Despite the regulatory restrictions and consumer demands, the transition to sustainable food packaging solutions is hindered by rising costs, scalability concerns, and supply chain disruptions. Companies struggle to source materials that are both environmentally friendly and commercially viable.

The challenge extends beyond simply finding alternatives. Many innovative packaging materials lack comprehensive performance data, complicating assessments of their durability, recyclability, compostability, and overall environmental impact. Without clear insights into these critical aspects, R&D teams find it difficult to confidently select materials that balance compliance, cost-efficiency, and functionality.

Several companies are proactively addressing these challenges through strategic partnerships and groundbreaking innovations. For instance, Cirkla introduced molded fiber MAP trays that significantly reduce plastic use while maintaining essential preservation properties. Similarly, W-Cycle partnered with Melhoramentos to scale production of compostable SupraPulp™ containers, demonstrating how sustainable packaging can integrate seamlessly into existing supply chains.

This article explores these key food packaging trends, highlights promising emerging innovations, and outlines the persistent challenges companies face in adoption. It offers actionable insights to help industry leaders navigate evolving regulations, mitigate risks, and implement future-proof packaging strategies.

GreyB’s complete research goes even deeper, exploring critical packaging innovations, industry insights, and strategies. The full report reveals what brands like Nestle and Gem-pack berries are doing to balance cost, scalability, and compliance challenges. It also highlights the new developments in food packaging technologies that can help you gain a competitive edge in the market.

Get the Report in your Inbox

Trend 1: rPET Will Be Preferred Over Bio-Based Plastics in Food Packaging

The Buying Green Report 2023 found that 82% of consumers are willing to pay more for sustainable packaging, but replacing plastic with bio-based materials for food packaging poses challenges. Bio-based materials have high costs, limited scalability, and underdeveloped recycling systems. On the other hand, recycled PET (rPET) is an affordable and scalable alternative to traditional plastics.

Here’s a detailed comparison of both:

| Feature | Bio-Based Plastic Material | rPET (Recycled PET) |

| Source | Derived from renewable resources like corn starch, sugarcane, or algae | Made from post-consumer PET plastics (e.g., recycled bottles) |

| Fossil Fuel Dependency | Can reduce fossil fuel use if fully bio-based | Still derived from fossil fuels but extends PET lifecycle |

| Recyclability | Varies; some bio-based plastics (e.g., bio-PET) are recyclable, others degrade instead | Fully recyclable within existing PET recycling streams |

| Biodegradability | Some are biodegradable or compostable (e.g., PLA), but not all | Not biodegradable, but can be recycled multiple times |

| Carbon Footprint | Lower than traditional plastics, but varies depending onthe material and the production | Lower than virgin PET since it reuses existing plastic waste |

| Durability & Performance | Some bioplastics have lower durability than PET | Maintains strength and barrier properties similar to virgin PET |

| Applications | Packaging, films, disposable cutlery, textiles | Bottles, packaging, fibers, food-grade containers |

| Challenges | High production cost, limited infrastructure for biodegradation | Contamination in recycling streams, downcycling over time |

Governments are also pushing for higher recyclability and sustainability in food packaging. For instance, the EU Circular Economy Action Plan mandates that all plastic packaging be 100% recyclable or reusable by 2030.

Recent developments focus on increasing the use of recycled materials, enhancing recyclability, and introducing compostable alternatives.

Innovations Addressing Sustainability Challenges:

1. Incorporation of Recycled PET to Enhance Sustainability

Celebration Packaging’s Tamper-Evident Containers (February 2024): Celebration Packaging introduced a range of tamper-evident food containers made from a minimum of 30% recycled PET (rPET). This initiative exceeds the UK industry average by 5%, setting a benchmark for increased recycled content in packaging.

This approach promotes sustainability by reducing reliance on virgin plastics and encouraging industry-wide adoption of higher recycled content.

