The patent world has changed a lot over the past couple of years. Critical court decisions and an increasing number of patent invalidation have made patents complex, harder to grant, and expensive at the same time.

Although non-practicing entities (NPEs) still make headlines with frequent litigation suits, the innovation economy is marching forward by leaps and bounds. The value of patents is also at an all-time high, courtesy of the exploding number of infringers. These infringers are now seen more as potential licensees and less as adversaries.

This fundamental shift in the value of the intellectual property (IP) have dramatically altered the way leading companies are thinking about IP strategy. According to a report published by WIPO in March 2019 –

“Patent Cooperation Treaty (PCT) passed a record-breaking quarter-million (253,000) filing mark in 2018, a 3.9% increase over 2017, while WIPO’s Madrid System saw 61,200 international trademark applications, a 6.4% increase. WIPO’s Hague System for industrial designs saw 3.7% growth in 2018, reaching 5,404 applications”

Evidently, patent filing activity is on the rise, and it’s time innovation-intensive companies devise a strong portfolio management strategy to stay ahead of the competition.

With the fast-changing technological landscape, it won’t be wrong to say that the development of a patent portfolio is a never-ending task. Once patent assets in a portfolio reach a critical mass, it becomes significantly important to tactically manage, monetize and prune the patents to keep the portfolio healthy.

In the business world, nothing comes without strings attached. For a patent portfolio to grow organically, it needs a lot of funds. Further, maintaining a patent portfolio isn’t cheap either. And if not managed properly, it won’t only fail to generate revenue but also take a huge toll on the company’s coffers.

This reason is compelling enough for the Patent Review Boards (in some companies it may be Patent Developers or CIPOs) to take a seat at the CEO’s table as one of his direct reports. This way IP management can be a regular item on the CEO’s agenda.

“IP management today requires more centralized control and alignment with the lines of business. Everyone needs to be on the same page with respect to strategies, trends, and laws.”

Scott Frank, President & CEO – AT&T Intellectual Property

Business executives need you, Mr./Ms. CIPO. Here’s why!

Most business executives in a corporation don’t know which of their patent assets shield which of their products. Which companies/products are infringing which of their patents by and large. They don’t know what kind of subject matter various patents in their portfolio cover.

Unfortunately for business executives, the need to know their patent portfolio manifest at the most inopportune of times – Be it the threat of patent assertion by a competitor, a sudden need for a portfolio valuation or a very short window for a patent transaction.

To curb such situations and make informed decisions, CIPOs need to provide the CEO with some visibility over the patent portfolio. However, this could be done using various short term measures like patent analytics, competitor surveillance, an IP advisor or good old sweat and tears.

How can CIPOs help CEO understand the competitive advantage based on their patent portfolio?

Before we get to that, it is to be noted that unlike CIPOs, CEOs do not need to understand the intricacies associated with the organization’s patent portfolio. They just need to know how the patent portfolio could be aligned with the business goals of their company.

They need to know which of their patents cover which of their own products, or which of their patents are being infringed and used by competitors, and by whom. This knowledge could be very useful to identify which assets in the portfolio are carrying their weight and how well. This would also be a helpful insight to unlock the revenue potential of the patent portfolio.

CEO objective is to constantly work on creating a competitive advantage against companies in the market. Therefore, even if they do not ask you, the following pointers are super useful for them –

- They need to know which patents could block their competitors and could be used strategically to obtain an edge over the competitors.

- Know which of their patents shield which of their products to assess their value for the business.

- How much revenue the existing patents can generate for the company

- How many patents are being generated by the company for every million being spent on R&D

Yes, this should also be done even if the company has a defensive strategy w.r.t. patents. The defensive strategy does not mean that you will not work on strengthening your shield. The interesting part is shield will only protect you if it has potential to cause damage to the other party. If the patent portfolio of the company is centered only on the company’s own product, it is not going to protect the company from others.

Patent analytics could help here. How?

Well, the value of IP is best understood in context. So, let me explain it in light of the situation mentioned above.

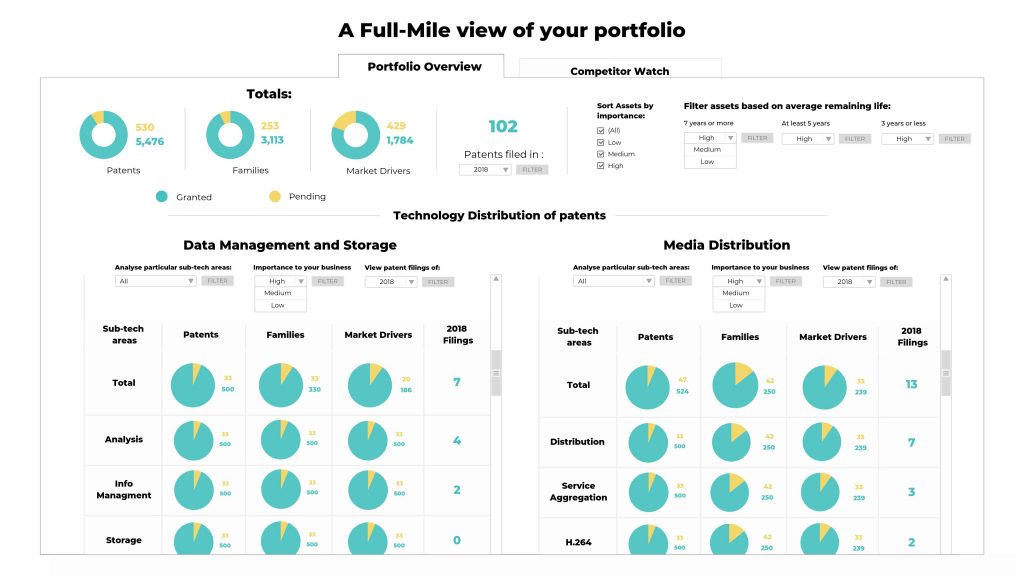

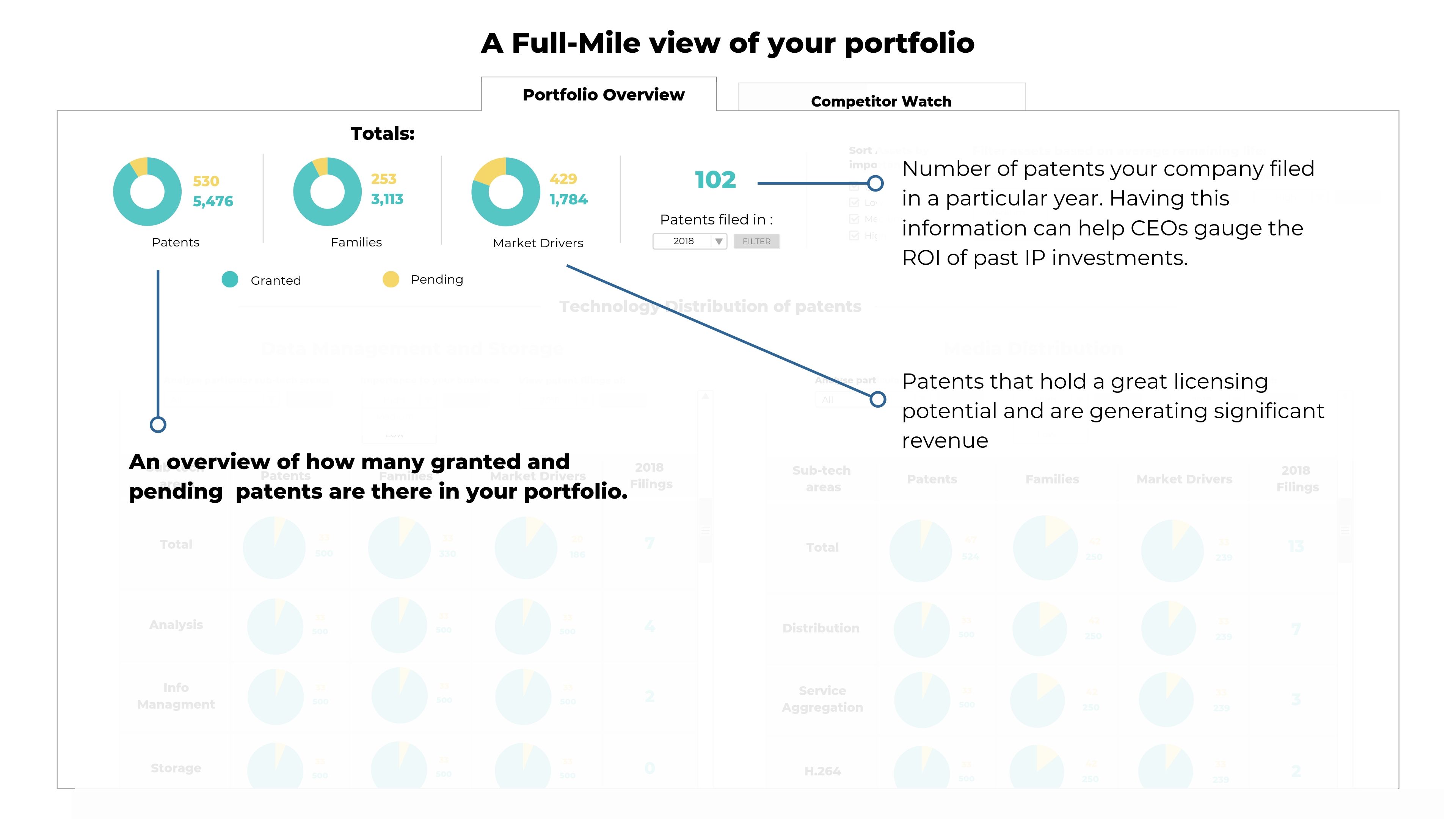

Let’s say the CEO wants to check which of the organization’s patents are protecting their core products. To better answer this, CEOs should have a sight over their entire patent portfolio. You can say, they should have a full mile view, something like this:

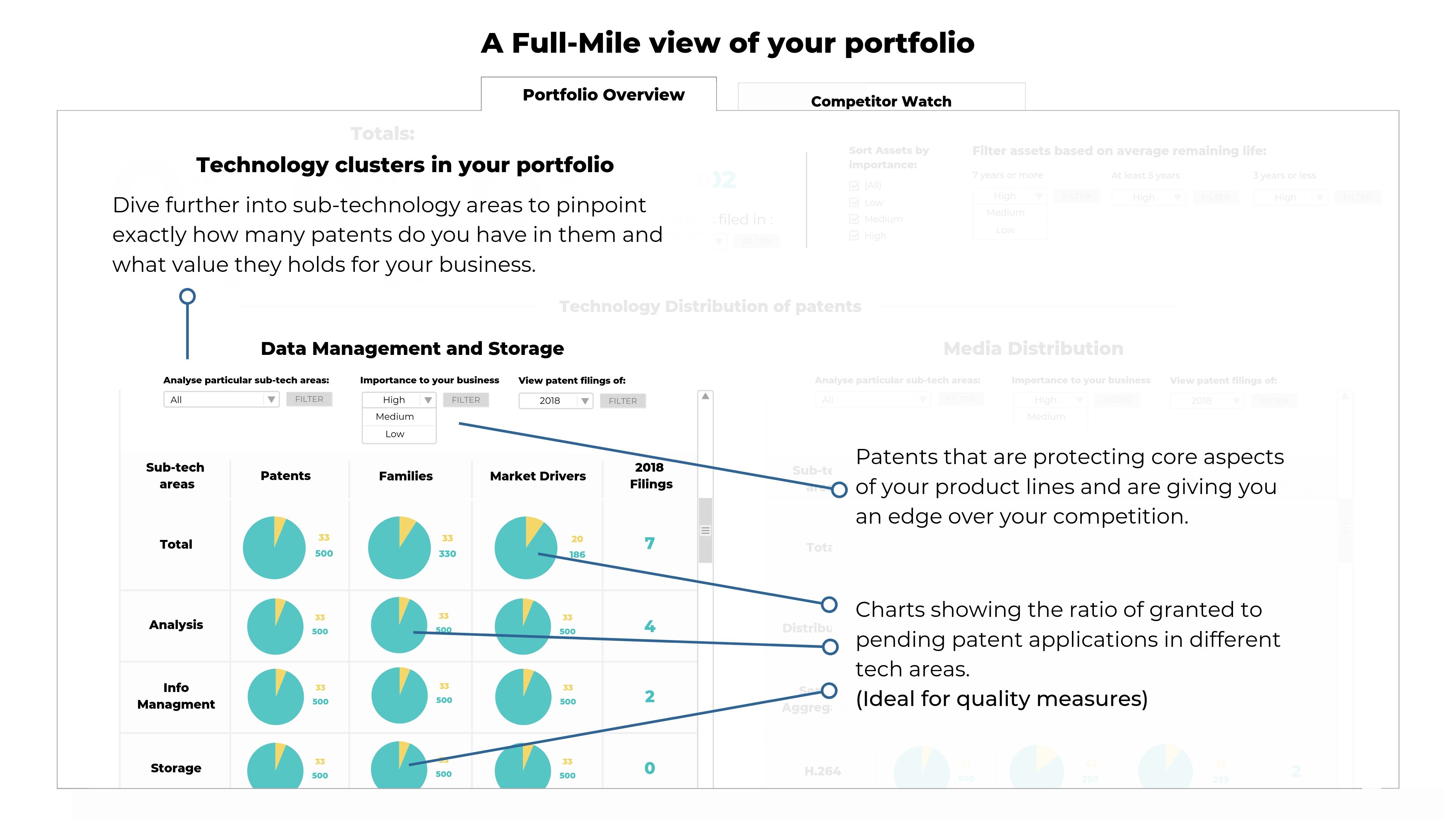

Having access to a full mile view does not only tell them how many patents they have in each technology, but it also gives them the power to dive a level deeper. Have a look at highlighted areas in below screenshot:

Let’s see how such a view can work for another example where you want to have a look at the patents which are shielding your products. All it takes is one click.

Let’s pick another scenario where the CEO wants to view which of your organization’s patents are blocking competitors or giving you a strategic edge over them. This question could be answered quickly in many ways based on multiple parameters like:

- Forward, backward citations by competitors

- Technology coverage of the patent

- Geographical distribution of patents

- Infringement potential of your patents (if a detailed view is required)

We believe in detailed view but for quick understanding, we will showcase here how a quick view can be developed.

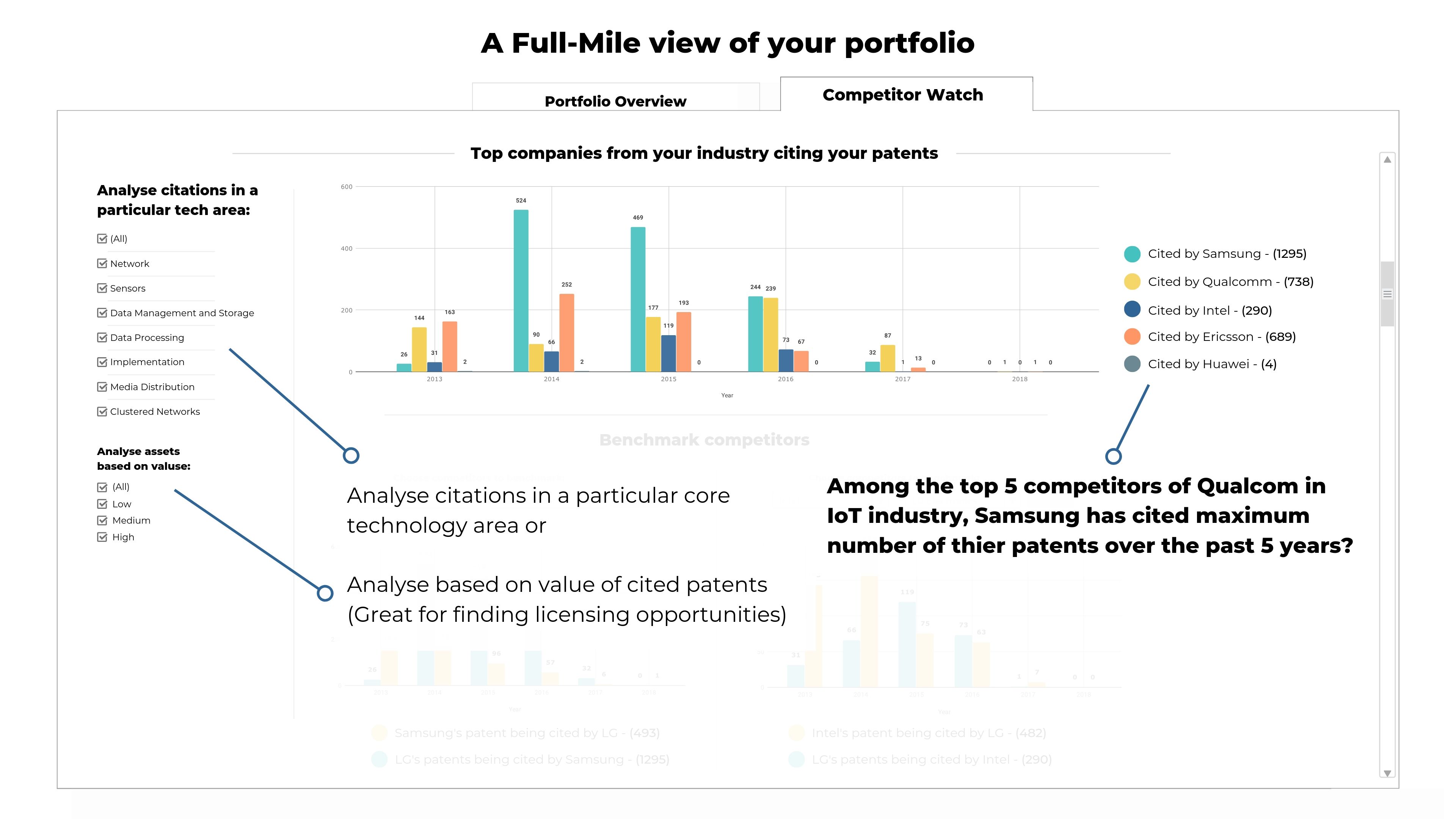

For example, let’s see how knowing forward, and backward citations by competitors can help answer this question.

A citation analysis of your portfolio tells you which of your competitors are working quite closely to your core technology areas and citing your work. If a lot of your patents are being cited by your competitors, it simply means that they are working on similar products and your patents are preceding their research.

A lot of citations from the competition is a good sign of you having some great gems in your portfolio. If built upon further, your patents can act as a defensive wall around your core technologies.

Knowing this information can give the CEO a clear idea about how they are faring against their competitors in terms of research.

I have prepared an exemplary dataset to explain this a bit more thoroughly. The data is from the IoT industry.

