When it comes to mergers and acquisitions, the incoming IP from the entity being acquired (or merged with) is vital. The concerned authority, in most cases a patent counsel, has to assess the patent portfolio to find its strategic value to the company’s business.

Assessing the strategic importance of an incoming patent portfolio has to be mapped with existing product lines or with the technological areas where a company wants to enter in the future. Another checkbox needs to be ticked is that the incoming portfolio can avoid a potential lawsuit or can keep trolls at bay.

Simply put, a patent counsel buying/licensing patent portfolio has to figure out if the company is going to deal with a high-maintenance white elephant or a golden egg-laying goose. The answer to this question decides whether a company wins or loses in the game of M&A of IP assets.

How a patent counsel make a go or no-go decision on M&A of a patent portfolio?

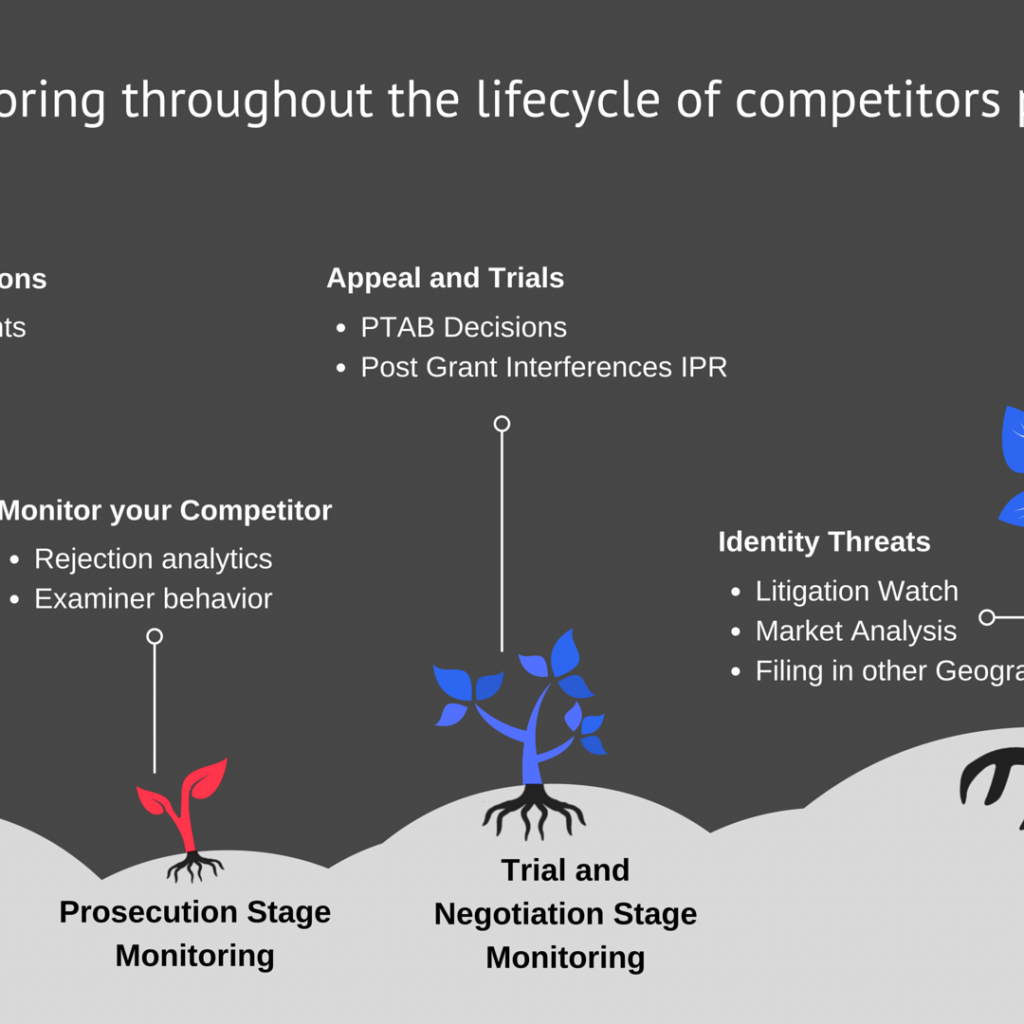

What adds to woes of a patent counsel in such a scenario is the fact that almost every patent portfolio grows organically over a period of time. It is rare to find an incoming portfolio organized and navigable– where patents are segregated by business units, product lines, technology features, advantages, etc. – making it easier for him to assess the worth and overlap of the incoming IP assets.

