In the USA alone, almost half of the population, around 133 million people, suffer from atleast one chronic disease, and this number continues to increase. Consequently, there has been an increase in research efforts by R&D to enhance chronic disease management.

However, creating new therapeutic drugs requires extensive financial investment, multi-disciplinary expertise, robust infrastructure, and the ability to run large-scale clinical trials effectively.

As top blockbuster drugs approach patent expiration, strategic ANDA filings are critical to secure early mover advantage. Download the Pharsight Digester report now for a deep dive into the patent strategies of the top 5 blockbuster drugs nearing expiration.

Over the past three decades, about one-fifth of drugs in development—or the companies developing them—have been acquired by another pharmaceutical company.

A study by the Congressional Budget Office

Pharma companies increasingly turn to partnerships and collaborations to pool resources and capabilities to take on such large-scale, high-risk projects. As a result, choosing the right partner becomes absolutely essential for success.

This article explores key strategies pharma companies should employ when evaluating and selecting collaboration partners for drug development.

Factors to Evaluate Your Potential Partners

Recent ANDA Filings

Companies that have successfully filed ANDAs for specific drugs showcase their regulatory expertise in this therapeutic area.

Partnering with such organizations can expedite the regulatory approval process, as they have experience navigating the intricacies of drug approvals and can provide valuable guidance to ensure compliance and efficiency.

Market Presence

A company’s market presence often signifies its experience in bringing drugs from development to commercialization.

Partnering with such a company can provide valuable guidance on market entry strategies, marketing campaigns, and post-launch activities, optimizing the commercial success of the drugs.

Acquisitions and Collaborations

Examining a company’s collaborations and acquisitions helps understand their strategies for market expansion.

For example – Partnering with companies that have successfully entered new markets or expanded their presence in the diabetes therapeutic area can offer valuable market entry insights and potential global reach.

Shift in company’s focus

Companies that have previously concentrated on a specific disease area tend to accumulate specialized resources and expertise in that field.

For example – A company’s shift of focus from diabetes can raise questions about whether it still possesses the necessary resources, knowledge, and experience to contribute effectively to anti-diabetic drug development.

Statements by CEOs

Future-oriented statements often reflect a company’s long-term vision and commitment to certain therapeutic areas.

Suppose a CEO’s statements indicate a short-term focus or a lack of interest in long-term involvement in anti-diabetic drug development. In that case, it may act as a discouragement to potential partners seeking enduring collaborations.

Ranking the companies based on these strategies

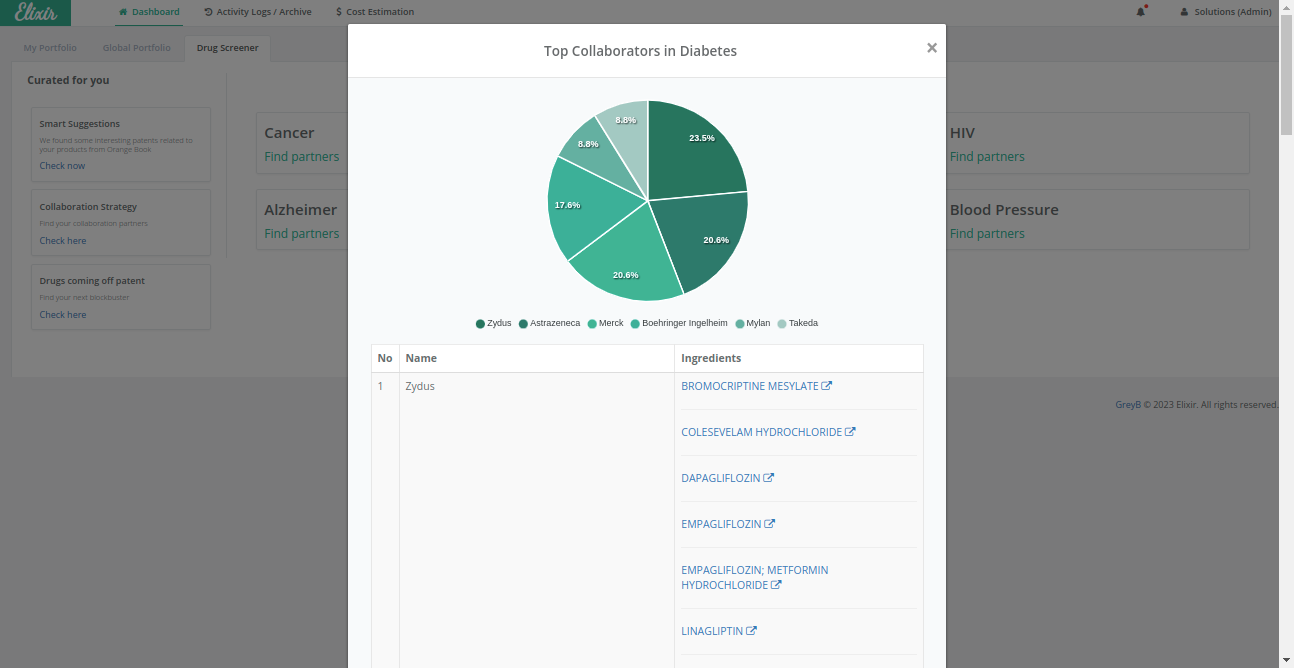

With diabetes afflicting over 463 million people globally and projected to increase up to 51% by 2045, the race is on to develop novel medications to help patients better manage this chronic condition.

Based upon the strategies discussed above, we grouped companies into three categories, i.e., high-, mid-, and low-ranked companies.