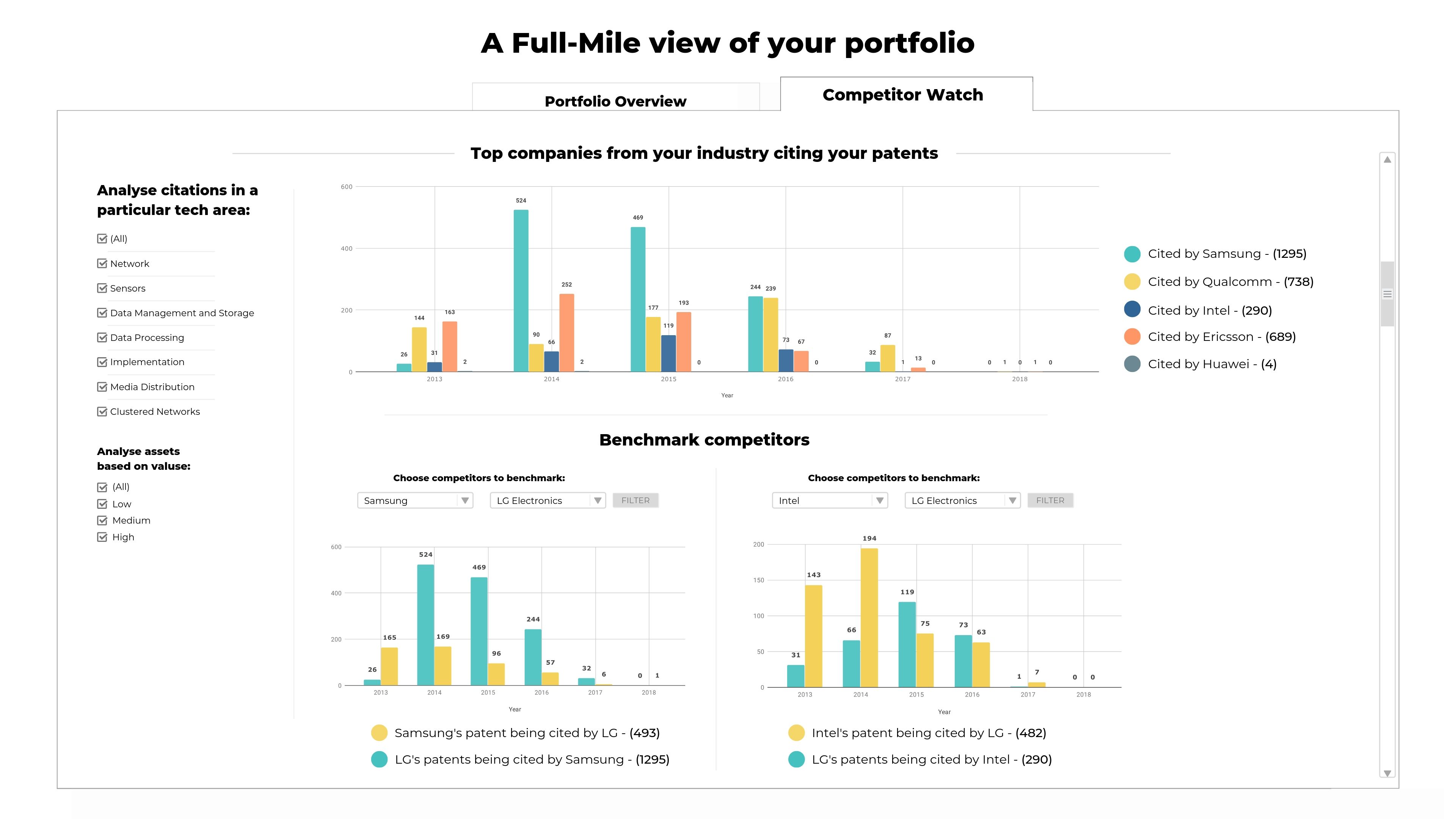

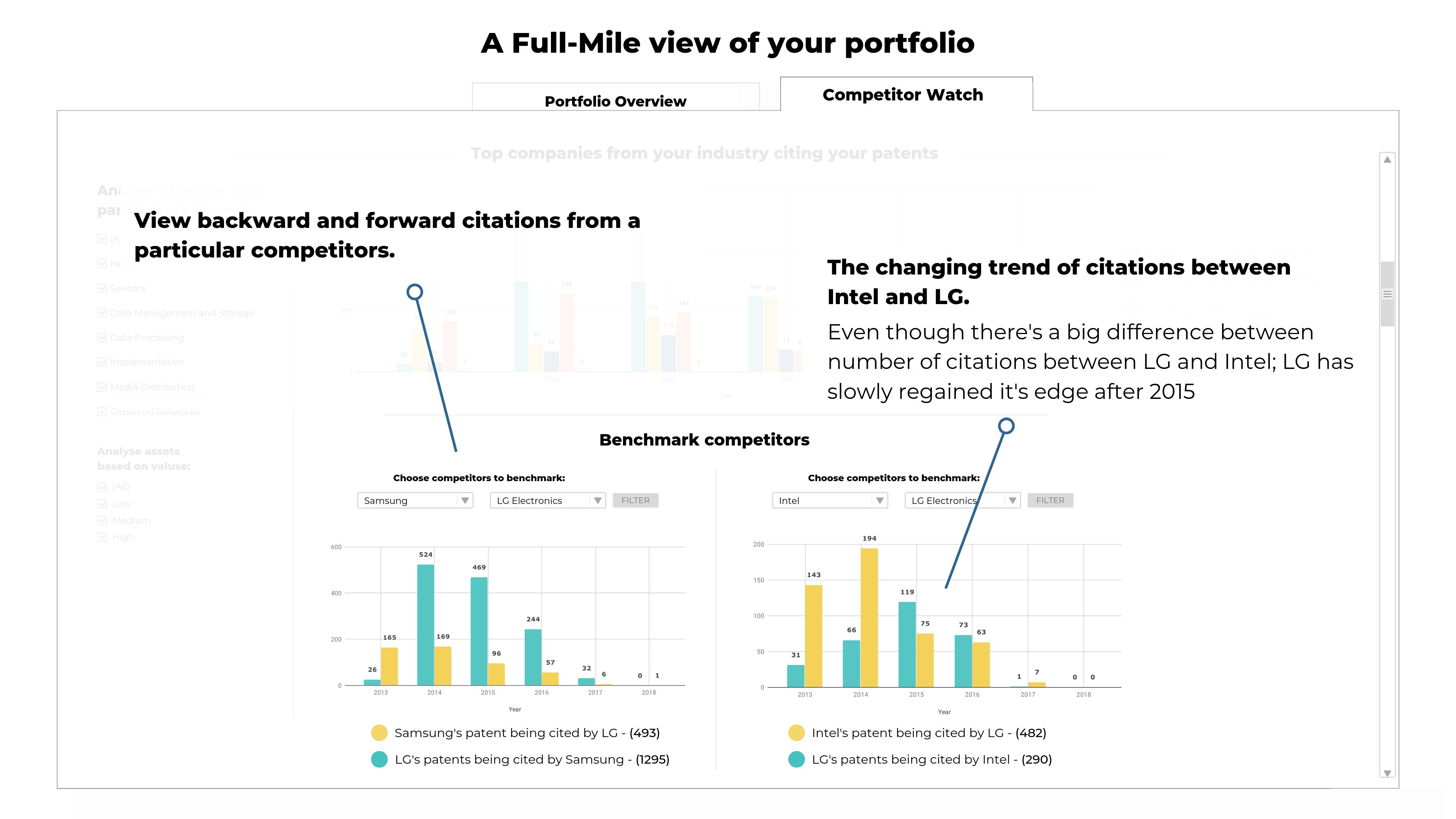

Let’s say you are managing the patent portfolio of LG Electronics and want to see how your competitors are faring in IoT tech. The second storyboard, ‘Competitor Watch’ is for you:

I’ve picked top 6 companies (LG being one of them) working in this domain and benchmarked 5 of them against LG’s patent portfolio.

In the screenshot above, a lot of their patents are being cited by Samsung, Qualcomm, and Ericsson. Analyzing these citations can help LG know the technology areas where they have a head start against their competition and areas where they are excelling by a significant margin.

These insights can be narrowed down further by bringing only one competitor in light and benchmarking their portfolio against yours, in this case, LG. In the dashboard below, I’ve compared LG’s patent citations with Samsung (left) and Intel (right).

Did you notice the difference between LG’s patent being cited by Samsung and vice versa? The data showcased above means that Samsung is working on similar tech areas and LG’s patents are preceding their research.

It could also work the opposite way. If a lot of LG’s patents are citing a company (in this case – Intel), to LG it suggests that it needs to improve its technology further, file more patents, and build a picket fence around that company’s portfolio. It is a really common strategy and effective too. Perhaps, Samsung is doing the same.

A dashboard like this brings all of these insights right on your fingertips and makes it easy for you to pass these on to CEOs as well.

This is the point where I talk about the obvious questions that you might be having. When it comes to setting up such dashboards, I’ve received a lot of questions from IP executives of various responsibility sizes, and almost all of them revolve around the same problem – Adapting such a system can disrupt their existing processes or they are simply not ready to move to a different way of managing their portfolio than what they already have.

And that makes perfect sense.

Large companies have complex systems in place and processes that evolved as the company grew, in motion. They simply can’t leave their current IP management environment because of various factors like:

- IP data and knowledge of a company is their treasure chest and new tools/system brings new challenges that might lead to mishandling of this information.

- Their senior executives and internal teams are used to current systems. It goes as far as the colors, symbols, layouts, and even the lingo of their management systems. Adapting to new system will take more time than it should.

- It might disrupt their already running processes.

The purpose of these dashboards is to empower you by giving you more control of your portfolio and rescue you from all the shortcomings of traditional tools of IP management; my team has kept all of the underlying concerns in mind.

These dashboards can be built and integrated into existing databases that you’re using, without disrupting your already running processes. These are not a replacement but rather a compliment to your IP management systems.

So even if your organization’s IP knowledge is being handled using Salesforce, Spreadsheets, Presentations, or any other platform; these dashboards can work seamlessly alongside, within your organization’s network environment, and with the same lingo that your team uses.

But since this a topic of managing innovations worth millions of dollars, there can’t be a one-size-fits-all scenario. And if you’re also looking to have more power and clarity over your patent portfolio, your questions might be entirely different than what I’ve stated above.

So, why not just let me answer them directly to you? Get in touch with my team using the button below and I’ll help you in setting up such a system for your organization too.