2. Development of Fully Circular APET Containers for Enhanced Recyclability

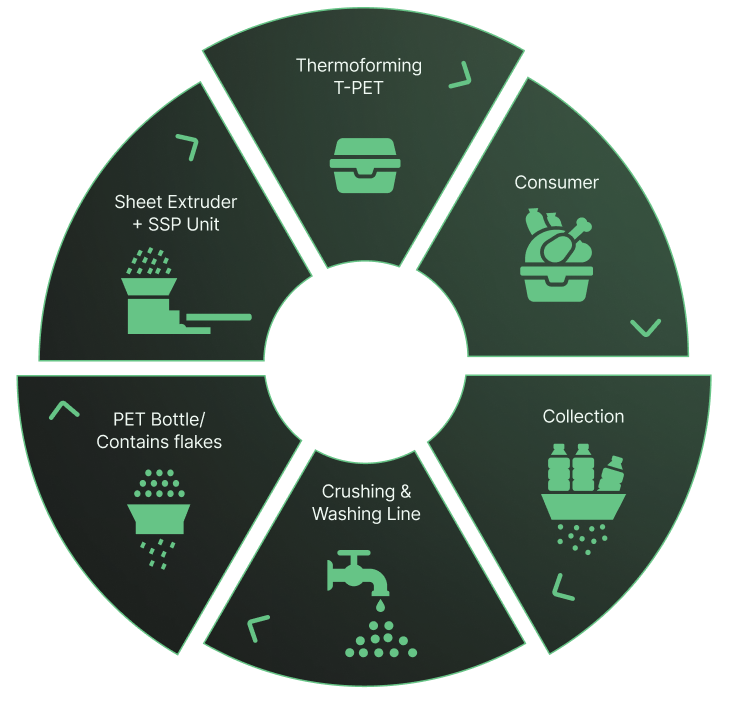

Thermapet Technologies’ APET Containers (November 2024): Thermapet Technologies unveiled its patented technology for producing fully circular amorphous-polyethylene terephthalate (APET) containers. These containers are made from Thermoforming-PET (TPET) using pure or recycled PET without nucleating agents or additives, allowing them to withstand temperatures up to 220°C. It is recyclable in circular bottle-to-bottle systems and cuts costs by 70% for food companies.

Source: Thermapet Technologies

3. Government-Funded Projects to Improve Recyclability of Complex Packaging

The BOTTLE4FLEX Project: Funded by the EU and Spanish governments, this project aims to increase the recyclability of Skinpack or ‘second skin’ food packaging. Partners including AIMPLAS, Covinil, and Eroski are developing a single-material film using recycled PET (rPET) through chemical recycling and polymerization innovations. This type of flexible packaging has a premium appearance and low cost. However, its multilayer structure and complex composition make recycling difficult. The goal is to create packaging that meets sustainability needs and regulatory requirements.

This initiative tackles the challenge of recycling multilayer flexible packaging by developing mono-material solutions that simplify the recycling process.

4. Integration of Enzyme Additives for Compostable PET Packaging

Gem-Pack Berries and Reborn Material Collaboration: Gem-Pack Berries partnered with Reborn Material to incorporate an enzyme additive into PET clamshell packaging during production. Once disposed of in soil or compost, the additive activates, breaking down the PET into smaller fragments that soil microbes can decompose completely, leaving no microplastics.

This approach addresses the challenge of PET’s environmental persistence by enabling compostability and reducing plastic waste.

Trend 2: Companies Aim To Decompose Natural Food Packaging Within 100 Days

Despite cost and supply chain challenges, many companies are investing in biodegradable and compostable materials for food packaging.

For instance, W-Cycle Holdings has developed a patented material called SupraPulp™ cellulose. It is derived from sugarcane waste (bagasse) and other natural residues, like eucalyptus wood fibers and banana leaves. These materials are combined with non-toxic additives to produce molded fiber packaging that decomposes within 100 days.

Innovations Addressing Sustainability Challenges:

1. Compostable Packaging Solutions Enhancing Sustainability and Scalability

W-Cycle and Melhoramentos Partnership (November 2024): W-Cycle, an Israeli clean-tech company, partnered with Brazilian company Melhoramentos to produce compostable food containers using W-Cycle’s patented SupraPulp™ material. Made from renewable materials like sugarcane bagasse, these containers are grease-resistant, moisture-proof, and temperature-resistant, decomposing naturally within 100 days. This collaboration leverages Melhoramentos’ extensive renewable forestry resources, highlighting SupraPulp™’s scalability as a viable alternative to plastic packaging. Raw materials like bagasse used for its production are abundant and low-cost.