High-Ranked Companies

| Company | ANDA Filings In Last 5 Years In Anti-Diabetes Domain | Rank | Market Study [News, CEO Future Statements, Mergers And Acquisitions] | Rank | Do They Have In-House Capabilities In Developing Biologics/Biosimilars Or Not? |

| ZYDUS PHARMS | 8 [BROMOCRIPTINE MESYLATE | PREGABALIN | LINAGLIPTIN | METFORMIN HYDROCHLORIDE | DAPAGLIFLOZIN | EMPAGLIFLOZIN | ICOSAPENT ETHYL] | High | 2020 – Drug firm Zydus Cadila has received tentative nod from the US health regulator to market generic Empagliflozin tablets, used for improvement of blood sugar control in adults with type 2 diabetes in the American market. | Mid | Yes |

| SUN PHARM | 3 [PREGABALIN | SAXAGLIPTIN HYDROCHLORIDE | METFORMIN HYDROCHLORIDE] | High | 1. In 2023, GL-0034 is under clinical development and in Phase I for Type 2 Diabetes.2. In 2021, sun pharma has acquired the rights to trademarks of diabetes drug Dapagliflozin under brand names Oxra, Oxramet and Oxraduo from AstraZeneca, and also it has taken a patent license to manufacture and commercialize Dapagliflozin. | Mid | Yes |

These companies are the top potential partners for creating new anti-diabetic drugs, especially those soon to be off-patent, like Semaglutide and Empagliflozin.

Want to identify more such partners? Talk to our experts

Mid and Low-Ranked Companies

| Company | ANDA Filings In Last 5 Years In Anti-Diabetes Domain | Rank | Market Study [News, CEO Future Statements, Mergers And Acquisitions] | Rank | Do They Have In-House Capabilities In Developing Biologics/Biosimilars Or Not? |

| SCIEGEN PHARMS INC | 1 [PREGABALIN] | Low | Received ANDA Approval for Metformin Hydrochloride Extended-Release Tablets, USP 500 mg and 1000 mg in 2016 | Low | Yes |

| TEVA PHARMS | 1 [ICOSAPENT ETHYL] | Mid | 2017 – Teva Pharmaceutical Industries Ltd., (NYSE and TASE: TEVA) today announced the launch of generic Glumetza®1 (metformin hydrochloride extended-release tablets), 500 mg and 1000 mg, in the U.S;2016 – Teva Settles Patent Litigation with AstraZeneca Allowing Teva to Commercialize Its Generic Version of Byetta® (Exenatide Injection) in the United State. The settlement allows Teva to commercialize its generic version of BYETTA® (exenatide injection) in the U.S. beginning October 15, 2017 or earlier under certain circumstances. All other terms of the agreement are confidential.Teva is now more into IBS and collaborated with Sanofi on this. | Low | Yes |

The low-level company discussed here has shifted its focus to other areas, like agents for irritable bowel syndrome (IBS). Therefore, waiting before approaching these companies for anti-diabetic drug production is advisable.

Conclusion

Choosing the right collaborator can be tricky, with many factors to consider. Evaluating each option thoroughly can be a little time-consuming.

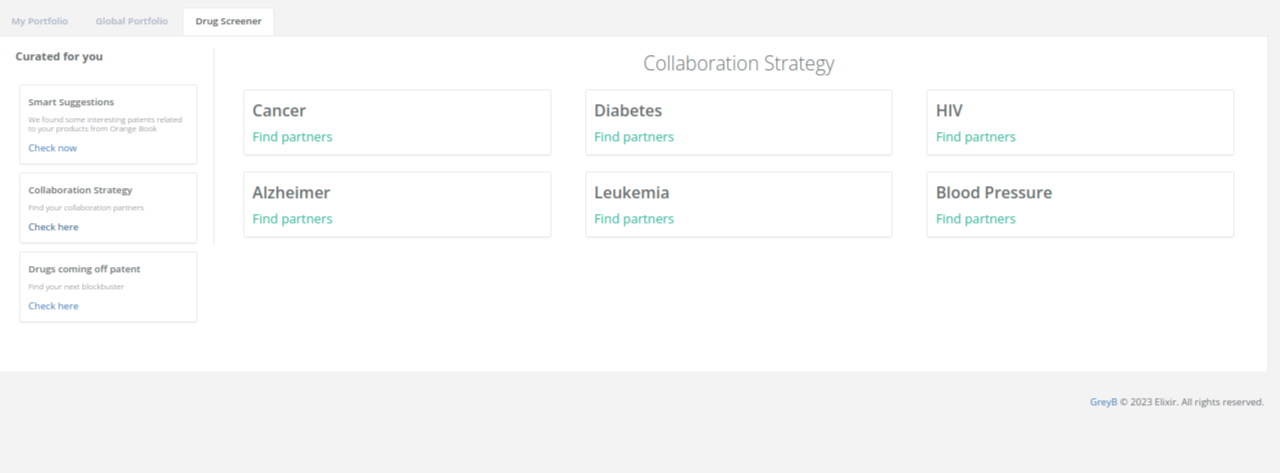

That’s where Elixir comes in.

You can explore collaboration opportunities for various diseases, offering a comprehensive approach to pharmaceutical partnerships.

How? See it for yourself!

Elixir’s advanced analytics make it easier for pharma and biotech companies by delivering the latest the required search data in under 1 second. This efficient process streamlines your research and saves over 90% of your time for each therapeutics research.

Book a demo and get hands-on experience with the tool today!

Authored By – Smiksha Sood, Product Development

Edited By – Ridhima Mahajan, Marketing

Also read – Lead the generic drug market with this one effective strategy