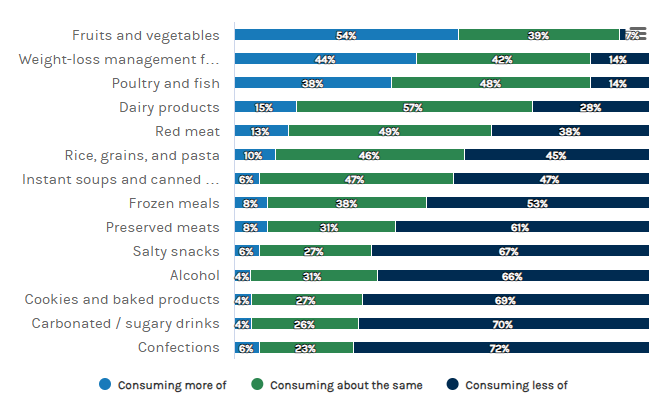

The rising use of GLP-1 receptor agonists like Ozempic and Wegovy isn’t just a medical trend; it’s also changing the landscape of the food and beverage industry.

According to a 2024 survey by Morgan Stanley Research, 59% of individuals on anti-obesity medication are drinking more tap or still water, 66% are consuming less soda and alcohol, and 38% are increasing their intake of protein beverages. Additionally, 93% of these users have reduced their portion sizes, indicating a significant shift in consumer diet trends.

These shifts in consumption patterns are forcing the food and beverage industry to adapt rapidly. Companies are prioritizing small, high-protein meals and more hydrating products to meet consumers’ evolving needs and align with the effects of GLP-1 medications.

Interested in more insights? Get access to our GLP-1 Food Landscape Report today!

GLP-1 Food Trends

Trend 1: Functional Foods with GLP-1 Properties

The trend of incorporating GLP-1 (Glucagon-like peptide-1) properties into functional foods is gaining traction as both consumers and the food industry shift toward health-oriented diets.

Foods with natural GLP-1-boosting properties, such as fiber-rich grains, lean proteins, and healthy fats, are gaining attention. They are being highlighted for their potential to mimic the effects of GLP-1 medications like Ozempic and Wegovy, primarily used for type 2 diabetes and weight loss.

Several companies are actively researching and producing foods that align with the GLP-1 properties trend. Nestlé, for example, has introduced Vital Pursuit, a brand focused on GLP-1-friendly meals that emphasize portion control and high protein content to aid appetite control and nutrition.

Through our nutrition expertise and consumer-centric approach, we identified a need for a new line of products that delivers great taste and functional benefits for GLP-1 users or those otherwise managing their weight

Kristen Stoehr, Registered Dietitian and Vital Pursuit Brand Manager

Conagra Brands has also announced an initiative, labeling select Healthy Choice meals as GLP-1 friendly due to their high protein and low-calorie makeup. These product innovations respond to the growing consumer base seeking to manage weight and improve overall well-being through dietary means.

Despite the potential, substantial obstacles hinder the mainstream adoption of functional foods with GLP-1 properties. One major challenge lies in consumer education and awareness; many consumers remain unaware of these foods’ benefits beyond traditional dieting.

Moreover, the regulatory environment for functional foods can be stringent. Companies must meet specific health claims standards, which can complicate product development and marketing. Additionally, the cost of producing nutrient-dense functional foods can be higher than traditional options, limiting their accessibility to a broader audience.

Focusing on GLP-1 properties in foods is a promising direction for supporting health and wellness. However, overcoming these barriers will be key to its success in mainstream markets. Continuous innovation and increased consumer education are essential for the widespread acceptance of these products.

Trend 2: GLP-1 Based Beverages

The emergence of GLP-1-enhancing beverages is gaining traction as a response to the rising use of GLP-1 receptor agonists, a class of drugs primarily prescribed for type 2 diabetes and weight loss management. The GLP-1 trend is characterized by the development of beverages that complement the effects of these medications by addressing their nutritional side effects and enhancing overall health benefits.