The solution is also home-compostable and works with existing manufacturing lines, reducing the need for costly changes or new facilities. Using SupraPulp™, food companies can meet sustainability goals and comply with environmental regulations within a limited time and cost.

2. Molded Fiber MAP Trays Reducing Plastic Content and Enhancing Recyclability

Cirkla’s Fiber MAP Trays Launch (January 2025): Cirkla introduced the world’s first molded fiber Modified Atmosphere Packaging (MAP) trays, reducing plastic content by approximately 85%. Made from renewable plant fibers like sugarcane bagasse, these trays feature a patent-pending, easy-peel liner that ensures recyclability within paper streams. Designed to maintain the oxygen and water vapor resistance necessary for preserving meat, poultry, and seafood, they integrate seamlessly into existing manufacturing lines without additional costs. Millions of units are slated for global markets by February 2025.

The innovation addresses regulatory requirements while maintaining the oxygen and water vapor resistance necessary for preserving meat, poultry, and seafood. Trials with U.S. meat packers show that these trays maintain product shelf life while integrating into existing manufacturing lines without additional costs. It is a scalable packaging solution for food companies that balances performance with sustainability goals.

3. Paper-Based Packaging with Enhanced Barrier Properties for Food Products

UPM Specialty Papers and Eastman collaborated to create paper-based packaging for food products requiring grease and oxygen barriers. The innovation combines Eastman’s biobased and compostable Solus performance additives with BioPBS polymer to create a thin coating for UPM’s compostable and recyclable barrier-base papers.

Source: Packaging Europe

This eco-friendly solution offers a recyclable alternative for packaging foods like confectionery and meat pies, providing strong heat sealability, barrier protection, and flexibility, making it ideal for flexible packaging. The packaging is fully recyclable under the PTS method (PTS-RH 021/97 cat II), and its components are compostable in both home and industrial composting systems.

Explore the latest research and innovations in bio-based food packaging materials on our proprietary research tool SLATE.

Trend 3: Edible Films Are Overcoming the Cost and Scalability Challenges

Edible food packaging transforms sustainability by eliminating waste entirely. However, it preserves food less effectively over time, degrades faster, costs more, and has weaker barrier properties. Variability in materials like starch, chitosan, and proteins also limits its scalability and effectiveness.

Despite its limitations, edible packaging is a growing choice in the food industry. Recent investments and technological advancements are addressing these issues.

Innovations Addressing Cost and Scalability Challenges:

1. Seaweed-Based Packaging Solutions Enhancing Scalability and Cost-Efficiency

- Notpla secured £20 million in Series A funding to scale its seaweed-based packaging solutions, mainly targeting the North American market. This investment aims to replace over 100 million single-use plastics annually within the next two years.

- B’ZEOS, another compostable seaweed-based packaging startup, raised over €5 million in seed funding to upscale its compostable seaweed-based packaging. The funds will accelerate product development and commercial production, offering scalable alternatives for global packaging manufacturers.

These investments enhance scalability by increasing production capacities and reducing costs through economies of scale.

2. Starch-Based Innovations Improving Mechanical Strength and Stability

Hydroxypropyl Starch (HPS) and Curdlan (CD) Composite Films: Research is focused on combining HPS, known for its excellent film-forming and gas barrier properties, with CD, an edible polysaccharide with strong, heat-resistant gel-forming abilities. This approach aims to enhance starch-based films‘ mechanical strength, stability, and moisture resistance, making them more viable for widespread adoption.

This innovation addresses the inherent weaknesses of pure starch films, improving their functionality and scalability.

3. Alginate-Based Edible Coatings Enhancing Practical Application and Waste Reduction

Freddy Hirsch Group’s Sausage Coating Innovation: The company developed a patent-pending edible coating for sausages (including meat, vegetarian, and vegan options) using alginate derived from seaweed. This coating forms a consumable layer around sausages just like a regular casing. However, unlike traditional coatings, this one doesn’t need to be removed after cooking. It mimics the texture and taste of sausages and is eaten along with, reducing packaging waste.

This solution offers a practical application that enhances consumer acceptance and sustainability by mimicking traditional textures and reducing waste.

Industry giants like Nestlé and the International Chemical Investors Group (ICIG) are also investing in edible seaweed packaging technology and startups.

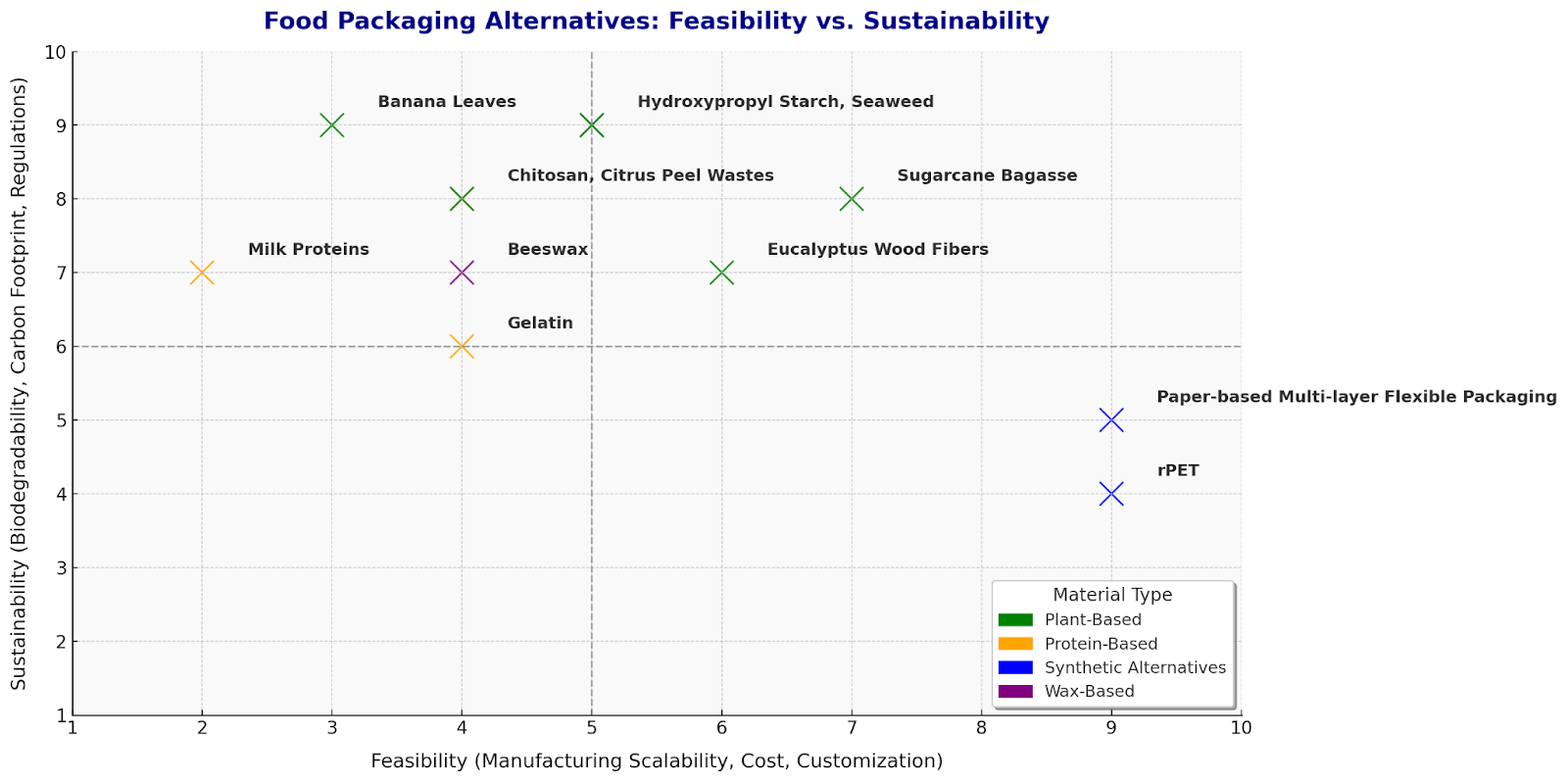

While seaweed-based films are among the most popular types of edible packaging, companies are also innovating with other materials, such as beeswax, citrus peel wastes, Milk proteins, and gelatin.

