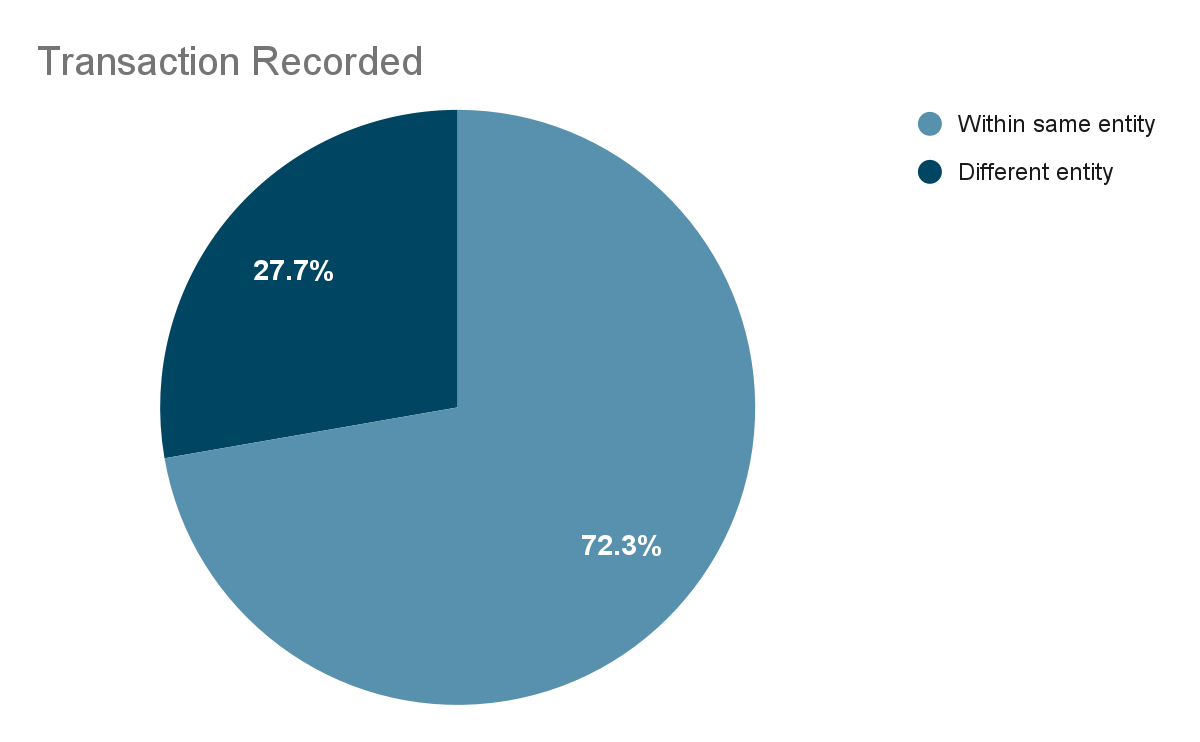

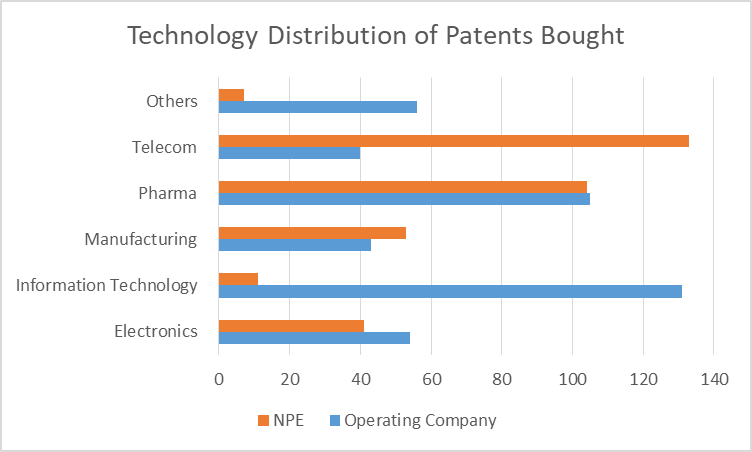

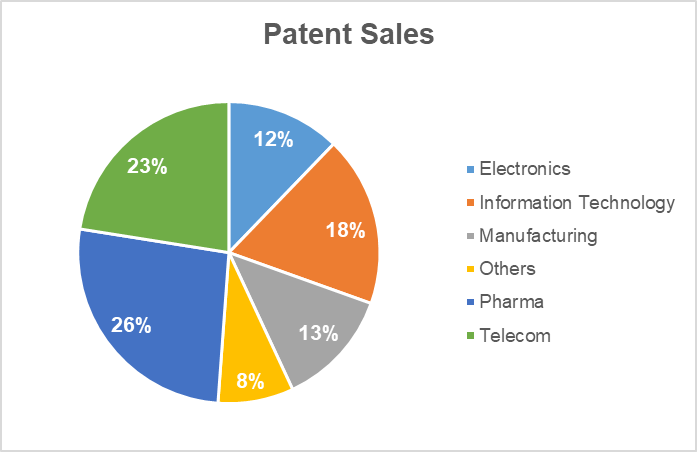

Beyond these major acquisitions, December 2024 saw a flurry of patent transactions across industries. A total of 312 assignments involving 10,896 patents highlight key shifts in intellectual property ownership. Below is a breakdown of the most active buyers, sellers, and technology domains shaping the patent landscape.

Overview of December 2024 Patent Transactions

1. Top Patent Buyers

In the December 2024 patent transactions, most IP transfers involved acquisitions by operating companies. However, as highlighted in the special features, a few standout buyers have shaped the market dynamics.

Here is the list of top 5 buyers :

| Assignee(s) | Industry |

| Progress Software | Telecom and IT |

| Ofinno | Telecom |

| HCL Technologies | IT |

| Fortuna IP | Gaming |

| Interlink Silicon | Semiconductor |

*Any patents transferred to a law firm, consulting firm, R&D Institute, or to a single inventor have been marked under NPE.*

2. Top Patent Sellers

The analysis of recent transactions highlights several key sellers across diverse industries. The table below lists the companies actively acquiring patents and the sectors they operate in:

| Assignor | Industry |

| Comcast Cable | Telecom |

| Citrix Systems | IT |

| Hewlett Packard Enterprise | Telecom and IT |