Forget the incoming IP portfolio, oftentimes one’s own patent portfolio becomes a maze of scattered IP assets which is assessed from a strategic point of view when looked in entirety.

Coming to the part, how in such a case, an IP Counsel can find strategic intelligence on an incoming patent portfolio to arrive at decision. An IP Counsels generally have two options in this case:

- Option 1: Using Internal Teams

- Option 2: Using External Teams (Outsourcing)

There is an Option 3, too, that, in fact, is an optimum solution which lies in the middle grounds. Here it is:

- Option 3: Strategically Combining the Internal as well as external teams

Let’s discuss the pros and cons of each option one by one.

Option 1: Pros and Cons of Using Internal Teams to Get Strategic Intelligence on Incoming Patent Portfolio

Under this solution, a patent counsel can consolidate all information at hand by using internal resources—internal team(s) and third-party tools. The benefit of this option is that no one knows your tools, business processes, and goals better than your internal teams. This leads to better insights, as a person assessing an upcoming portfolio who built a product knows a few things subtly that can’t be expected from someone in an outsourced team. Also, it is way cheaper than option 2 below.

It’s great if you have a highly funded IP department and can dedicate resources for this. However, this option comes with its own set of challenges which are as follows:

- This is a time-intensive process that becomes a bugbear when relatively quicker answers are required. This may be because, often, only a handful of internal resources are capable of executing this task.

- The limitations of existing patent portfolio management tools, at times, lead to analysis with an inaccurate assessment. Most of these tools are weak when comes clustering a portfolio as per technology, product lines or business units.

Option 2: Pros and Cons of Outsourcing the Patent Portfolio Assessment

This is a widely followed approach in which the assessment of an incoming patent portfolio is outsourced to a firm specializing in the task. The benefit of this option is that it overcomes the cons of Option 1. A patent counsel can get an expeditious assessment, which can help him make a go-or-no-go decision.

Now coming to the challenges or shortcoming this option brings alongside:

- A patent counsel not being the part of an assessment, many a time feels difficult to answer a follow-on question during a board meeting. Hence, in such cases, he relies on an outsourced party to get an answer which delays the decision-making process.

- An analysis performed by consultants used to be customized. Many a time, these analyses don’t answer additional questions that were not part of the requirement when an external vendor was engaged. Getting an additional analysis done increases cost and leads to further delay in decision-making.

- Finding a reliable external vendor is a task in itself. Choose an ill-fitted party and you lose money as well as time. This is one of the major drawbacks of this option.

Option 3: Strategically Combining the Internal as well as external teams

This option is all about combining the best of the above two options so that both advantages can be exploited. Here, you get the legwork involving manual reading and analysis of the patents by external analysts while the insight derivation task is done internally.

How is this possible? Well, in this option, you don’t get a traditional static report in an Excel sheet or a PowerPoint presentation. On the other hand, an outsourcing team gets you an online dashboard built at the backend of a small database of patent set you asked an outsourcing team to analyze.

Further, your in-house team can direct an outsourced team to update backend data regularly as per their requirements. This will avoid the customization problem that used to exist in the static report. In such a system, the brains (IP team) and the brawns (external analyst with manual analysis capabilities) work in tandem to give the correct picture to upper management.

Does GreyB offer option 3?

Yes, we have been offering option 3 for two years. FTO-inspired landscapes are one example of a solution where a firm’s internal fast-moving product development team uses GreyB (External Team) to proactively avoid FTO-related issues. You can read more about it here: How to optimize FTO Studies? If you want to know in detail on how this can be of help to you –

Authored by: Gaurav Sharma, Research Associate, IP Solution

Here is the article in the form of Infographics: