Ask anybody who has ever even thought about filing a patent application for their invention: In which country would you want to protect it? Most likely, their answer would be the US, or China — besides their native country, probably. In fact, statistically, we have had these two countries floating as the top markets for almost all of the domains — be it the emerging technologies like Blockchain or Internet of Things, or eye-catching domains like FinTech or Packaging.

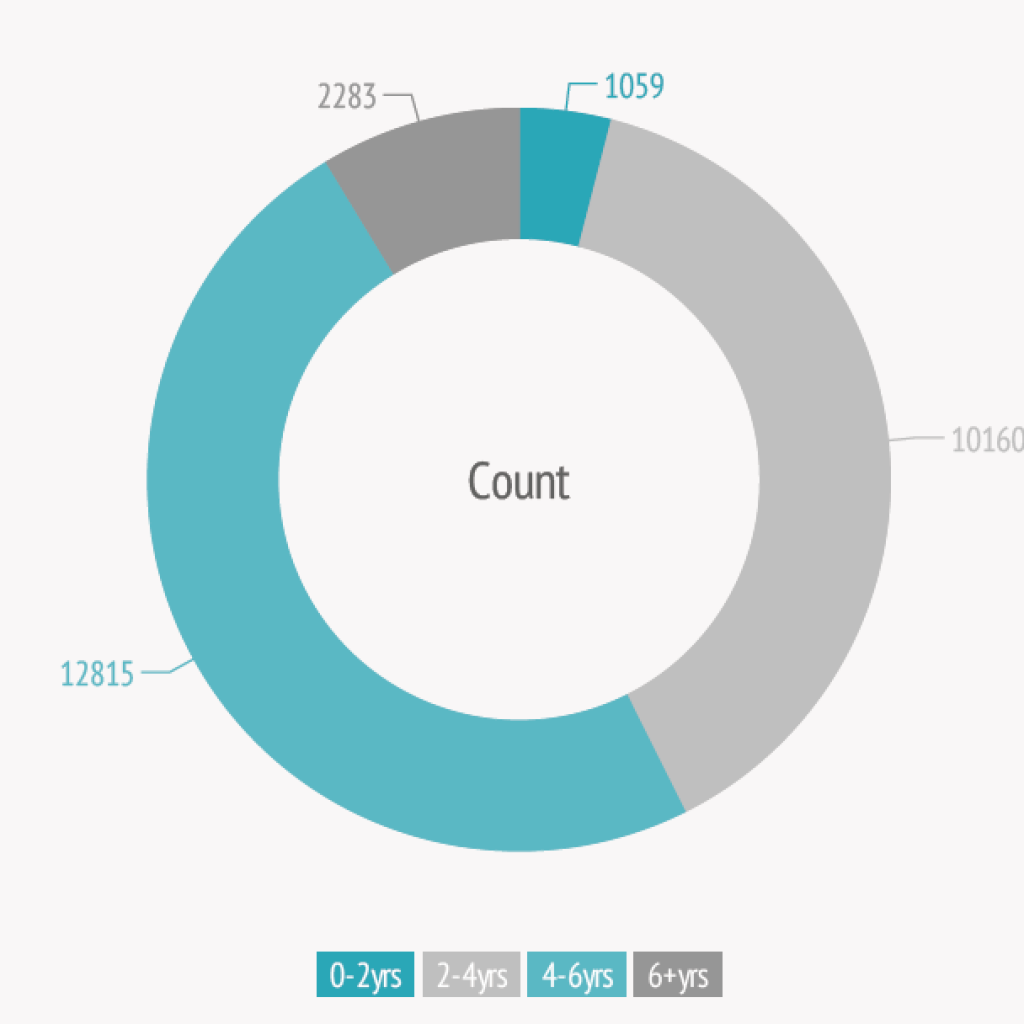

From our analyses of the last decade (2009–2019), we noticed that ~70% of Blockchain patents and 50% of FinTech patents were filed in the US and China. Thus, it seems like most in-house patent counsels and patent attorneys look to these nations while filing patents.

Furthermore, if we look at the globe from even higher above, the other jurisdictions that gather the most attention include Europe, Japan, Korea, and another most-favorite pathway: the PCT route. If we include these jurisdictions/pathways, too, the numbers rise to as high as 80% patent filing here for FinTech and 50% for the packaging domain. And these stats are high (!) considering the count of countries in the whole wide world.

However, in a number of our recent analyses, we noticed a trend: Certain seemingly lesser-known, tail-end countries begun appearing more and more — not at the top, but they were certainly there, increasing. So, we scrutinized the data.

And we filtered out the top tail-end countries that should certainly be considered by in house patent counsels and patent attorneys for protecting inventions. Else, the stakeholders risk losing a potential market share and growth opportunities waiting to be tapped in those jurisdictions.

For this piece, we have majorly focused on potential jurisdictions for FinTech and packaging domains.

The Philippines

This archipelagic country has witnessed a great rise in patent filing in a number of domains over the recent years. Particularly, the packaging domain saw a radical shift in patent filing in the year 2014 — back then, the number of patents filed grew 5 times (from ~20 in 2013 to ~100 in the year ahead).

One major reason for this growth can be attributed to the impact of its rapidly growing F&B industry, which is indirectly affecting the growth of IP protection for related packaging inventions. According to Your IP Insider, the consumers here are becoming more influenced by the way the products look.

In fact, these market factors seem to have provoked several big-shots like Nestle, Proctor & Gamble, Colgate-Palmolive and Mondelez International for protecting their packaging inventions in the Philippines; majorly since 2013. Further, foreign companies like Omya, which operates with a packaging vertical, has been constantly filing patents in the Philippines in the very recent years.

Now, although the number of filings is less, the consistency shows the company’s growing interest in this geography. Further, even the native universities seem to be researching on packaging actively.

About FinTech: although less in number, the market here has been witnessing increased patent protection since 2013. Notably, it seems like players like nChain Holdings and Alibaba have been able to observe the potential here already and filed patents in the very recent 2018.

Hong Kong (S.A.R)

Hong Kong, a world financial center, has shown an ever-increasing trend in patent filing from 2012 in both the packaging and FinTech domains. This can be attributed to their Business of IP Asia Forum (BIP Asia Forum), which was initiated in 2011 and is being held annually since then.

Besides this, there are a couple of Chinese initiatives that are fueling the innovation potential of the region; this includes the Greater Bay Area development and the Belt and Road initiative. Per this source, these are meant to provide Hong Kong with major opportunities to serve as an IP trading hub.

In the packaging domain, the area has witnessed humongous rise in the number of patents filed in the last decade. Moving from 2011 to 2016, the patent filing has grown by 95% to reach about 350. And in case of FinTech, while the increasing numbers appear less, the government seems keen to attract more start-ups.

One such initiative is Cyberport: the FinTech hub of HK, which has garnered more than 300 start-ups and companies to nurture the selected ones with financial assistance. Talking about the known companies, Alibaba seems to have found the market attractive and has increased patent filing in Hong Kong in the recent years. Some major companies include financial services providers like MasterCard, HSBC, VISA, Square and Tencent Tech Shenzen, as well as names like Microsoft and Nokia.

Furthermore, only recently, Apple has been on a streak for winning design patens in the region. PatentlyApple here shows a glimpse of the same. Such happenings showcase the way Hong Kong is being witnessed by the biggest of companies.

Taiwan

Over the recent years, it has become the growing hub for FinTech startups. From our analysis, we have noticed its ever increasing trend of FinTech patents from 2013, with almost 3 times increase when moving to 2017 (to 150+ and counting patent filings). Some major engines for this rise are government-backed: for example, the E-Payment Act and E-Payment Rules (as described here). Such FinTech promotion programs have facilitated the growth and can interest international markets to expand in Taiwan.

Interestingly, banks seem to be quite innovation-oriented in the recent years and top the list of patent filers — including Land Bank of Taiwan and CTBC Bank. Rest, companies like Alibaba and nChain Holdings have also increased patent filings in the region. Other key players considering this geography include Apple and Tencent Tech Shenzen.

Singapore

This Southeast Asian country has seen an increase in FinTech patents from 2013 to 2017. The major reasons seem to be the different steps taken by Monetary Authority of Singapore (MAS), including include investment of a gigantic $225 million under the Financial Sector Technology & Innovation (FSTI) scheme, launch of the FinTech and Innovation Group (FTIG) and the FinTech Office, creation of a FinTech regulatory sandbox (which enables different financial institutions as well as non-financial players to experiment with FinTech solutions) (Source). Moreover, in 2018, the FinTech Fast Track (FTFT) initiative was launched by the government to expedite the application-to-grant process to as fast as 6 months (Source).

Major players in the market like MasterCard International, Alibaba, Nchain Holdings Ltd. and Visa International have already started filing patents in Singapore and show an increasing trend during 2015–2017. Companies like Hitachi, Amazon, and American Express have also considered Singapore as an attractive FinTech market and own few patents there.

Israel

This Middle Eastern country has witnessed a constant increased patent filing in packaging over the last decade, with an average of a 100 patents a year. And in case of FinTech, the country has always been in buzz — considering the huge number of FinTech start-ups here (~500 currently).

In fact, as per this source, Israel is being considered as a great testing ground for startups that want to make sure that their technology works properly before they launch it in some bigger country.

It seems like nChain Holdings is aware of the growing Israeli FinTech market and hence has been protecting its innovations there in the recent years. In fact, Facebook, HSBC and Citi Bank have also been considering this as a potential market.

Other Tail-End Countries

Apart from these, a few other tail-end countries including Vietnam, Turkey and Indonesia, have seen decent increases in patent filing for FinTech over the recent years, along with government support. Interestingly, big players like Hitachi, MasterCard International, Samsung and Sony have already started filing in these countries.

With respect to packaging industry, Croatia looks eye-catching, with an increasing patent filing trend ahead of 2014. And not just packaging, the European government has launched a Smart Specialization Strategy to focus supporting R&D projects.

Looking at these stats and the considerable number of initiatives in these regions, we believe that several tail-end countries hold a lot of untapped potential and market opportunities. These should definitely be considered as a candidate for protecting any innovation.

Authored by: Priya Vashishth, Senior Research Analyst (Patent Analytics) and Sneha Banerjee, Research Analyst (Patent Analytics).