Disney’s annual revenue in 2023 was more than Paramount and Warner Bros put together!

Statista reports that in 2023, the entertainment giant held the highest domestic market share of ticket sales among American movie studios, with a total of 30.2%. The biggest revenue source was its entertainment segment, which generated revenues of over $40 billion.

This company’s name is synonymous with iconic family entertainment works for all ages. Although unorthodox, Disney’s business and growth strategy has proven its effectiveness through its spectacular success and industry dominance over the last hundred years. It’s among the top 10 global companies in terms of brand value!

I believe three businesses will drive the greatest growth and value creation over the next five years. They are our film studios, parks business, and streaming, all inextricably linked to our brands and franchises.

– Bob Iger, CEO of Walt Disney Co.

This report will explore Disney’s business strategy, growth tactics, and other notable takeaways from its franchise operations.

To download this entire report as a PDF, please fill out the simple form below.

How does Disney make money?

Disney’s revenue primarily comes from its media and entertainment business, parks, IP licensing, and royalties. Let’s discuss these in more detail below.

Media and Entertainment

This is the company’s most valuable business segment, earning over $55 billion in 2022. Furthermore, it generated $14 billion in the third quarter of 2023. This sector includes streaming services, linear networks, revenue from content sales, and licensing.

1. Disney’s various TV Networks

Disney owns several influential networks, notably the Disney Channel, ESPN, National Geographic, and ABC television, and it has a 50% share in A+E Television Networks.

But since 2021, Disney has cut down their network TV portfolio, focusing heavily on direct-to-consumer streaming channels instead. They’ve shut down over 100 networks in the last five years, but their larger channels still netted $6.69 billion in Q3 2023 with minimal investment.

2. Disney Streaming Services

Despite suffering some revenue losses on Hotstar, Disney earned $5.5 billion through its online streaming services last quarter. Its subscriber base is growing, with outlets like ESPN+ and Hulu gaining approximately 73.5 million paying customers.

The majority of Disney+ revenue is derived from subscription fees. In addition, Disney+ Hotstar generates advertising revenue, and Disney+ generates Premier Access fees.

Disney is betting big on streaming, planning to spend up to $16 billion per year on content for 2024. However, they’re not seeing a significant return on their investments yet, so the linear networks business is still around.

Streaming is the company’s long-term plan, but for now, its entire media entertainment division cannot solely depend on this.

Recommended reading: How Disney is competing with Netflix

3. Disney’s Revenue from Licensing and Content Sales

This income source includes royalties from licensing and intellectual properties. According to License Global, Disney is among the top 10 licensing companies globally, stacking over $61.7 billion in retail sales revenue in 2022.

Its content sales wing sells or licenses Disney film and television media to third-party TV and subscription streaming services. Additionally, the company provides staging and licensing of live entertainment events worldwide and post-production services through Industrial Light & Magic and Skywalker Sound. Furthermore, Disney holds a 30% ownership interest in Tata Sky Ltd., an India-based direct-to-home satellite distribution operator.

Parks and Live Event Experiences

Disney earned $29 billion from their theme parks in 2022, a significant jump of $12 billion from the year prior. These revenues were combined contributions of Disney’s theme parks and resorts in Florida, California, Hawaii, Paris, Hong Kong, and Shanghai.

Most income comes from selling theme park admissions, food & beverages, and branded merchandise.

Disney’s Most Notable Acquisitions

1. Capital Cities/ABC

Disney made its first multi-billion-dollar acquisition in 1995 by spending $19 billion on Capital Cities/ABC Inc., gaining rights to several networks, such as ABC.

Furthermore, they got an 80% stake in ESPN, a joint stake in Lifetime Entertainment Services, a minority stake in A&E Television Networks, and a limited partnership stake in Walt Disney Television.

The acquisition empowered Disney to tackle Netflix through Live content and sports. Even today, ESPN is a gold mine for Disney with ESPN-related cable networks and the streaming platform ESPN+. It is a household name among sports fans.

2. Fox Family Worldwide

Fox struggled with declining viewership at the time. Unable to keep up, Fox Family was sold to Disney for $5.3 billion in 2001. With this acquisition, Disney gained a foothold in 81 million homes, making it the company’s second most-viewed cable station. The channel was subsequently rebranded as ABC Family, proving to be a strong platform for Disney’s content.

Disney’s then-CEO Michael Eisner said it is nearly impossible to build or buy a network with Fox Family’s reach today. This subsidiary has since been amalgamated into the Walt Disney Television group named Freeform in 2016.