Companies like Robard are at the forefront of this trend, creating companion products focusing on functional benefits such as muscle preservation, digestive health, and hydration.

In 2024, Robard Corporation introduced Biocare®, a dietary beverage tailored for individuals using GLP-1 receptor agonists. Biocare’s patent-pending formula mitigates common side effects such as nausea, bloating, and constipation while addressing nutritional deficiencies. Each serving provides 20 grams of protein, 26 vitamins and minerals, probiotics, and prebiotic fibers. It is available in chocolate and mixed fruit flavors.

According to BevSource, notable trends in this sphere encompass high-protein shakes and hydration drinks enriched with electrolytes, probiotics, and other essential nutrients. These products are designed to cater to the specific needs of GLP-1 users, who often experience muscle mass reduction, digestive issues, and dehydration due to the drugs’ appetite-suppressing and weight-loss effects.

The adoption of these beverages over traditional options is driven mainly by the need for nutrient-dense solutions that align with the dietary restrictions necessitated by GLP-1 drugs. As these drugs can significantly reduce caloric intake—by as much as 39%—users may struggle to meet their macronutrient and micronutrient needs, making these functional beverages a valuable supplement to their diet.

However, the path to mainstream adoption of GLP-1-enhancing beverages is not without challenges. Formulating palatable and effective beverages to deliver nutritional benefits is complex, particularly given the need to mask or complement flavors associated with functional ingredients like protein and probiotics.

Additionally, the high cost of GLP-1 drugs, which can range between $900 and $1,350 per month, presents an affordability barrier, although it simultaneously motivates the search for more cost-effective dietary supplements.

Regulatory hurdles also pose a challenge, as companies must comply with strict FDA regulations regarding health claims associated with their products. Despite these obstacles, the demand for specialized nutritional solutions continues to rise, offering a promising avenue for innovation in the beverage industry.

Trend 3: Plant-based GLP-1 Agonists

Exploring plant-based GLP-1 agonists has emerged as a promising frontier in metabolic therapy. Glucagon-like peptide-1 (GLP-1) agonists, traditionally derived synthetically, are pivotal in managing type 2 diabetes and obesity due to their ability to enhance insulin secretion and promote satiety.

Recent studies are identifying plant extracts as potential GLP-1 secretagogues. Research has shown that certain bitter compounds in plants, such as ginseng and gentiana scabra, can stimulate GLP-1 secretion, suggesting their possible use as natural GLP-1 agonists.

An AI-based study identified two plant compounds with potential as GLP-1 agonist weight loss pills, reflecting a burgeoning interest in plant-based therapies.

Key players include academic and research entities like the Catholic University of Murcia, which employ high-performance computing to identify these non-peptide GLP-1 receptor activators.

However, despite the promising outlook, several challenges impede the mainstream adoption of plant-based GLP-1 agonists. First, the efficacy and safety of these compounds require rigorous clinical validation, which is time-consuming and costly.

Furthermore, the complexity of plant biochemistry presents challenges in standardizing and replicating effective active compounds for mass production. Additionally, the regulatory frameworks surrounding natural therapeutics are stringent, necessitating compliance with safety and efficacy standards that can delay progress.

The scientific community is tackling these challenges by leveraging cutting-edge computational tools to predict and optimize plant compound interactions with GLP-1 receptors.

Yet, the transition from laboratory research to clinical application remains a bottleneck, necessitating concerted efforts in interdisciplinary collaboration and innovation in drug delivery systems to maximize the therapeutic potential of these natural compounds.

Trend 4: Personalized Nutrition based on GLP-1

The trend of personalized nutrition plans for GLP-1 optimization revolves around integrating tailored dietary strategies with GLP-1 receptor agonists (GLP-1 RAs), a class of drugs primarily used for managing type 2 diabetes and obesity. These drugs mimic the GLP-1 hormone, which is essential in blood sugar regulation and appetite control.