| Vulcan Gaming Llc | Gaming |

| Mediatek | Semicon |

3. Patent Transactions between Operating Companies

Here are some of the December 2024 patent transactions between the operating companies.

| Assignor | Assignee | Patent assets | Technology Overview |

| Citrix Systems | Progress Software | 63 | Cloud Collaboration & Document Security |

| Hewlett Packard | Hcl Technologies | 59 | Microservices and Container Orchestration |

| Mediatek | Interlink Silicon | 37 | Memory Interface Circuits |

| Novartis | Seqirus Uk Limited | 26 | Surfactant-Containing Compositions and Emulsions |

| Oppo | InterDigital | 6 | Service Switching Methods and Devices |

Conclusion

Oak IP’s newly acquired patents have a strong litigation history, with past wins against Samsung and relevance to sub-10nm semiconductor technologies. Foundries relying on ultra-thin interfacial layers should assess their risk immediately. Meanwhile, Ofinno’s 5G portfolio expansion signals potential licensing assertions. Companies in semiconductors and telecom must act now to evaluate their exposure and prepare defense strategies.

Oak IP’s lawsuits show how quickly patent deals can escalate. GreyB’s IP Litigation Risk Assessment helps you pinpoint these threats, assess their impact, and build counterstrategies. Fill the form below to request a customized risk analysis today.

Authored by: Ojasvi Jain, Infringement team

Edited by: Annie Sharma, Marketing Team