3. Pixar

In 2005, Disney acquired Pixar for $7.4 billion. Pixar was already a recognizable name in the industry, having produced successful animated movies like Toy Story and A Bug’s Life.

Pixar was the first acquisition by Bob Iger as CEO, and it was an expensive one. Disney Animation Studio wasn’t working well, and Disney had a joint venture with Pixar to co-produce Pixar’s films. Upon a disagreement on distribution rights, both companies were on the verge of ending the deal.

Iger had to convince Steve Jobs to proceed with this acquisition. Post-acquisition, Steve Jobs became a member of Disney’s board and the company’s largest shareholder.

Pixar was a colossal success for Disney, especially for its animation Studio. Pixar has released almost 17 movies after the acquisition, and most of these movies performed well at the box office. In the list of top 10 highest-grossing animated films ever, four movies were developed by Pixar.

Pixar further helped improve Disney Animation Studio, producing all-time classics like Frozen, Frozen 2, and Zootopia.

4. Marvel Acquisition

Disney acquired Marvel in 2009 for $4.4 billion. Through this acquisition, the company got the right to Marvel’s 5000+ characters. The year before Disney acquired them, Marvel reported net sales of $676.2 million. Under Disney’s wing, Marvel has grown into one of the top 10 media franchises, with an estimated total revenue of $35 billion.

After the release of Disney+, Marvel planned to advance the story into a TV series. In January 2021, Marvel released Wandavision, its first TV series as a Disney+ original, to commence Phase 4.

More recently, Marvel has released shows like Ant-Man and the Wasp: Quantumania and Guardians of the Galaxy Vol. 3 in 2023, among others. Those two titles were commercial hits, grossing over $1.3 billion in box office revenue globally.

5. LucasFilm

Disney often goes against the norm by acquiring certain media franchises simply because people love them. LucasFilm’s acquisition in 2012 got Disney access to timeless classics like Star Wars and Indiana Jones.

Star Wars was an iconic and undeniably successful franchise even before Disney. It is the fourth highest-grossing media franchise of all time, with an estimated revenue of $46.7 billion. Their merchandise sales alone generated $29 billion in revenue.

Star Wars: The Force Awakens was the 3rd movie to gross over $2 billion at the box office. Star Wars’ “The Mandalorian” is the first original Disney+ series released for the platform. The series became an instant success, prompting Disney to release the second season within a year.

In the future, Disney has planned to release seven more Star Wars live-action series and two animated series for its platform. An Indiana Jones film is set to arrive on Disney+ in December 2023.

6. 21st Century Fox

This is one of Disney’s biggest acquisitions, costing $71.3 billion. Disney now owns 20th Century Fox film and TV studio, U.S. cable/satellite channels such as FX, Fox Networks Group, a 73% stake in National Geographic Partners, Indian television broadcaster Star India, and a 30% stake in Hulu.

This acquisition helped Disney by providing content for Disney+, giving it ownership of Hotstar, and increasing its stake in Hulu from 30 to 60%.

In October 2019, AT&T sold its 9.5% Hulu share for $1.43 billion, and Comcast agreed to sell its remaining 33% stake to Disney by 2024 and became a silent partner until then. Thus, Hulu became a subsidiary of Disney.

Furthermore, by acquiring Fox Media, Disney reserved the rights for more Marvel characters such as X-Men, Deadpool, Fantastic Four, etc. The company could utilize these characters to make the MCU franchise bigger than ever.