The growing interest in personalized nutrition for GLP-1 optimization stems from the need to maximize the therapeutic outcomes of GLP-1 medications, minimize potential side effects, and promote sustainable weight management.

Personalized nutrition plans are particularly valuable as they consider individual dietary preferences, health goals, and potential metabolic responses to GLP-1 medications.

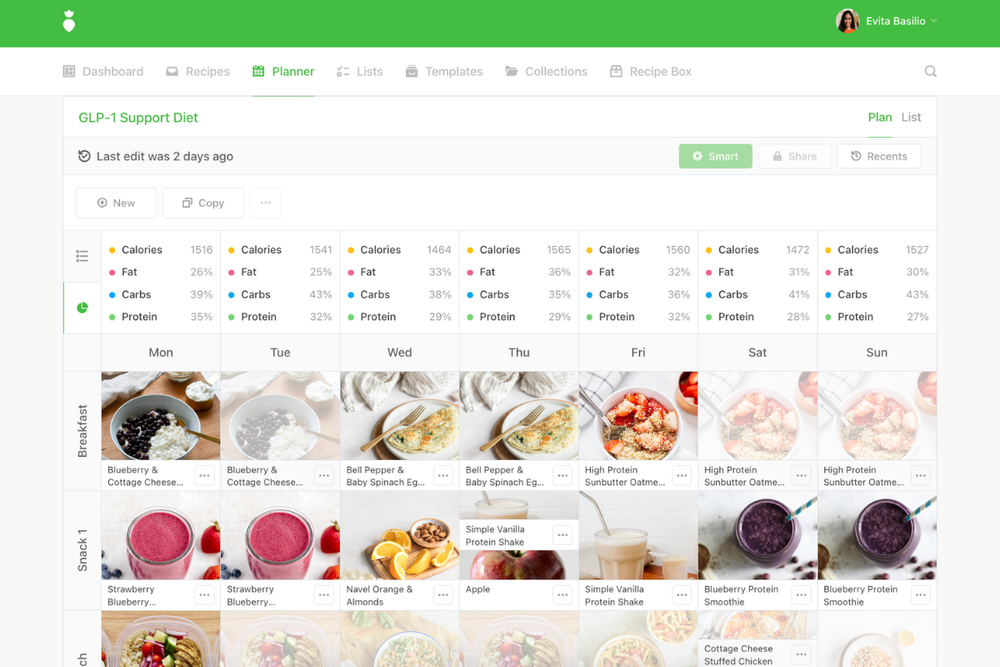

According to That Clean Life, a company that offers customized diet plans for clients using GLP-1 medications, dietitians are essential in crafting nutrition strategies that align with these medications’ appetite-suppressing effects.

Their involvement ensures clients maintain a balanced diet rich in essential nutrients despite reduced caloric intake due to appetite suppression. This approach helps prevent nutritional imbalances and supports overall health and weight loss goals.

The company has even developed templates specifically for clients on GLP-1 medications. These evidence-based templates allow dietitians to create individualized nutrition plans that are consistent in quality and tailored to meet specific client needs.

However, the widespread adoption of personalized nutrition plans for GLP-1 optimization faces several hurdles. One major challenge is the accessibility and affordability of these services, which often require the involvement of healthcare professionals like dietitians, whose services may not be covered by insurance.

More comprehensive research is needed to establish standardized guidelines for integrating nutrition with GLP-1 therapies.

Another barrier is the pharmaceutical industry’s physician-centric nature. The sector may overlook dietitians’ critical role in optimizing patient outcomes with GLP-1 medications.

Food Tech Trends Report

Download ReportHow Companies are Strategizing for Introducing New GLP-1 Food Products?

1. Launch of New Product Lines

Nestlé launched the “Vital Pursuit” line of food intended to be GLP-1 companion food.