These materials have drawbacks like low water retention and moisture control in pure form. But mixed with other functional materials and active ingredients, they are suitable for creating active edible packaging that preserves food, extends shelf-life, and provides anti-microbial properties.

4. Alternative Edible Materials Extending Shelf-Life and Functional Performance

- Beeswax-Based Packaging by One Good Thing (OGT): OGT utilizes proprietary technology to produce beeswax-based packaging for health bars, providing enhanced shelf-life and sustainable production.

- Citrus Peel-Based Films by Eat-Pack Project: Innovation Fund Denmark leads the Eat-Pack Project, aiming to create edible food films using citrus and orange peel powder extracted from juice industry waste. These films are expected to be ready by 2028.

By incorporating functional ingredients, these materials offer active packaging solutions with improved moisture control and antimicrobial properties, addressing previous limitations.

Commercialization Challenges

Edible packaging is an ideal alternative to replace plastic packaging as it neither uses petroleum-based sources nor any plastic in production and doesn’t produce any end-of-life waste. However, it has significant commercialization challenges, including scalability, cost, and implementation.

For instance, sourcing sufficient quantities of citrus peel waste or milk proteins requires consistent and large-scale agricultural processing, which may not be feasible in all regions. The production processes for these materials can be complex and cannot be easily integrated into existing manufacturing lines. Hygiene and taste concerns also hinder the widespread acceptance of edible packaging.

The following chart plots these food packaging alternative materials’ feasibility in industry application and sustainable profile.

Trend 4: Mono-Material Designs Are the Next Big Thing in Flexible Packaging

Flexible packaging offers cost-effectiveness, a lightweight nature, and the ability to protect food from moisture and oxygen. However, its reliance on multi-material laminations makes recycling difficult and costly. Traditional flexible packaging combines PE, PP, and PET, which are challenging to separate and contribute to environmental waste. Its lack of structural durability also increases the risk of damage during handling and storage.

These challenges drive the industry toward sustainable alternatives that maintain product quality while reducing environmental impact.

Companies are exploring mono-material packaging, biodegradable films, and advanced coatings to increase the recyclability of flexible packaging.

Innovations in Flexible Packaging

Nestlé recently developed a paper-based multi-layer flexible packaging for dry food products featuring a BVOH, PBS, PLA, or PHA polymeric layer. This layer combines a nano clay barrier and sealant to remove traditional plastics like PE or PP from packaging. This patent-pending innovation is fully recyclable and degrade in marine environments, marking a step toward sustainable packaging.

Similarly, Brawny Bear partnered with Pakka to launch India’s first Date Energy Bars in compostable flexible packaging, showcasing a growing shift toward eco-friendly alternatives.

Source: FoodTechBiz

Further, researchers are transitioning from tri-laminate to bi-laminate structures to reduce material usage and improve recyclability while lowering manufacturing costs.

Modern flexible packaging solutions also face challenges related to barrier protection, product longevity, and packaging integrity. Integrating active packaging technologies like barriers and oxygen scavengers helps overcome the flexible packaging challenges. These advancements ensure functional, cost-efficient, and sustainable packaging solutions.

Despite progress, several questions remain for innovation managers and R&D leaders. How do mono-material designs compare to multi-layer plastics in terms of cost and performance? Can biodegradable solutions replace conventional films without compromising food safety? How can companies implement these technologies without disrupting production?