Disney’s Patent Strategy

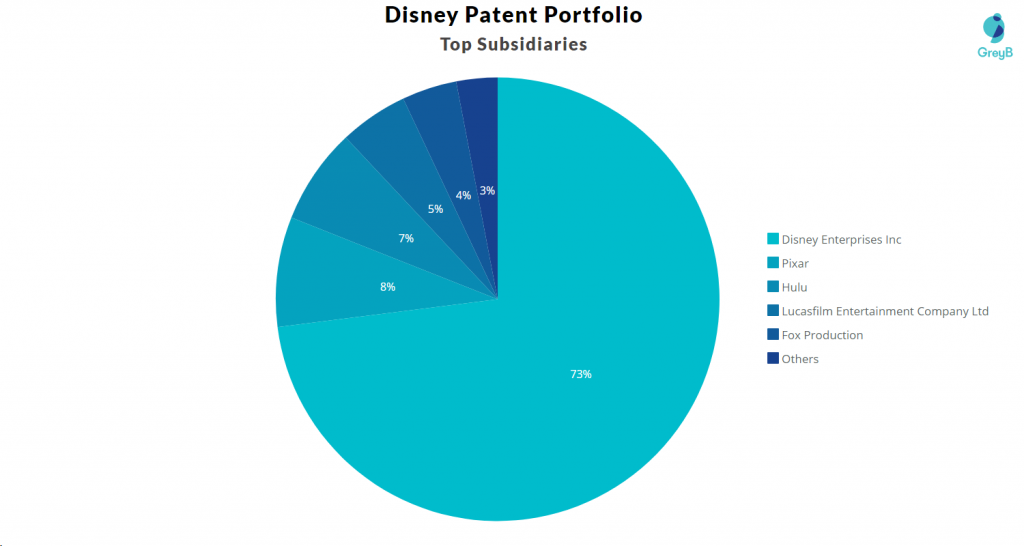

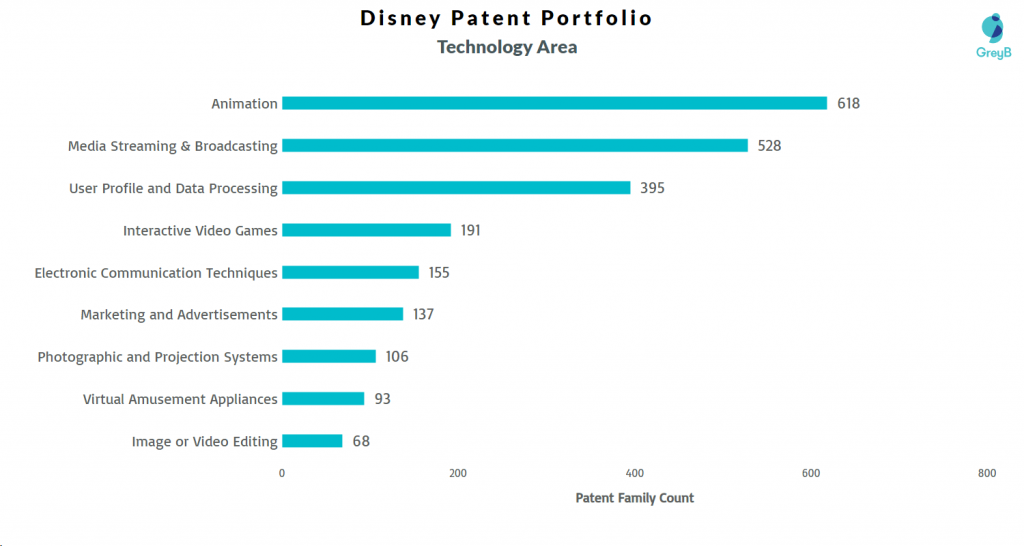

Intellectual property is a central part of Disney’s business and revenue strategy. The company owns 6045 patents in its portfolio, 3349 of which are unique patent families. Of these, 4109 patents are still active.

27% of the patent families in Disney’s patent portfolio are acquired and weren’t initially filed by Disney. Here’s the breakdown:

Source: Insights;Gate

The company first launched its R&D wing, Walt Disney Imagineering, in 1952 to design its theme parks, such as Disneyland.

Once Disney realized people spend more time on the Internet, they immediately formed Disney Research on August 11, 2008, to improve their online delivery experience.

The lab works on robotics, artificial intelligence, and immersive technology and covers other technologies such as computer graphics, displays, human interaction videos, and wireless communications.

Here’s the technological distribution of Disney’s patent portfolio:

Source: Insights;Gate

Disney’s Popular Patents

Naturally, being a photoplay company at heart, Disney owns most of its patents in animation. They’ve patented some iconic ideas, such as the Method and apparatus for synchronizing photoplays. This patent design describes Disney’s method of perfectly syncing the audio to the characters and the environment in an animated scene.

Another notable one is the Real-time high-quality facial performance capture patent. This is among their newer methods of transferring an actor’s facial expression to a computer-generated character for realistic animation and face movement.

Here are Disney’s top 5 most cited patents.

| Publication Number | Title | Count of Citing Patents |

| US7396281B2 | Participant interaction with entertainment in real and virtual environments | 99 |

| USD558778S1 | Portion of a computer with an icon image | 98 |

| US7603626B2 | Method and system for creating a collaborative work over a digital network | 96 |

| US7693992B2 | Technique for providing access to data | 94 |

| US7426642B2 | Integrating legacy application/data access with single sign-on in a distributed computing environment | 92 |

This dashboard details the complete list of Disney’s active patents.