In May 2024, Nestlé launched “Vital Pursuit,” a range of foods designed to complement GLP-1 weight loss medications. The products include frozen meals such as whole grain or protein pasta bowls, sandwich melts, and pizzas, each priced at $4.99.

These portion-controlled meals are packed with essential nutrients like protein, vitamin A, potassium, calcium, and iron to compensate for the reduced food intake caused by the medication.

“Over the past several years, we have been expanding choices across our meals portfolio to address consumer eating habits, and as the market evolves, we’ll continue to expand Vital Pursuit with more product formats for our consumers.”

– Tom Moe, President, Nestlé USA Meals Division

Other companies, including Conagra, Daily Harvest, and General Mills, are also entering this segment, either launching or planning to launch similar products.

2. Using existing ingredients to explore the effect on GLP-1

Arla is testing whey-based ingredients for Insulinotropic and glucagonotropic effects

Among dairy companies, Arla Foods has been filing patents on whey and different whey-based ingredients for diabetes and weight management via GLP-1. Collaborating with universities in Denmark and the UK, they tested whey protein hydrolysates, beta-lactoglobulin, and other whey-based ingredients targeting GLP-1 levels.

Currently, Arla is selling its ingredients as food for special medical purposes for diabetes patients. However, its patent mentions – “glucagon has been shown to increase energy expenditure, and therefore we believe that BLG (beta-lactoglobulin) may have positive effects in weight management.”

This indicates that Arla can also venture into weight management using its whey-based ingredients.

3. Converting non-food ingredients into GLP-1 companion ingredients

Nagase Viita transforms cosmetic ingredients into food ingredients for GLP-1

Japanese company Nagase Viita Co., Ltd. (formerly Hayashibara Co) has innovated using glycosyl naringenin, terpenes, and terpenoids to promote GLP-1 secretion.

Currently, Nagase Viita offers the glycoside form (Glucosyl Naringin) as a cosmetic ingredient for anti-aging purposes. They have also developed a technology to extract it from citrus fruits.

Given its presence in the food ingredient sector, the company might also explore opportunities in the GLP-1 market with these innovative ingredients.

4. Repositioning existing SKUs as GLP-1 companion products

Beyond new product launches, companies are also repositioning existing products to target GLP-1 users.

The vitamin and dietary supplement chain GNC faced long-standing challenges. In 2024, it repositioned its product line to cater to people taking GLP-1 drugs for weight loss, hoping to attract customers and grow its business.

In its 2,300 U.S. stores, GNC has dedicated sections for vitamins, protein shakes, and supplements tailored to GLP-1 medication users. They also train employees on common GLP-1 side effects and appropriate products.

Other companies like Nestle are also betting on their existing product lines to target GLP-1 users.

Meeting the vitamin and gut health needs of GLP-1 patients is also a consideration. Credible brands like Pure, Solgar, Garden of Life, and Nature’s Bounty give us a strong shelf presence. They deliver both vitamins to mitigate any gaps from reduced food intake, and fiber, probiotics, and prebiotics that help with potential gastric discomfort and constipation side effects. And importantly, these brands have also helped us build a credible relationship with healthcare professionals, key partners in solving these challenges for GLP-1 patients.

Mark Schneider, Nestle CEO

Recent Trends in Food & Beverage

Future Outlook

Companies are adopting diverse strategies, from launching new product lines to utilizing existing ingredients and repositioning current products to cater to the growing GLP-1 companion food market.

As this market continues to evolve, companies that can effectively align their product offerings with the unique needs of GLP-1 users are likely to thrive. A deeper research can help F&B companies capitalize on this emerging opportunity, contributing to better health outcomes and securing a substantial market presence.

Talk to our experts and get a detailed landscape study tailored to your needs!

How Can We Help You?

We support industry-leading R&D and Innovation professionals through complex problems. Describe your challenge, and let us bring clarity and expertise.