Addressing these concerns will be essential for companies navigating the transition toward sustainable, flexible packaging while balancing cost, functionality, and industry regulations. An all-in-one database like Slate can help you find answers to these questions. Explore now:

Trend 5. Smart Labels Will Reduce Food Waste and Improve Safety

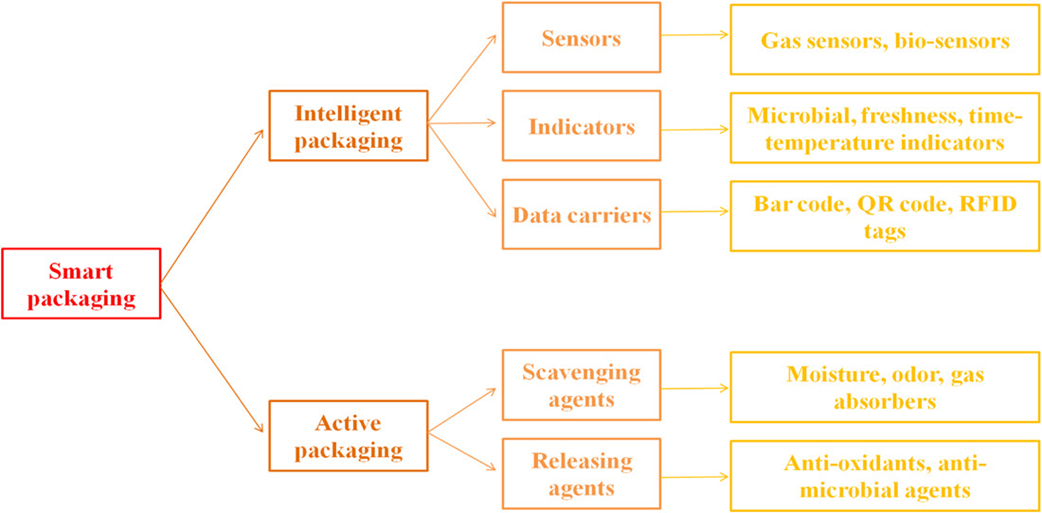

Intelligent packaging (smart or responsive packaging) enhances the traditional functions of providing protection and containment for food products by integrating technology that can monitor and communicate the quality and safety of the food. This type of packaging uses indicators, sensors, and data carriers to provide real-time data about the condition of the food or its environment.

Indicators in intelligent packaging change color or form to show whether food has been exposed to undesirable conditions, such as temperature spikes that can lead to spoilage. Sensors, more sophisticated than indicators, can detect specific substances or conditions affecting the food, such as the presence of gases produced by decomposition or the detection of pathogens.

Source: Wiley

Data carriers, such as RFID tags and barcodes, don’t monitor food quality directly but are crucial for tracking and managing the distribution and retail of food products. They help ensure the food’s traceability throughout the supply chain, adding a layer of safety by allowing recalls to be more targeted and efficient.

