While 5G is still being developed and implemented, the 3GPP has already initiated discussions on 6G technology. Given the transformative impact of 5G across various industries, 6G innovation will extend far beyond telecommunications. This expanding scope attracts active involvement from companies outside the traditional telecom sector.

Companies should anticipate a broader range of intellectual property challenges and opportunities in this dynamic course. Failing to participate in the standardization discussions and delaying adoption might lead to potential legal action in the future. On the other hand, as market potential grows, so will the associated fees for licensing the technologies, depending on the Smallest Saleable Patent Practicing Units (SSPPUs).

This article stresses the importance of active participation in high-tech discussions to identify key technologies and offers real-world cases to illustrate the repercussions of inaction.

Learning from Nokia V. Daimler: Why Non-Tech Companies Need to Invest in 6G Technology Now

Examining industry-wise degrees of contributions highlights that non-core entities are increasingly entering the hi-tech domain. Traditionally dominated by core telecom or video streaming companies, the 5G and video codec contributor landscape now includes automotive giants like Daimler AG (Mercedes-Benz), Toyota Motor Corporation, and Hyundai Motor. Compared to core companies, the contributions from automotive companies are so low that we can easily strike these down as outliers. However, in the long run, early adoption is a smart choice. The Nokia vs. Daimler dispute was a wake-up call for the automotive companies.

Daimler (Mercedes-Benz Group) rejected Nokia’s licensing proposition twice on their telecom SEP portfolio, failing to express willingness to comply with a FRAND license. Daimler wanted to engage directly with the Telematics Control Units (TCUs) manufacturers instead of Nokia. Three years later, when Daimler’s market share was soaring, Nokia filed a lawsuit against the German Car Shark.

Despite counter offers from Daimler and a protracted legal battle, the court ultimately ruled in favor of Nokia in 2021.

This case highlights a crucial point: connectivity is becoming increasingly central to automotive advancements. As a result, technologies like 6G, WiFi-8, and VVC will significantly impact connected vehicles, autonomous driving, and vehicle-to-cloud systems. Companies who fail to invest in understanding and potentially contributing to these innovations risk facing similar legal challenges in the future.

Kia Gearing up for 6G and VVC Next-Gen Innovations

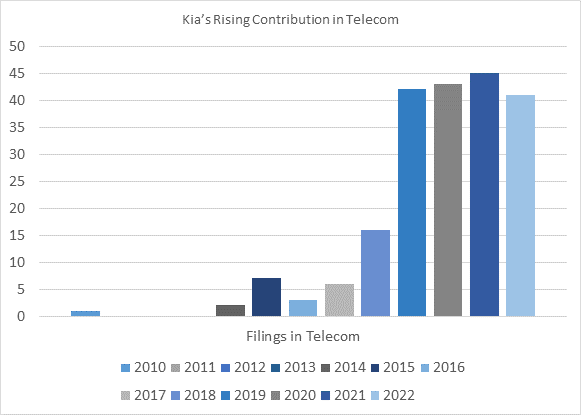

The study shows that South Korean automobile manufacturer Kia—a subsidiary of Hyundai, has been ramping up its innovation arsenal. It has increased participation in discussions of telecom and video codec standard evolution and patent filings. It has been found that Hyundai and Kia have recently collaborated with 11 local universities to work on vehicle electrification. Some of these universities include Seoul National University, Korea Advanced Institute of Science & Technology, and Chungnam National University.

In addition to establishing centers for emerging research concepts, these collaborations with local universities have supported the patent program. Hyundai and Kia have jointly filed patents and proposals for standard development in the high-tech sector in partnership with these universities. They have also contributed to developing V2X with NR through mobility enhancements, SL-RSRP measurements, sidelink resource allocation, and more.

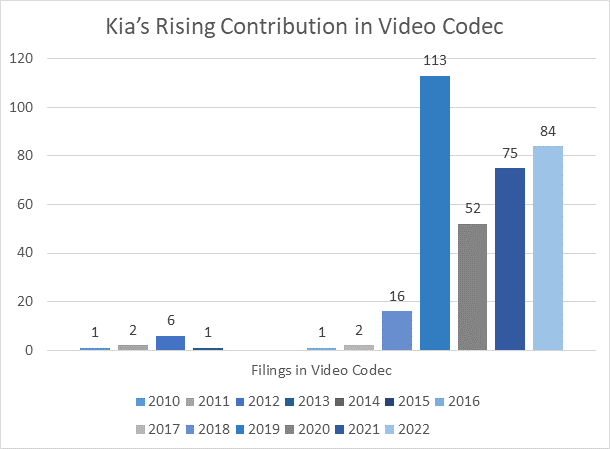

Next-generation technologies aren’t just about 6G. Kia has also adopted various video codec technologies like HEVC, AV1, WMV-9, etc. It is constantly adding to its existing video coding portfolio with additions on cross-component prediction, intra-prediction, entropy coding, etc.

It aims to increase coding efficiencies and arm its coding innovations with artificial intelligence, marking the speedy development of Heads-up Display systems, built-in infotainment systems, driving alarms, etc.

The company has been equally active in securing innovations for self-driving vehicles, driver assistance systems, enhanced infotainment, etc. A few exemplary filings include US20230291926A1 (video prediction network), US20230410374A1 (Point Cloud Compression), US11516478B2 (Coding Feature Maps), etc. Snippets of these innovations could be visible in the face of the standards in the coming period.

Conclusion

Similar to 5G, Kia is now actively filing patents in areas such as video compression and data transmission. This marks a 50% increase compared to non-automotive firms. More automotive companies will follow suit as discussions around 6G are underway. This is predictable due to the transformative potential of 6G, WiFi-8, and VVC next-generation technologies across various industries.

While previous technology versions reach full implementation, a window of opportunity exists to claim a stake in these “gray spaces.” This is especially important for companies involved in cloud development, underwater communication, satellite technology, and health tracking. Read more about the 10+ crucial 6G enabling technologies and their impact on your industry.

Fill out the form below for a personalized strategy to leverage 6G Technology, WiFi-8, and VVC to achieve market dominance.

Authored by: Raima Ghosh, Aman Kumar, and Supreet Kaur, Prior-Art Team

Edited by: Annie Sharma