Key Takeaways for Business Leaders from Disney’s Growth Strategy

1. Contrary decisions carry long-term branding opportunities

Disney has made many unpopular decisions over its century of operation. For instance, in 1940, they released their musical work, Fantasia. It carried heavy production costs and nearly drove Disney to bankruptcy! People were dissatisfied with the work, which was an initial box office failure.

However, a newer audience rediscovered it in the 1960s and loved it. Fantasia was just ahead of its time!

Had Disney not taken the plunge in the 40s in the face of financial burdens, they would have missed the chance to experiment with innovative lighting, sound design, and animation techniques, which have since been hailed “the ultimate in sight and sound” by fans.

Rotten Tomatoes describes Fantasia as a “landmark in animation (and a huge influence on the medium of music video).” Fantasia shows that taking the contrary stance and striving for excellence can serve the company well tomorrow despite today’s financial pain.

2. Don’t get lost in rigorous money management

Disney lost some of its creative steam in the early 2000s. Their decisions were strongly guided by financial feasibility. Their works, such as Lilo and Stitch and Dinosaur, completely flopped.

Disney’s magic bullet was the acquisition of Pixar. Despite being a costly acquisition, it allowed Pixar to operate independently for the most part. Pixar executives brought a director-driven culture into the rest of the organization. For instance, box office hits like Frozen would have never happened in the old way of Disney’s business operation and growth strategy.

Many companies lose sight of essential innovations as they work on overdelivering the following quarterly report. Sometimes, a strategic expense without seeking total control from the get-go is a great way to reset the present working mentality. Fresh perspectives are rarely a bad thing.

3. Be selective about branding and franchising

Despite being a master at building franchises, Disney does not invest fully in every asset it owns. The company carefully considers the creator’s interests when deciding which characters to franchise, granting its directors creative freedom.

Most of Disney’s acquisitions, such as Marvel and Pixar, were perceived as overpriced by market standards. However, analysts then failed to understand the company’s long-term franchising plans for their content.

The way Disney protects and repurposes its intellectual property is a masterclass in building a media and entertainment empire that stands the test of time.

Future Outlook

Disney’s upcoming years of business look unsurprisingly promising, thanks in no mall part to their strategy. Forecasts suggest Walt Disney will grow earnings and revenue by 31.2% and 5.1% annually. Some experts believe the media giant could reach a $1 trillion market cap by 2030!

Though their streaming businesses aren’t taking off at full speed just yet, the company will reportedly reach about 300 million subscribers by 2024, 200 million of which will come from Disney+.

Disney is currently negotiating with Reliance Industries Ltd. on a multi-billion dollar deal. The US media giant may sell a majority stake in Disney Star business, valued at approximately $10 billion, to Reliance. The Indian multinational conglomerate has already scored some wins by bagging a multi-year pact to broadcast Warner Bros Discovery Inc.’s HBO shows in India. That content was previously with Disney.

They plan to complete the EPCOT transformation and update popular rides for Disney World. Some planned projects include CommuniCore Hall and CommuniCore Plaza in EPCOT, an updated show at Magic Kingdom’s Country Bear Musical Jamboree, new adventures at Star Tours in Disney’s Hollywood Studios, etc.

Additionally, the company will continue its long-standing relationships with other tech giants, like Apple. Earlier this year, Disney revealed that the Apple Vision Pro headset would run Disney+ on its platform and offer a more immersive experience for users through content in National Geographic and Star Wars. This integration would be available from day one of the mixed reality headset’s availability in 2024.

Similarly, Disney has recently partnered with Amazon to create a new voice assistant project called “Hey, Disney!” This family-friendly experience brings the best Disney, Pixar, and Star Wars characters to Amazon Alexa. This feature would be bundled with the Amazon Kids+ subscription.

Disney’s century-long business strategy and operation are an excellent case study of taking measured risks and planning for a long-term win. It shows business owners how taking the time to build an iconic brand image can help them withstand the varying market tides.

If you’d like to understand more about Disney’s innovation scope and get insights into its newest projects, use the form below to request a report from GreyB’s experts.

Amazon follows an equally remarkable business model. Did you know that Amazon’s Web Services hosts one-third of the world’s internet?

Read more about Amazon’s business strategy that led to its $1.3 trillion valuation!

Authored By – Hemanth Shenoy, Marketing