Innovations in Smart Packaging

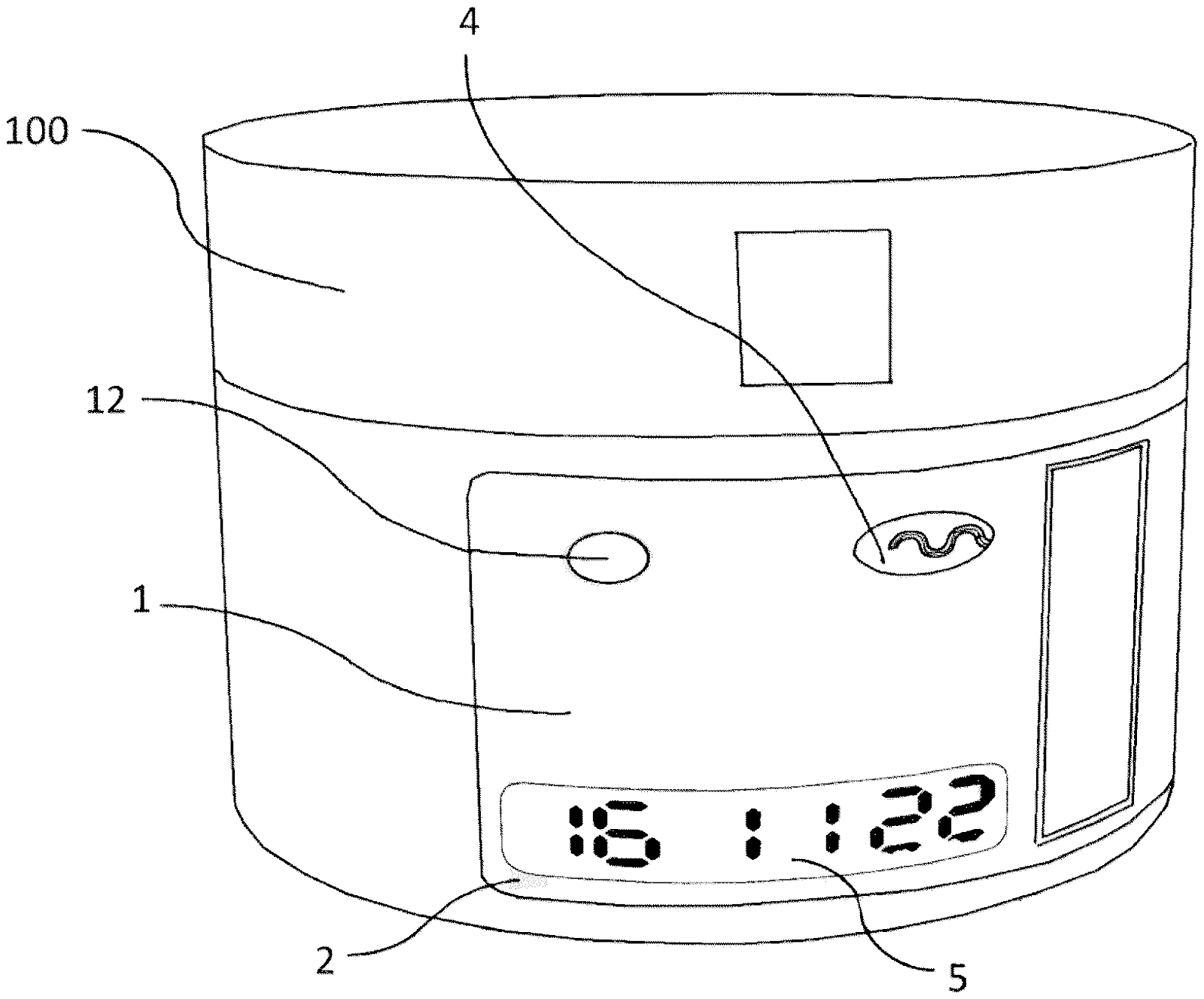

Fleep Technologies Srl (FleepTech) recently filed a patent application for a smart label device in packaging that provides information on the residual period of life of a perishable product inside. The label comprises a flexible support substrate, an electronic control unit, and a sensor to detect perishability data. It also includes a signaling unit for display and a power supply for operation. The electronic control unit processes data from the sensor to determine and display the product’s remaining life.

This innovation aims to overcome issues found in previous similar devices, such as poor mechanical flexibility, high manufacturing costs, and complex disposal requirements.

Other Innovations in intelligent packaging focus on integrating bio-based materials and natural colorimetric sensors to make packaging more sustainable.

Conclusion

The demand for sustainable food packaging is growing, but the challenges are significant. Nearly 40% of all plastics are used for food and beverage packaging, yet less than 10% are recycled globally. Only 13.3% of plastic packaging waste is recovered in the U.S., while 85% remains in landfills, oceans, or incinerators. Regulations like the EU’s PPWR and the FDA’s stricter scrutiny are pushing companies to rethink their packaging choices.

At the same time, plastic food packaging contains over 3,600 harmful chemicals linked to serious health risks, including BPA and phthalates. While brands like Nestlé and Brawny Bear are testing compostable and paper-based alternatives, many sustainable materials remain costly and difficult to scale.

Which packaging innovations balance cost, performance, and sustainability, and are they suitable for your product?

Find answers to such questions and many other challenges in GreyB’s Food Packaging Trends Report. It explores emerging materials, industry benchmarks, and market insights to help you make informed decisions.

Download the full report now by filling out the form below:

Get the Report in your Inbox

Authored By: Naveen Kumar, Marketing Research

Edited By: Nidhi, Marketing Research